New York state governor Andrew M. Cuomo

Wang Ying | Xinhua | Getty Images

Four blue states that had unsuccessfully sued the IRS over a new $10,000 cap on the federal deduction for state and local taxes filed an appeal on Tuesday.

The states — New York, New Jersey, Connecticut and Maryland — originally filed suit against the Treasury Department, Treasury Secretary Steven Mnuchin and the IRS, among others, in July 2018.

They alleged that the new limit on the so-called SALT deduction, part of the Tax Cuts and Jobs Act of 2017, was “an unconstitutional assault on states’ sovereign choices.”

U.S. District Judge J. Paul Oetken in Manhattan dismissed the suit on Sept. 30, saying that the plaintiffs ultimately failed to show that the SALT cap was unconstitutionally coercive or that it imposed on their own sovereign rights.

The four states are challenging the dismissal, and filed an appeal in the U.S. Court of Appeals for the Second Circuit today.

“The Trump Administration’s SALT policy is retribution politics — plain and simple,” said Andrew M. Cuomo, governor of New York, in a statement.

“New York is already the nation’s leader in sending more tax dollars to Washington than we get back every year, and we will not allow this administration to pick the pockets of hard-working New Yorkers to fund tax cuts for corporations and send even more money to red states.”

In 2016, New Yorkers writing off state and local taxes took an average SALT deduction of $21,779, according to the Tax Policy Center.

Meanwhile, in New Jersey and Connecticut, the average deductions were $18,092 and $19,563, respectively.

Multiple suits

Treasury Secretary Steven Mnuchin is seen during the House Financial Services Committee hearing titled The End of Affordable Housing? A Review of the Trump Administrations Plans to Change Housing Finance in America, in Rayburn Building on Tuesday, October 22, 2019.

Tom Williams | CQ-Roll Call, Inc. | Getty Images

Litigation against the federal government over the SALT deduction is following two tracks, according to Jared Walczak, director of state tax policy with the Center for State Tax Policy at the Tax Foundation.

One track — including the appeal that was filed on Tuesday — asserts that the SALT cap itself is unconstitutional.

The other track — which includes this July 2019 suit filed by New York, New Jersey and Connecticut — defends some workarounds blue states have created to permit their residents to write off their state and local income and property taxes above the $10,000 limit.

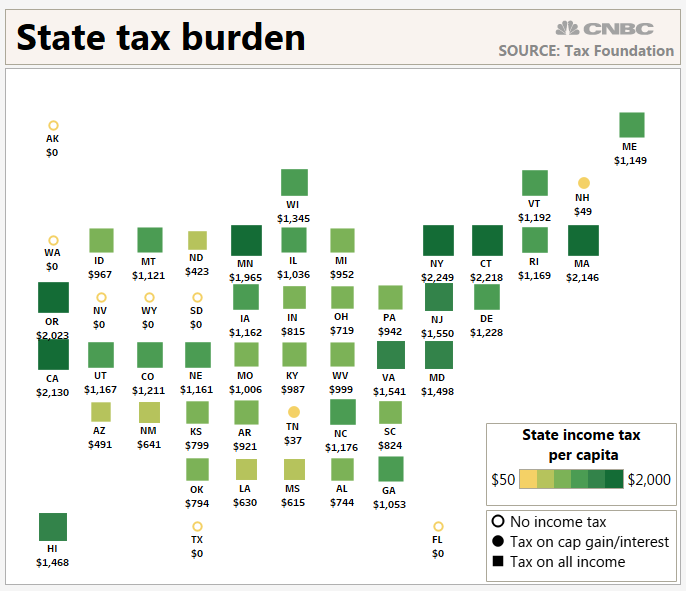

Indeed, residents in these states pay some of the steepest levies on income and property.

New Yorkers paid $2,249 per capita in individual state income taxes in the 2017 fiscal year, according to data from the Tax Foundation. See below for your state.

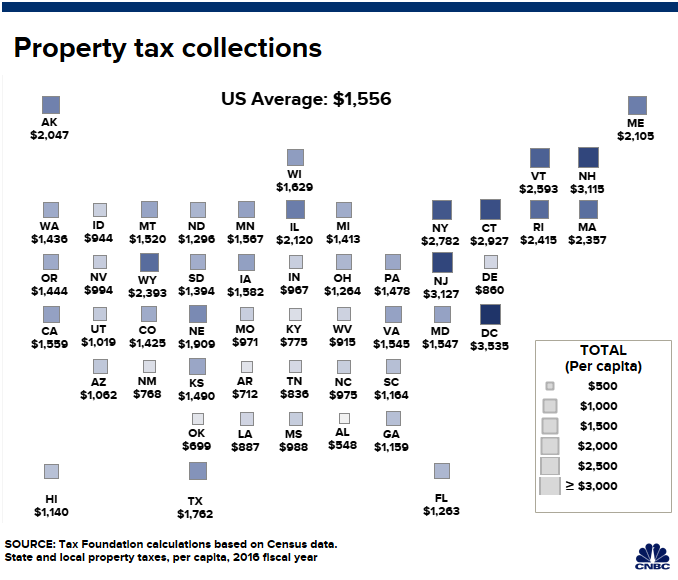

Meanwhile, New Jersey residents pay some of the heftiest property taxes in the nation.

Per capita, homeowners in the Garden State paid $3,127 in property tax during the 2016 fiscal year, according to the Tax Foundation.

The July 2019 suit addresses legislation passed in New York, New Jersey and Connecticut that would allow municipalities to establish charitable funds to pay for local services and offer property tax credits to incentivize homeowners to give.

This way, taxpayers can write off the payment as a charitable deduction on their federal tax returns, which is still allowed if you exceed the standard deduction. In 2019, that is $12,200 for single filers and $24,400 for married filing jointly.

In June, the IRS and Treasury blocked these workarounds, saying that the receipt of a state or local tax credit in return for making this contribution would be a “quid pro quo.”

Widespread effect

The Internal Revenue Services offices in Washington, D.C.

Adam Jeffery | CNBC

The new blue state “workaround” programs aren’t the only ones that would be affected by IRS rules.

There are more than 100 existing state charitable tax-credit plans in 33 states, according to a research paper authored by a group of tax law professors. They range from private school tuition scholarships to conservation easements.

Earlier this year, some of those programs — including the Alabama Opportunity Scholarship Fund and the Exceptional SC program in South Carolina — reported a slowdown in contributions due to ambiguity around whether the IRS would permit taxpayers to deduct the full amount donated.

More from Personal Finance:

Blue states file suit over SALT caps

Feds block tax breaks for donating to these charitable state funds

States sue IRS over SALT workarounds

Alabamans and South Carolinians contributing to those scholarship programs are eligible for a dollar-for-dollar tax credit on their state return.

Whether the final rule will ultimately deter people from donating to these funds remains to be seen.

“If you’re really passionate about private school vouchers in Georgia, you donate and you still get 100% of your donation back,” Carl Davis, research director at the Institute on Taxation and Economic Policy, told CNBC earlier. “You just won’t get a federal tax deduction on top of it.”