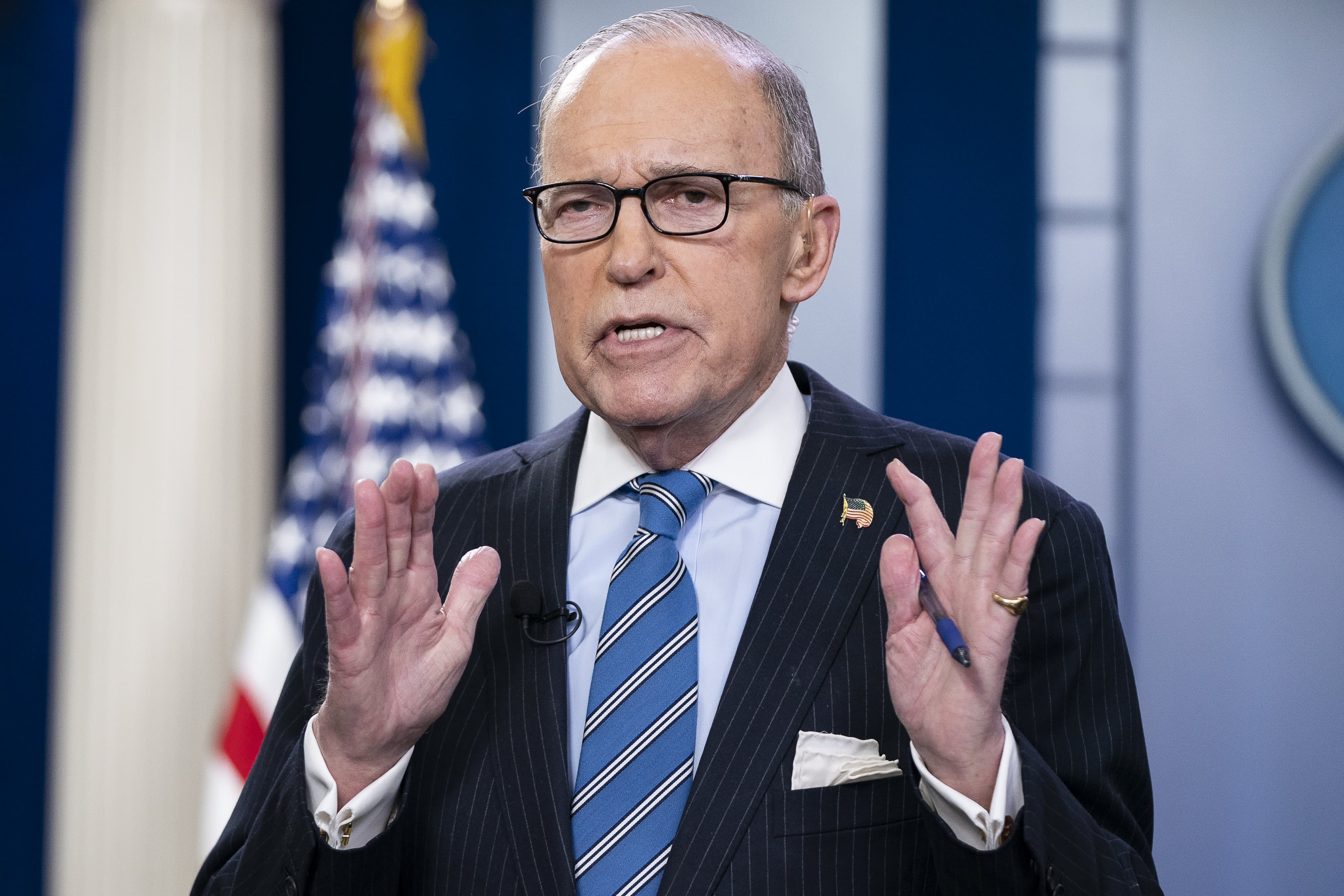

Larry Kudlow, director of the U.S. National Economic Council, speaks during a television interview at the White House in Washington, D.C., U.S. on Thursday, Jan. 30, 2020.

Alex Edelman | Bloomberg | Getty Images

National Economic Council Director Larry Kudlow said the coronavirus-triggered selloff has created a buying opportunity for long-term investors.

“The virus story is not going to last forever,” Kudlow said on CNBC’s on “The Exchange” on Tuesday. “To me, if you are an investor out there and you have a long-term point of view I would suggest very seriously taking a look at the market, the stock market, that is a lot cheaper than it was a week or two ago.”

Stocks plunged for a second day, with the Dow Jones Industrial Average tumbling about 1,800 points since Monday, after officials warned of a wide spread of the coronavirus in the U.S.

“The markets obviously are reflecting new fears. A lot of volatility out there. I don’t think these are fundamental factors …This thing will run its course,” Kudlow said.

Along with the drastic drop in stocks, the benchmark 10-year Treasury yield plunged to a record low of 1.31% on Tuesday.

The Centers for Disease Control and Prevention officials said the coronavirus is “likely” to continue to spread throughout the U.S. and outlined what schools and businesses should do if the disease becomes an epidemic.

Total confirmed cases globally have surged to more than 80,200 and at least 2,704 people have died of the coronavirus. Overnight, South Korea reported 60 new cases to bring the country’s total to 893 infected, while China’s National Health Commission reported 508 new confirmed cases and 71 new deaths.

Kudlow reassured investors that the U.S. has “contained” the coronavirus and it will likely not be an “economic tragedy.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.