For some, 2020 will be the year that retirement becomes a reality. For others, it will be a financial improbability.

Retirement readiness nationwide is shaky overall. Only 23% of men and just 12% of women are “very confident” in their ability to fully retire with a comfortable lifestyle, according to recent research from the Transamerica Center for Retirement Studies.

On the other hand, two-thirds of U.S. workers said they are very or somewhat confident they’ll be able to live comfortably throughout retirement, according to a separate study by the Employee Benefit Research Institute.

Yet only 42% have done any retirement calculations, EBRI found. And fewer than 1 in 3 workers has tried to figure out how much money is needed for medical expenses.

Add to that a looming pension crisis and longer life expectancy — particularly for women — and retirement seems even more uncertain. But it’s not unattainable.

If 2020 is the year you plan to step away from the workforce for good, these are the steps you should take now:

1. Create a budget

“Knowing what you can live on in retirement is critical,” said Matthew Sotir, a principal of Highland Financial Group and vice president at AXA Advisors in Wellesley, Massachusetts.

While there is no “magic number” to tell you exactly what you’ll need, there are some retirement calculators and rules of thumb that can help.

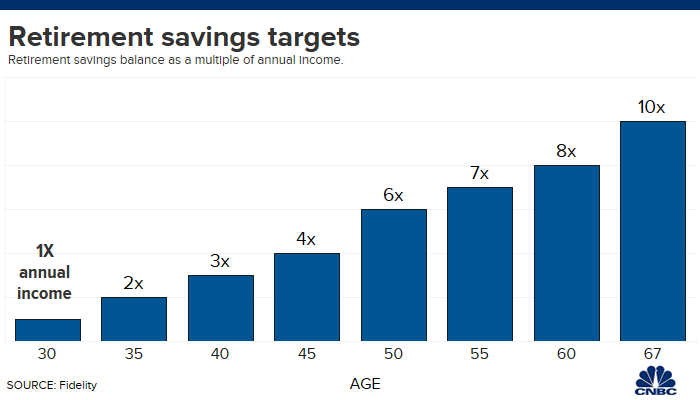

For example, the Stanford Center advises aiming to save 10% to 17% of your income if you plan to retire at 65 — about double what most people are actually socking away. Fidelity Investments recommends saving 10 times your income by retirement age.

Consider how your expenses will change in retirement. “The dollar amount is dependent on how long someone expects to be retired but also the lifestyle they plan to lead,” added Lauren Anastasio, a certified financial planner at SoFi in Claymont, Delaware.

“The first question people should ask themselves is ‘what do I expect retirement to look like?'” she said. “Some folks want to be close to their family, others want to travel the world.”

2. Consider the tax bite

3. Stash a cash cushion

Unlike a rainy day fund for working adults, in retirement a cash reserve acts as an emergency fund and allows for smoothing out those distributions from investment accounts.

In this case, advisors recommend having enough in the bank to cover a year or more of living expenses.

That will help you avoid taking money out of those accounts during a dip or downturn, Sotir said.

The downside is that this money will earn a low rate of return but, alternatively, “it allows your other investments to be more aggressively invested,” he said.

4. Revisit risk

With that in mind, make sure your asset allocation makes sense for your retirement income plan.

How your portfolio is divvied up among stocks, bonds and cash depends on how much you need to generate in income during retirement and how much risk you are comfortable with.

“People are very averse to risk at that stage in the game,” Anastasio said, but that could be a mistake, she said.

“It’s absolutely OK to continue to take on risk if you are going to be invested for a long time,” she said.

On the other hand, make sure it’s conservative enough to weather a downturn, added Sotir.

Sotir recommends “at least a 60% equity, 40% fixed income” split. A traditional 60/40 portfolio has done particularly well this year, and even over the past decade.

5. Pay down debt

Debt is not necessarily a retirement inhibitor but you do want to be careful about the type of debt you have, Anastasio said.

Generally, there is “good debt,” such as a mortgage or car loan with relatively low interest rates, and “bad debt,” like credit cards.

“The returns people are making is very rarely going to be greater than the interest they are paying on bad debt, which can be as high as 20%,” Anastasio said.

Sotir advises near-retirees to aggressively pay down high-interest debt before it eats away at your retirement income.

“Paying down debt with low-yield investments is often a good cash flow management tool that will help,” he said.

6. Prepare for the unexpected

At a time when people have the potential to live longer than ever before, an unexpected, or even expected, health expense can derail even the best plans.

Naturally, health-care costs typically rise as you age – but even more than most anticipate.

In fact, the average 65-year-old couple will spend $280,000 on health care over the remainder of their lives, research from Fidelity found.

Once you reach age 65, you’re eligible for Medicare. However, it doesn’t cover everything; for example, dental, vision and long-term care are not included. (Medicare would cover dental, vision — if the Senate passes a bill that cleared the House this past week.)

Long-term care can “wipe out” many families’ financial resources leaving them without the assets they had counted on, Sotir said.

“A combination of legal planning, asset protection and insurance is often the solution, but it requires careful analysis about the tradeoffs.”