©relif – stock.adobe.com

How to use a simple hedge fund technique to your benefit

I am not a tax advisor, and this is not tax advice per se. However, I am a portfolio manager. And, my core approach is similar to what the early hedge funds did, before the term “hedge fund” became an oxymoron. After all, many don’t hedge at all. But I digress.

The long and short of capital gains taxes

One of my favorite things about taking the basic “long-short” structure of those original hedge funds, and running them in private client accounts is the natural tax-efficiency that comes with doing so. You see, if you devote part of your portfolio to investing in stocks (”long positions”) and the other part to hedging that stock market risk (“short positions”), it is hard to avoid having losing positions in a give calendar year. Either your long or short positions (or both) will produce losses and gains during the year.

This is all part of the plan for a long-short, or hedged investor like me. For investors that like the idea of participating in the growth potential of the stock market, but proactively limiting their risk of major loss, a hedged portfolio can be a nice way to roll.

As the year draws to a close, I want to alert you to a way to potentially grab some last-minute offsets to what may have been a big capital gains year. This is especially likely if you have most of your assets in taxable accounts, instead of IRAs or a 401(k) plan.

A real-life example

As it turns out, I identified some situations among my clients recently that called for some late-year ingenuity. So, I am sharing this with you not only in case of a last-minute drive to offset some realized capital gains this year, but also to arm you with a nice additional weapon in the years ahead.

Importantly, none of what I outline here should substitute for tax advice you get from a CPA or other tax advisor. Consult them before considering something akin to what I describe below.

Let’s say that you want to try to shrink your expected tax bill from capital gains you earned this year from buying and selling securities. Unless you have some big unrealized losses to take before year-end, that ship has sailed. Or has it?

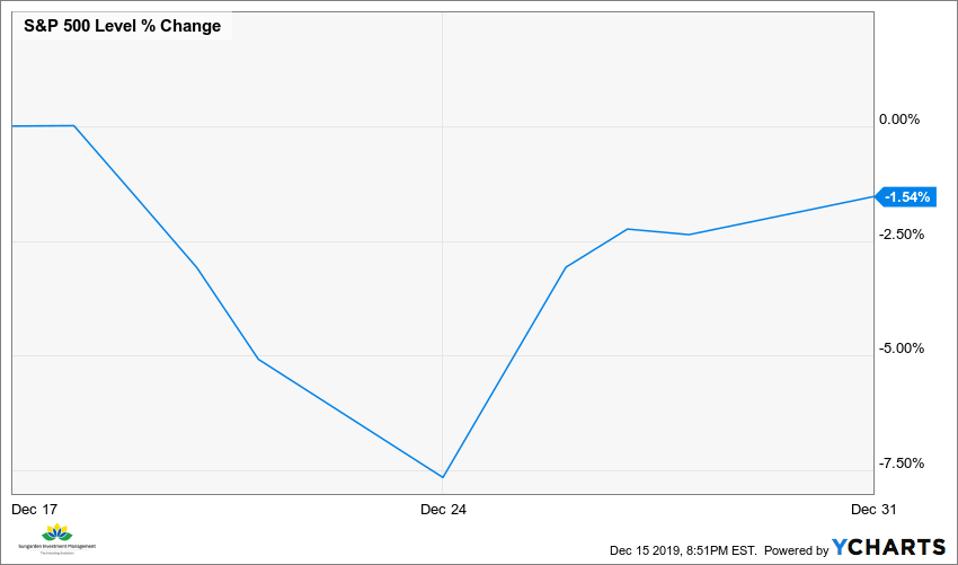

As you see in the chart below, the S&P 500 traded in a more than 7% range up and down in the final 2 weeks of 2018. And, while it is late in the year, remember that the premise of this idea was that you have essentially given up on finding ways to produce any more losses to offset your capital gains for tax purposes in 2019.

^SPX_chart (4)

So, what’s the plan?

The basic idea is to invest in a pair of near-opposite securities, then hope for some year-end volatility like we had last year. If you have excess cash in your portfolio, that is one good source for this approach. The other would be if you have very small unrealized gains or losses in securities that you don’t mind kicking out of your portfolio for a while. Selling them could help you raise some cash for this year-end push to essentially manufacture some losses, without taking a lot of risk to do so.

This approach involves identifying 2 securities that are likely to move in nearly opposite directions over the short-term. For instance, you could buy an index ETF that tracks large cap stocks. There are scores of them.

Alongside this position, you could also buy an ETF that aims to deliver the opposite of a major index, such as the S&P 500, Dow Industrials or Nasdaq 100. These are called “Inverse ETFs.” There are far fewer of these than the “long” securities I noted. And, it all depends on how much you are investing in these strategies. It is essential to evaluate the liquidity of the positions you are taking before committing any money to it.

Opposites attract…tax savings?

To summarize: you have 2 ETFs that go in opposite directions. You can invest in them in equal dollar amounts, and your return on both over nearly any time period will be close to zero. Or, you can tilt this toward one or the other (55% or 60% to one, and the rest to the other), which would give you a little “wiggle room” to make or lose a modest percentage. For more on this, look up the concept of “Market-Neutral” investing. This is a very simplified version of that.

Here is the key: if the stock market moves much at all in either direction, one of your two positions should go up, and the other should go down. The latter event will produce a tax loss. You can take that tax loss right away and reinvest in a similar security to try to manufacture more losses before year-end. Or, you can just wait until the last few trading days of 2019 to sell off whichever of your original 2 positions ended up as the loser. If you want to try to be very nimble and the market cooperates, you might actually have an opportunity to sell both securities at a loss before year-end. In 2018, this was quite possible, given how volatile things were down the stretch.

Handle with care!

Again, this is NOT for everyone. In fact, it might just be something you think about this year, but use in 2020. After all, you can allocate a portion of your portfolio to this loss-harvesting strategy at any time during the year. It doesn’t have to be reserved for the last 2 weeks of the year.

In hedge fund language, some refer to this as a “pairs trade” and others as a “long-short” technique. Regardless of what you call it, having additional ways to be proactive in managing your taxable investment assets is something that any serious investor should be thinking about.

Comments provided are informational only, not individual investment advice or recommendations. Sungarden provides Advisory Services through Dynamic Wealth Advisors