President Donald Trump addresses the International Association of Chiefs of Police annual convention at the Orange County Convention Center in Orlando, Florida on October 8, 2018.

Mandel Ngan | AFP | Getty Images

President Donald Trump is making his move to Florida official.

His home state of New York may not let him go without a fight.

The president, a Queens, New York, native, tweeted on Thursday night that he and his family will be making Palm Beach, Florida, their permanent residence.

“I cherish New York, and the people of New York, and always will,” Trump tweeted.

“But unfortunately, despite the fact I pay millions of dollars in city, state and local taxes each year, I have been treated very badly by the political leaders of both the city and state,” he wrote.

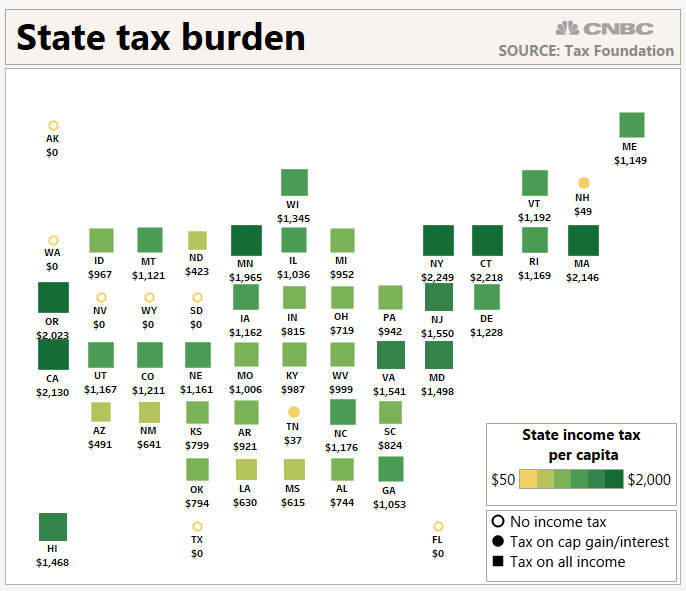

The warm weather isn’t the only reason why someone would want to leave New York for the Sunshine State.

Florida doesn’t tax personal income, and it has no estate or inheritance tax.

Meanwhile, the top New York State income tax rate is 8.82%. Residents of New York City also face top rate of 3.8% on income.

However, the president — and any other wealthy New Yorker — should anticipate a fight with the state auditor when it comes to fleeing for more tax-friendly locales.

(See below for the filing Trump made with the Palm Beach County clerk and comptroller.)

That’s because it’s not enough to just declare yourself a resident of Florida. You must also prove that that’s truly your permanent home.

“You can leave New York, but you also have to land in a new location with the intention of staying there indefinitely,” said Mark S. Klein, partner at law firm Hodgson Russ in New York.

“I wonder if you can really argue that someone who spends 90% of his time overseas or in Washington, plus weekends in the winter at Mar-A-Lago, has he really stuck the landing?” Klein asked. “I’m not sure he did.”

Tax obligations

States look at two tests to assess residency.

To be considered a statutory resident — and to be taxed as a resident of that state — you must have spent 183 days there during the year and you must maintain a permanent place of abode there.

The domicile test considers five key aspects that determine whether your true home — the place you return to after you’ve been on the road — is in fact that state.

Five criteria

A person loads a moving van in the Denver metro area.

Steve Nehf | The Denver Post | Getty Images

Here are the five factors of determining where home really is.

1. Domicile: You can have many residences but only one domicile. For Trump, those residences include his property in Bedminster, New Jersey, and the White House.

He listed Trump Tower as his “former residence,” according to paperwork he filed with Florida’s Palm Beach County.

Taxpayers can show their commitment to leave by selling the abode in their original home state.

“The best way to do it is to give up all ties to New York and sell your home, so there is no possible question that you’ve moved,” said Bruce D. Steiner, an attorney at Kleinberg Kaplan in New York.

2. Business: If you have a business headquartered in the Empire State and maintain an office there, an auditor might argue that you’re probably spending time there, too.

In Trump’s case, if he collects income from real estate properties that he owns in New York, then that income is still subject to that state’s taxes, Klein said.

Any pass-through income that flows to him via a New York property will also face those levies.

Further, even though he’s collecting W-2 income as president, Trump will be subject to state taxes if he visits the Empire State for a day. That’s because technically some of his income will have been earned in New York, Klein said.

3. Time in the new state: Merely spending 183 days in the new state isn’t enough.

“If I leave New York and go to Florida, spend six months in Washington, two months in Europe and a month here or there, they’ll say you left New York, but you didn’t really land in Florida,” said Klein.

Home is where you rest your head at the end of the day.

Caiaimage/Agnieszka Wozniak | Caiaimage | Getty Images

“What I tell people is this, you need to have your head on the pillow for two nights in the new home for every one you spend in the old,” said Klein.

Auditors want to know where you spend your weekends and where does your spouse wait for you when you’re traveling. Both are indications of where your true home base is.

4. Your teddy bear: When you move, you’ll take your most cherished possessions with you.

State tax auditors want to know where you keep the things that are most valuable to you, including your family photos and your grandmother’s china set, Klein said.

More from Personal Finance:

Where to get the best rates on savings accounts

How your travel plans affect which Medicare plan is best for you

Don’t miss the tax advantages of this savings account

“Auditors expect to see moving bills,” he said. “I’ll tell clients with as much effort as I can: Please find something to move.”

5. Your family: State tax authorities want to know where you, your spouse and your minor children are based, as that’s an indication of home.

“The presumption is that spouses share a life together and thus share their domicile together,” said Klein.

A situation in which one spouse has business activities in New York, while the retired spouse is residing in Florida could draw attention from an auditor.

William King | Stone | Getty Images

If they’re constantly traveling together, it’s hard to say that one’s a Floridian and the other’s a New Yorker,” said Klein. “How do they not share a domicile?”

Couples who assert that they live in different states need to walk the walk.

“It’s possible for them to not share a domicile together, but it’s unusual and difficult to prove,” said Klein. “They have to start living separately if they’re going to make this argument.”