Tom Werner | DigitalVision | Getty Images

If you were diligently saving money for medical expenses all year, you may be about to lose it.

A health-care flexible spending account, which you may have access to at work, allows you to save pretax dollars in a savings account.

You can take tax-free distributions from the FSA as long as you’re using the money for qualified medical expenses.

This money doesn’t stick around forever, however. If you contributed money in 2019, you generally have until the end of the year to use it up.

That means if you’re still holding onto the cash in your FSA, you might be about to lose it.

While the IRS offers employers the option of permitting workers to roll over up to $500 into the new year or granting them a grace period until March 15 of the following year to use the money, they don’t have to.

“Start by finding out whether your employer requires you to use the money up now, or do they give you a grace period or allow you to carry forward the money,” said Brian Ellenbecker, senior financial planner at Robert W. Baird & Co. in Milwaukee.

“They’re not obligated to offer either option, but it’s important to see what’s available,” Ellenbecker, a certified financial planner, said.

Dollars that are forfeited to the plan are used to cover its expenses, said Kristen Appleman, vice president of health and wealth at ADP TotalSource.

How much to save

Getty Images

In 2019, you were able to stash $2,700 in a health-care FSA. Next year, that amount goes up to $2,750.

These accounts are different from other tax-advantaged benefits you’ll find at work.

For instance, dependent care FSAs, which you can use to cover child-care costs for kids under 13, allow you to save up to $5,000 a year on a pretax basis. These funds must also be used by the end of the year.

Health-care FSAs are also different from health savings accounts. So-called HSAs are also funded on a pretax basis, and you can use the money tax-free for medical costs.

The key difference is that you can continue to save your HSA balance from one year to the next. You can even invest the funds and use them for health-care expenses in retirement. They generally are paired with high-deductible health plans.

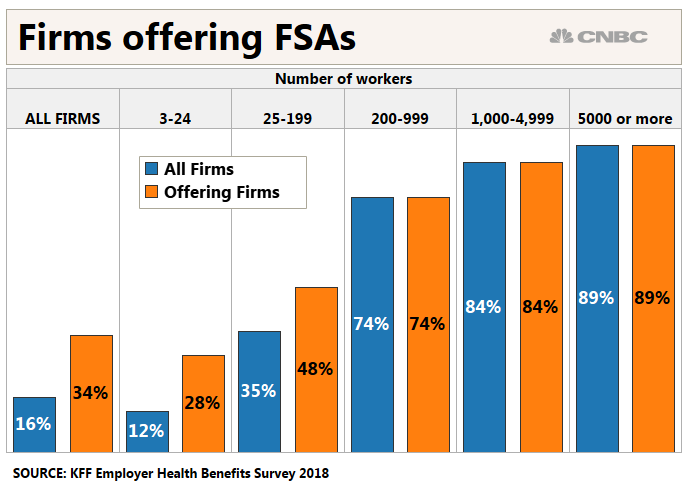

FSAs are popular among large employers.

In 2018, about 3 out of 4 firms with 200 or more employees offered the accounts, according to the Kaiser Family Foundation.

Best use of the money

Jon Feingersh Photography Inc | DigitalVision | Getty Images

If you’re sitting on a hefty health-care FSA balance, you still have time to use the money — and you don’t have to blow it all at the last minute on bandages and prescription cough syrup.

“We encourage people to think about eye care, so make an appointment for an eye exam and get your contacts and glasses,” Ellenbecker said. “Fill out all of your prescriptions prior to year-end.”

If you’ve been holding off on elective but eligible medical procedures and services, now might be the time to get the work done.

More from Personal Finance:

How to keep a tax bomb from blowing up your bonus

Spend your retirement savings without triggering a penalty

More than half of U.S. adults say this about their retirement accounts

This would include laser-eye surgery, weight-loss programs – provided your doctor diagnosed a need — and smoking cessation programs, said Appleman.

Whether it’s a dreaded root canal or your kid’s new braces, dental work is also FSA-eligible. Get it done.

Finally, you can also use your FSA balance for some self-care under the right circumstances.

Massage therapy, acupuncture and chiropractic work are all eligible expenses. Just be aware that you’ll need your doctor to provide you with a letter of medical necessity, indicating that these therapies are necessary for treating a condition.