Daniel Grizelj

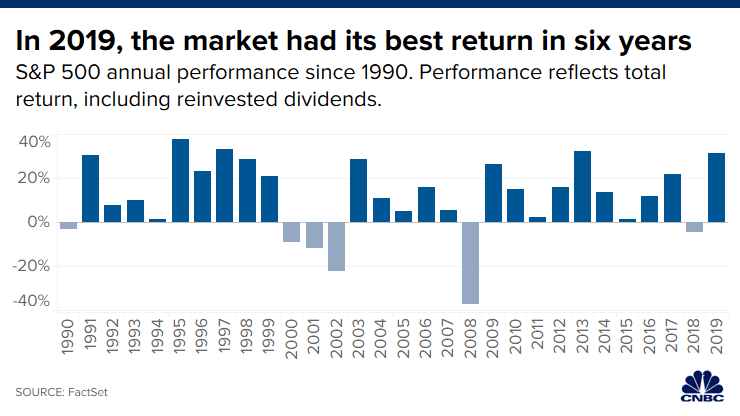

The stock market surged in 2019, closing out the end of the decade by posting its best annual gain in six years.

But investors hypnotized by the prospect of big profits should temper any knee-jerk reaction to load up on stocks as the new year gets under way.

Charlie Fitzgerald, a financial advisor at Moisand Fitzgerald Tamayo, an advisory firm with offices in Orlando and Melbourne in Florida, said a strong stock market often leads investors to be overconfident and assume the gravy train will last.

“People look at their portfolios and say, ‘Stocks did great last year. I don’t want to miss out,'” Fitzgerald said.

“One of the biggest investing myths is that people can time the market,” he said. “It’s just not possible.”

The S&P 500 index was up a whopping 31.5% last year, including reinvested dividends. That’s its best showing since 2013, when the index had a total return of 32.4%.

The only year that saw better annual performance over the past three decades was 1997, when the S&P 500 yielded 33.4%.

There were several factors nudging the stock market upward in 2019.

For one, the Federal Reserve reversed course on its monetary policy, reducing its benchmark interest rate three times last year. The Fed had previously raised rates four times in 2018, up to 2.5%.

Lower interest rates generally lead investors to pour more money into stocks in search of higher returns, since safer havens such as cash and certificates of deposit yield less in low-rate environments.

Further, much of last year’s market run-up went into erasing steep losses from the fourth quarter of 2018, which contributed to the S&P 500’s first annual loss since the financial crisis a decade earlier. A surge in stocks is typical after a year in which there was a downturn.

While there aren’t strong indicators suggesting the market’s upward trajectory won’t continue in the near term, some financial experts say the prudent course of action for investors — especially those near or in retirement — after 2019’s banner year would be to reduce stock holdings.

“It stands to reason after this performance that you’d want to take some chips off the table,” said Christine Benz, the director of personal finance at research firm Morningstar.

That doesn’t mean selling out of all stock holdings, though. Increasingly longer lifespans mean retirees will have to make their money last for perhaps three to four decades, and some investment risk is necessary to ensure adequate returns.

One of the biggest investing myths is that people can time the market. It’s just not possible.

Charlie Fitzgerald

financial advisor at Moisand Fitzgerald Tamayo

However, investors should consider rebalancing their portfolios, which are likely stock-heavy after 2019’s performance, Benz said. That would mean selling some stock holdings and re-allocating them to a less risky part of the portfolio such as bonds.

Let’s consider a $100 portfolio, allocated 60% to stocks and 40% to bonds, to see how an investor could inadvertently take on more investment risk over time.

A 31.5% increase in stock returns last year would have grown the stock portion of the portfolio to $78.90. Let’s say bonds returned 5%, bringing bond holdings to $42. The portfolio would now be 65% stocks and 35% bonds, instead of the investor’s target of 60%-40%.

“You have to think about portfolios not just from a return perspective but from a risk perspective,” Fitzgerald said. “If rebalancing isn’t done, the risk is unchecked.”

More from Personal Finance

Why you might not want to move all your IRA money to a Roth

Here’s why you should consolidate those 401(k)s and IRAs

If you hit the $237 million Powerball jackpot, this is your tax bill

Based on average annual stock market returns of around 10% over the last century, probability dictates that performance exceeding 25% in any given year is rare — or, with odds of roughly 1 in 6, Fitzgerald said.

It’s impossible to know how long the current market rally will last, but chances are returns will, at the very least, be lower in 2020.

Younger investors with decades until retirement should maintain stock-heavy portfolios, because they have time to weather any future losses and can afford to take more risk, Benz said.

However, such investors can re-allocate within their stock holdings, Benz said — perhaps by adopting some more foreign versus U.S. stocks, since the former underperformed U.S. stocks last year and may be in store for stronger returns.