Workers in the Peterborough Amazon Fulfilment Centre prepare for Black Friday on November 27, 2019 in Peterborough, England.

Hollie Adams | Getty Images

Turkey didn’t slow down shoppers this Thanksgiving.

Shoppers spent $4.2 billion online on Thanksgiving, a 14.5% increase from last year and a record high, according to data released by Adobe Analytics, which monitors the online transactions of 80 of the top 100 web retailers in the U.S. This is the first year Thanksgiving spending as surpassed $4 billion. While e-commerce giants saw a 244% increase in sales, smaller retailers saw a 61% jump.

Black Friday online sales are on track to hit $7.4 billion as of 9:00 a.m. ET. Shoppers have already spent $600 million online, a 19.2% growth from last year, Adobe said.

The trend of shoppers moving from visiting brick-and-mortar stores to online shopping was evident on the eve of Black Friday. Crowds were thin at retailers on Thursday evening as U.S. consumers spent more than $2 billion online in the first hours of Thanksgiving shopping.

Nearly half the of revenue on Turkey Day came from smartphones, a 24.4% increase from last year.

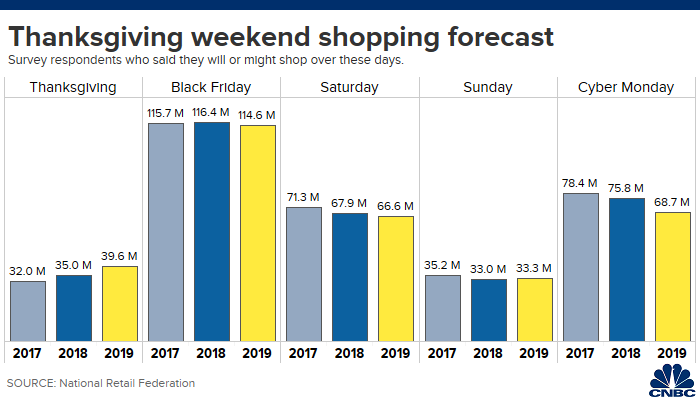

Black Friday is expected to be the biggest shopping day for U.S. shoppers, according to the National Retail Federation. Over the weekend, more than 165 million people are expected to join in. As this year’s Thanksgiving holiday happened one week after last year’s, shoppers have six days less to squeeze in their purchases this holiday season.

Shoppers spent $57.2 billion online between Nov. 1 and Nov. 28 this year, Adobe said.

During the full holiday season, Adobe said it is expecting shoppers to spend $143.7 billion online.

Companies have been investing in their e-commerce offerings, and integrating them with brick-and-mortar stores. This has been especially apparent for major retailers Target and Walmart, which both saw bigger jumps than Amazon in online customer spending during the first two weeks of November this year compared to last year, according to research firm Edison Trends.

These retailers are improving their products and enhancing shopping options by providing different ways to shop.

“They’re making it easy for you to purchase however you want to purchase, whether it’s going into the physical store, ordering online and picking it up or ordering it online and having it shipped to you,” said Sucharita Kodali, retail analyst at Forrester research.

So far this shopping season, about 40% of shoppers have opted to make a purchase online and pick it up in the store or curbside, Adobe said. It expects the trend to increase as the holiday approaches, estimating that about 61% of online shoppers will choose this option.

Despite the shorter shopping season, retailers can expect shoppers to spend as the U.S. consumer is doing well. While uncertainty looms around how trade tensions with China will impact retailers, consumer spending grew by 2.9% in the third quarter. Despite a drop this month, consumer confidence is near historic highs.