Jamie Grill | Getty Images

Sometimes it pays to hold off on that holiday bonus.

Workers on Wall Street received an average bonus of $153,700 in 2018, according to a report from the New York State Comptroller’s office. That’s down 17% from the prior year — but still enough to make the holidays happier.

Meanwhile, annual performance bonuses are projected to either remain flat or decline slightly in 2019 for most employees, according to data from Willis Towers Watson.

While you may be inclined to scoop up that extra year-end cash sooner rather than later, there are situations where it might make sense to push it off until January. That’s because a windfall at year-end will come with a tax bite.

“If there is an opportunity to defer, it pays to do so,” said Carolyn Mazzenga, a CPA and leader of the family wealth services group at Marcum LLP in Melville, New York.

Know your bracket

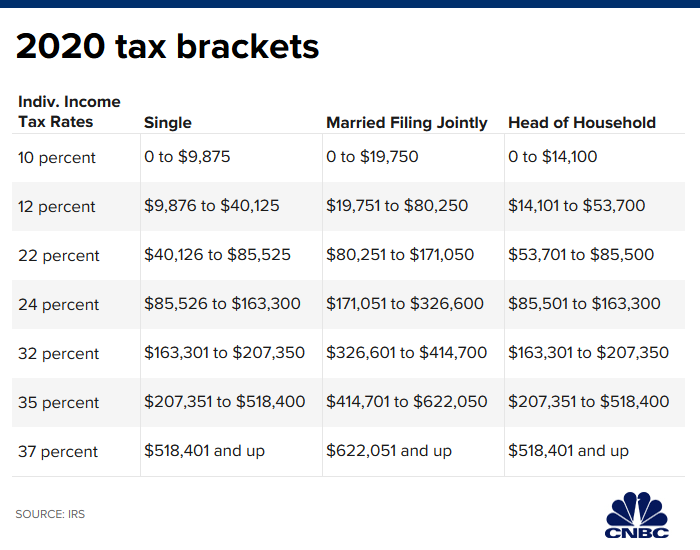

It pays to know your income tax bracket for both 2019 and 2020.

See below for 2019’s brackets.

.1574276952666.png)

Here’s where tax brackets stand for 2020.

Getting a bonus at the end of the year can push you from one bracket to the next, depending on the size of the payment.

That’s when waiting makes sense.

“With bonuses, there’s generally some control or no control over when it’s paid,” said Robert Westley, a CPA and member of the American Institute of CPAs’ financial literacy commission.

“If there is some control, you can ask if they can pay it to you in January instead of December,” he said.

This way, you lower your income tax obligation for this year.

You can also ask about spreading your bonus over multiple pay periods, Westley said.

Meet with your tax preparer to better gauge where your taxes stand for 2020.

Rethink your withholding

The Internal Revenue Service (IRS) headquarters in Washington, D.C.

Janhvi Bhojwani | CNBC

Bonuses are considered “supplemental wages” by the IRS, so they are taxed at a different rate from your ordinary wages.

Your employer can withhold federal income taxes from your bonus at a flat 22% or may give you your bonus along with your salary and use the aggregate amount to figure out the withholding.

Failure to withhold the appropriate amount of tax now could mean that you’ll owe the IRS or receive a smaller refund when you file your 2019 return next April.

“The 22% might not line up with your true tax bracket,” said Westley. “So either request extra withholding at year-end or make an estimated payment to cover the short fall.”

Donate strategically

Hero Images | Hero Images | Getty Images

There’s still time left in the year, so strategize with your accountant to minimize taxes.

For instance, if you itemize deductions on your tax return, consider making a hefty donation to your favorite charity or to a donor-advised fund — a tax-favored account that you can use to direct grants to charities.

Get more out of your charitable giving by “bunching” two or more years’ worth of donations in one year to boost your deduction.

Bump up savings

MoMo Productions | Taxi | Getty Images

You can also stuff extra cash into your retirement plan to help slash your taxable income and ramp up your savings.

In 2019, you can put away up to $19,000 in your 401(k) plan, plus $6,000 if you’re age 50 or over.

Next year, the deferral limit goes up to $19,500, and the catch-up contribution for the 50-and-over crowd rises to $6,500.

So-called “highly-compensated employees” who received more than $125,000 in pay from a business in 2019 ($130,000 in 2020) face limitations on how much they can put into 401(k) plans and other workplace benefit plans.

Talk to your financial planner or tax advisor if that’s the case.

More from Your Money, Your Future:

Why raising the Social Security retirement age won’t be easy

The number of 401(k) millionaires hits a fresh high

Here’s what Americans really want for the holidays