plant seeding growing step. concept agriculture

I’ve heard a handful of conversations about how cryptocurrency returns are going to be used to fund early retirements, however, one thing I don’t think many investors realize is that there is a specific IRA – or individual retirement account – that allows Americans to save for retirement by holding crypto assets today. If you are a savvy investor who wants to take control of your funds, diversify your risk, and trade while completely deferring or eliminating income taxes these are the types of retirement solutions important to pay attention to.

There are multiple types of IRAs that the IRS has granted special tax advantages to. For context, these plans are designed to reduce taxes, and in turn incentivize savings for retirement. The two main types of IRAs are Traditional IRAs and Roth IRAs

- Traditional IRAs: allows pre-tax contributions to grow tax-free until withdrawn (taxes are paid only at the time of withdrawal). Funds contributed to a traditional IRA can also be deducted on a tax return in certain cases.

- Roth IRAs: allows post-tax contributions (you pay taxes now) that then grow in your retirement account tax free (if you meet certain criteria). In this case there are no extra tax deductions.

Traditional Vs. Roth IRA

What IRA can hold crypto?

Cryptocurrencies are normally prohibited from holding in regular IRAs. Traditional IRAs and Roth IRAs can only hold securities like stocks, bonds, certificates of deposit, and mutual or exchange-traded funds (ETFs). However, the IRS clarified that cryptocurrencies are taxed as property (not securities), per Notice 2014-21, they can be held in a properly set up self-directed IRA (SDIRA).

Self-directed IRAs are retirement accounts that allow the holder to have alternative investments such as precious metals, commodities, real estate, and other sorts of alternative investments – including cryptocurrencies. SDIRAs have been around since IRAs were established in 1974 but are still a pretty new phenomenon to crypto holders.

SDIRAs are directly managed by the account holder. Therefore, the responsibility of the investment and the due diligence fall solely upon the account holder – hence the name “self-directed.” SDIRAs are only available through specialized firms that offer SDIRA custody services.

Funding an SDIRA

An SDIRA itself is funded by transferring money from a Traditional IRA or a Roth IRA. This is known as a “rollover.” The funds for a traditional or Roth IRA typically come from regularly earned income such as wages, investment income, business income, etc.

Therefore, in order to trade cryptocurrency tax free within a self-directed IRA, the steps are:

- Open and fund a traditional or Roth IRA with USD

- Rollover the USD from the traditional or Roth IRA into a self-directed IRA

- Buy/trade cryptocurrency from the USD in the self-directed IRA

Taxes on SDIRAs

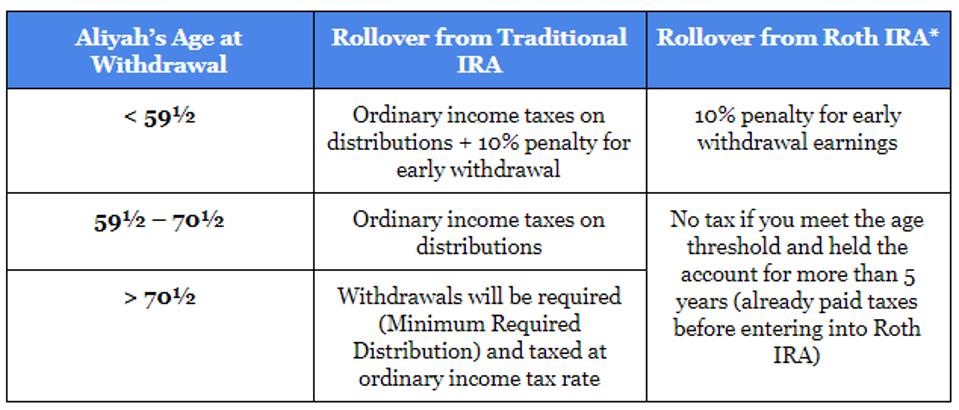

SDIRAs can be very tax advantageous. Let’s say that Aliyah trades cryptocurrency in a SDIRA funded by rollover funds. Here’s what will happen in various scenarios:

IRS Vs. Roth IRA Chart

* with a Roth IRA, Aliyah can withdraw the original contributions at anytime without any taxes or penalties (only the earnings are subject to taxes and penalties listed)

The beauty of tax deferral is that the deferral compounds each year. Let’s say Aliyah rolled over $20,000 from a traditional IRA to a SDIRA and bought 2 bitcoins. Aliyah is 25 years old. Let’s assume that the price of bitcoin increases at 10% each year. If she takes out the funds at age 71, she would be able to defer over $2 million in taxes assuming a 15% average tax rate.

IRAs are a somewhat complicated area of the tax code, but they come with significant tax benefits. There are several platforms which offer self-directed IRA accounts for cryptocurrency holders. If you are a savvy investor who wants to build cryptocurrency wealth while mitigating taxes, look into trading with a reputable SDIRA custodian. To maximize the benefits, just remember that you’ll need to hold off on withdrawing the funds until you reach 59½ years of age.

Disclaimer: this post is informational only and is not meant as tax advice. For tax advice please speak with a tax professional.