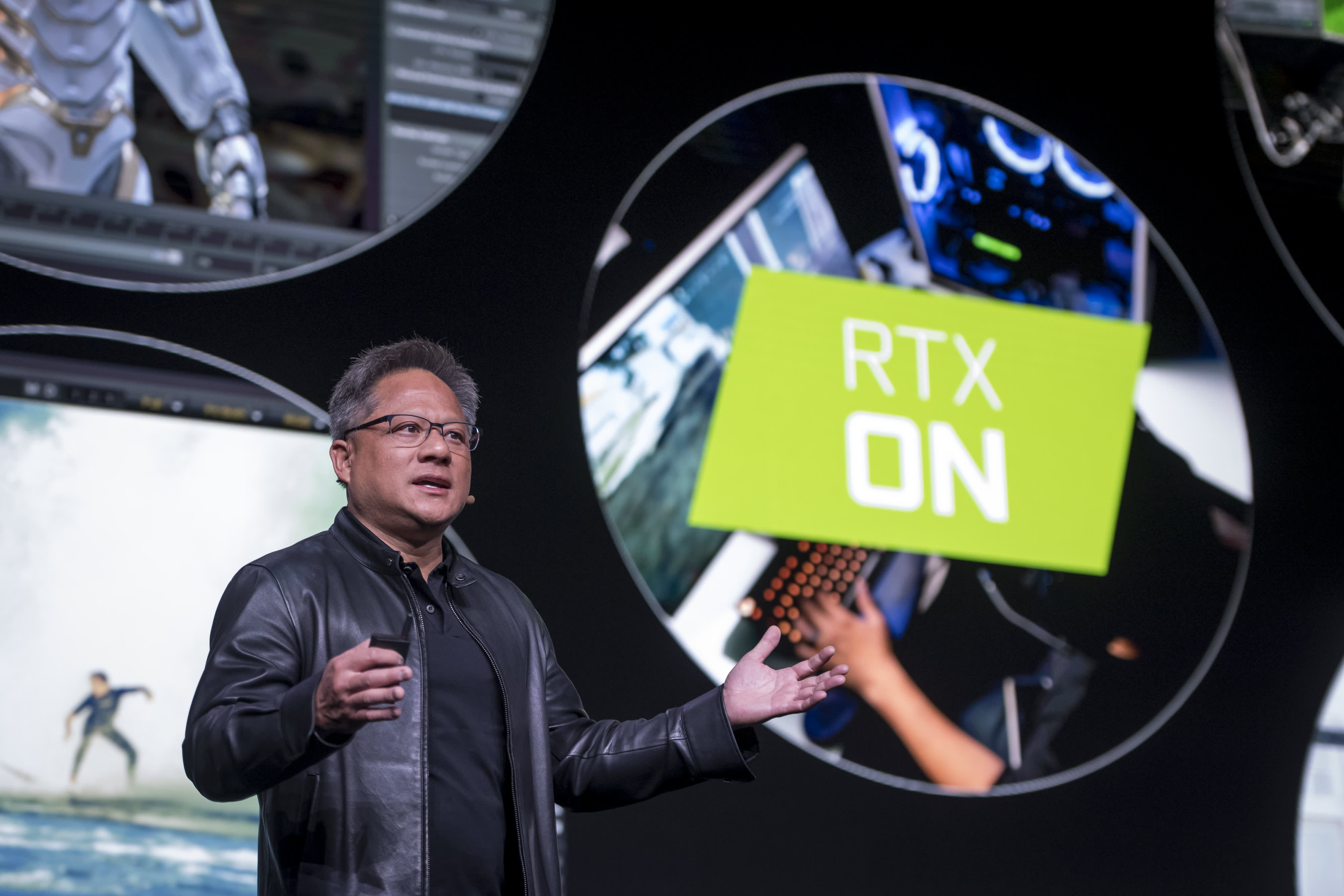

Jensen Huang, president and CEO of Nvidia, speaks during the company’s event at the 2019 Consumer Electronics Show in Las Vegas on Jan. 6, 2019.

David Paul Morris | Bloomberg | Getty Images

Here are the biggest calls on Wall Street on Monday:

Wells Fargo downgraded Netflix to ‘underperform’ from ‘market perform’

Wells Fargo said in its downgrade of the stock that Wall Street is overestimating the video streaming service’s free cash flow, and also pointed to increasing competition.

“We’ve dug deep into our NFLX cash estimates and have conviction in our 2019-25E cumulative FCF forecast that’s $18bn below the street. If we’re right, it brings the cash returns of the business into debate, thus we downgrade NFLX to Underperform. We think NFLX can achieve the street’s sub growth expectations but those subs will be more expensive than investors realize.”

Read more about this call here.

Barclays downgraded Molson Coors to ‘equal weight’ from ‘overweight’

Barclays downgraded the stock and said it is taking a “wait-and-see” approach as there have been “too many disappointments for too long” with the company.

“We continue to appreciate the newfound urgency and creativity with which TAP has been working to improve top-line trends across its portfolio over the last 6 months and view the growth agenda within the newly announced ‘revitalization plan’ as a welcome extension of this. Still, there have been too many disappointments for too long and we worry that the company’s approach of doing very little hand-holding with regard to near term guidance will mean improved revenue trends will need to be apparent before investors are willing to re-engage with the story. As such, a ‘wait & see’ stance feels more appropriate at this time.”