Ariel Skelley | DigitalVision | Getty Images

For some financial advisors, the person behind the assets is the key to providing the best investment advice possible.

That is, awareness of the nuanced differences that distinguish clients helps those advisors construct investment portfolios based on more than, say, a person’s age and how long until they need the money.

“We don’t use one-size-fits-all model portfolios or dictate a generic risk tolerance,” said certified financial planner Victoria Trumbower, managing member of Trumbower Financial Advisors in Bethesda, Maryland. Trumbower Financial ranked No. 22 on the CNBC FA 100 list of top financial advisors for 2019.

“We develop unique investment policies and design portfolios for each client,” Trumbower also said. “There is a consistent approach, but the assumptions all reflect their individual circumstances.”

Basically, the more an advisor knows about a person’s financial picture — for example, their short- and long-term goals, and views on money — the better they can accurately invest assets to reflect the client’s individual needs.

“A person’s perspective on the world, their experiences, their emotions — that all plays a role in how we develop an investment policy for them,” said David Belej, partner and chief investment officer at Veritable in Newtown Square, Pennsylvania. Veritable also ranked on the CNBC FA 100 list, at No. 25.

“Our objective is to help them make better decisions but not impose our opinions on them,” Belej said.

A person’s perspective on the world, their experiences, their emotions — that all plays a role in how we develop an investment policy for them.

David Belej

partner and chief investment officer at Veritable

There also might be insight to be gained from understanding a person’s investment approach, recent research suggests.

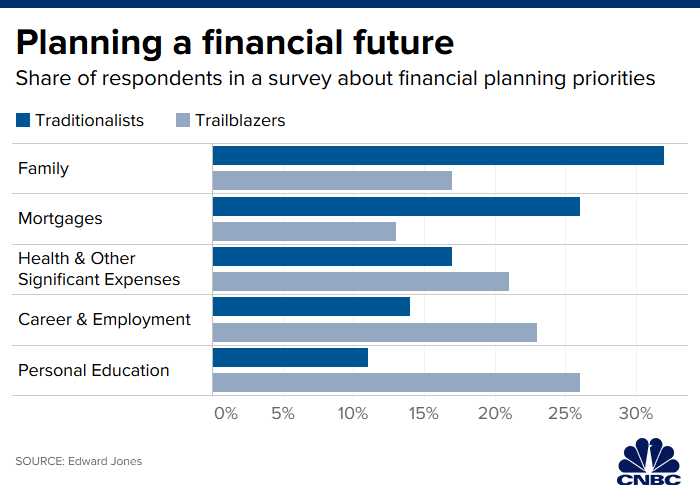

“The customary demographics — age, gender, marital status and income — aren’t always the most useful barometers for identifying ideal clients and understanding their needs,” according to a study released earlier this year by Edward Jones.

However, “it’s less about putting clients in one category or the other and more about just understanding that clients think differently,” said a company spokesperson in an interview earlier this year about the study, which split investors into two categories.

The first category, “traditionalists,” are described as more optimistic about market performance and comfortable with a buy-and-hold strategy. They also are more private about their finances. More than half of respondents (55%) fell into this group.

The remaining 45% are “trailblazers.” These folks are pessimistic about market performance, want holistic financial advice and are more willing to share their financial information, the research shows.

Commonalities do exist between the two groups, the study says. For example, among the survey respondents who focus on health and other significant expenses — regardless of which category they fell into — preparing for future medical expenses is more important than saving to buy a car or have emergency savings.

However, each group prioritizes major life expenses differently. For traditionalists, family-related aspects are the focus (32%), while personal education ranks highest among trailblazers (26%).

While not referring to the Edward Jones study, Belej said it can be hard to generalize when it comes to clients and that understanding each as an individual is an ongoing process.

“I don’t think listening to a client is a one-time thing,” Belej said. “It’s important to get to know the person over the long term, see how they’ve acted in the past and get to know their background.”

More from Financial Advisor 100:

Move to zero commissions concerns advisors

The worst money mistakes these advisors have seen

Advisor firms step up succession planning efforts

Separately, Trumbower has encountered new clients who discover through the financial-planning process that their existing investments might not reflect their views or their approach (whether conservative or riskier).

“They think their existing portfolios are consistent with the way they characterize themselves and are often surprised when we tell them what they really own,” Trumbower said.

Meanwhile, the Edward Jones research also looked at what investors consider when choosing a financial advisor.

Some differences between the two categories were more pointed than others: For example, 28% of traditionalists said fees were their biggest focus, compared with 12% of trailblazers. Of those who do focus on cost, though, more are concerned about investment fees and transaction fees or commissions than the advisor’s fees, the study shows.

They think their existing portfolios are consistent with the way they characterize themselves and are often surprised when we tell them what they really own.

Victoria Trumbower

managing member of Trumbower Financial Advisors

Additionally, 53% of traditionalists focus on the financial company’s characteristics — including size and heritage, employee diversity and social media presence — while just 22% of trailblazers do.

Trailblazers are more focused on technology when selecting an advisor or advisory firm, with 37% naming it a priority, compared with 9% of traditionalists.

However, they also weigh an individual advisor’s characteristics — such as experience, online presence, feedback from family or friends — more heavily in the selection process (29%) vs. traditionalists (10%).