The final few weeks of the year aren’t just for last-minute shopping and holiday parties. It’s also a crucial time for tax savings.

While the 2017 tax overhaul did put a whole new spin on year-end planning, it did not eliminate the need to do it altogether.

In fact, from making an 11th-hour charitable donation to an early college tuition payment, now is your last chance to reduce what you’ll owe Uncle Sam come April.

So put down the eggnog and cross these tax movesoff your holiday to-do list:

1. Check your withholding

Last year, the Treasury Department and the IRS updated the withholding tables to reflect the tax law’s new standard deduction, as well as the personal exemptions that were eliminated and the limits on certain itemized deductions.

As a result, some filers wound up with smaller-than-expected refunds. Others ending up owing money.

(If you withhold far too much, you get a large refund the following year, but you’ve also given the government an interest-free loan. If you withhold too little, you take home more cash in your paycheck, but you may owe the IRS next spring.)

“The withholding you have now may or may not be the right amount of tax for you,” said Elda Di Re, a partner at EY (formerly Ernst & Young).

More from Invest in You:

Surprising purchases that actually qualify for pretax savings

The top 10 rules for gift-giving

6 steps to take now for a strong financial new year

To avoid another April surprise, use the IRS withholding calculator to figure out whether you should file a new Form W-4 with your employer. You may need to increase the amount of taxes withheld from your paycheck before the end of the year.

“You potentially can save yourself from underpayment penalties,” Di Re said.

If that’s the case, since there aren’t many pay periods left before Dec. 31, you should go to line 6 on your Form W-4 and fill in the dollar amount you want to have withheld.

Bonus Tip: In many cases, you only have to worry about a penalty if you paid less than 90% of the amount of tax due for 2019.

2. Boost retirement contributions

Reduce your taxable income dollar-for-dollar by contributing as much as you can to your 401(k) plan by Dec. 31.

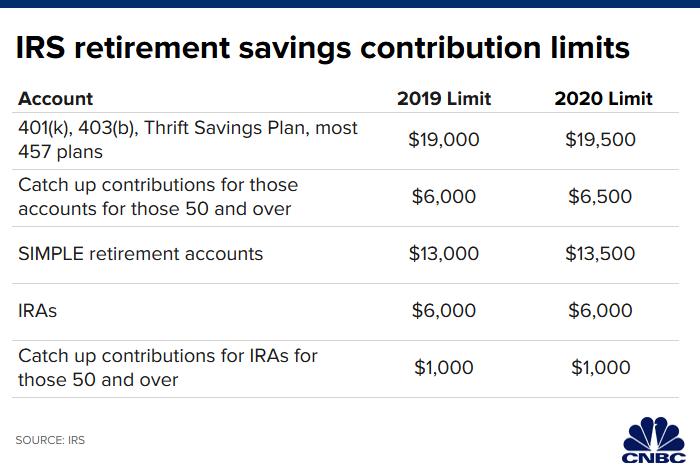

You can save up to $19,000, and if you are over 50 you can kick in an extra $6,000. Ask your human resources department what you need to do to increase your contributions before the end of the year.

If you work for yourself, you can set up an individual 401(k), or solo 401(k), and make tax-deferred contributions for retirement totaling $56,000 (or $62,000 if you’re 50 or older). Many brokerage firms offer these accounts and charge low — or even no — setup fees.

Bonus Tip: It’s a good idea to make pre-tax IRA contributions, too, and you have until the April deadline to do it.

3. Offset losses

After December’s choppy start, chances are you have some investments that lost value this year.

You can use those losses to zero out capital gains, and then deduct up to $3,000 a year against ordinary income, according to Di Re. Losses in excess of that can be carried forward to future tax years until the balance is used up.

For example, if you have $10,000 of losses and $5,000 of gains, you have an overall loss of $5,000 — and up to $3,000 of that loss can be used to offset your ordinary income. The additional $2,000 in losses can be shifted to next year’s return.

For just that reason, tax-loss harvesting is a popular tool for maximizing after-tax returns, most commonly in the fourth quarter of the year, when investors aim to lower their tax liability.

Tax-loss harvesting is a strategy in which investors deliberately incur losses in a taxable account by selling off investments that have fallen in value.

Bonus Tip: This strategy only works on taxable accounts, not your 401(k) or IRA.

4. Give to charity

Although the tax law reduced the incentives for many households, there are still ways to maximize your tax savings.

For starters, if you itemize on your taxes – meaning your deductions exceed the 2019 standard deduction of $12,200 for singles and $24,400 for married couples – you can write off the value of your charitable donations.

Remember to document what you give, said Genevia Gee Fulbright, the president and chief operating officer of Fulbright & Fulbright in Durham, North Carolina. The organization you’re giving to should also be able to confirm it is a registered 501(c)(3).

If you need a boost to surpass the higher standard deduction, consider saving money over time and donate every two or three years instead of every year.

One way to accomplish this is with a donor-advised fund, which lets you make a charitable contribution and receive an immediate tax break for the full donation, and then recommend grants from the fund to your favorite charities over time.

Bonus Tip: High-income earners in particular would do well to consider a non-cash donation — such as appreciated stock or part of a required minimum distribution from a retirement account — specifically because of the tax advantages.

5. Prepay tuition

Those with children starting college or graduate school, or even taking a single class, can prepay their tuition before Jan. 1 and use credits to reduce their 2019 taxes, according to Lisa Greene-Lewis, a CPA and tax expert at TurboTax.

Whether you’re footing the bill for your child or planning to take a class to improve your own professional skill, paying for those courses ahead of time could give you break this year, Greene-Lewis said.

For example, if you have a child in college, you may be eligible for the American opportunity tax credit, which offers a maximum annual credit of $2,500 per eligible student.

If you are taking the class yourself, you could also qualify for a credit of up to $2,000 with the lifetime learning credit.

Bonus tips: A tax credit can be more valuable than a deduction since it lowers your taxable income dollar for dollar.

6. Contribute to 529 plan

Families saving for college should consider contributing to a 529 college savings account before the end of the year. While contributions to 529 plans are not deductible for federal taxes, more than 30 states and the District of Columbia may offer a full or partial deduction or credit for those contributions.

The deduction or credit can vary, depending on the state plan. In some cases, you have to contribute to your own state’s plan to get the deduction, but several states will allow you to deduct contributions to any state’s plan.

Bonus tip: Consider making a contribution to a 529 plan for your child or grandchild. It can be a tax-free gift for up to $15,000.

7. Open an ABLE account

More than 9 million children in the U.S. are estimated to have special needs — that’s 20% of households with children under 18.

Those with special needs and their families can contribute up to $15,000 a year in an ABLE account. If the person with the disability is working and does not participate in a workplace 401(k) or other retirement program, the annual limit is even higher. Money is put in after taxes, and earnings growth and qualified withdrawals are tax-free.

Similar to a 529 plan, these contributions won’t give you a break on your federal taxes, but many states do allow you to deduct your contribution to such savings programs.

Bonus tip: Some plans, such as the one sponsored by Massachusetts, have zero minimums to open the account, as well as no annual maintenance fees.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How much to tip a doorman, babysitter, and others for the holidays, according to an etiquette expert via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.