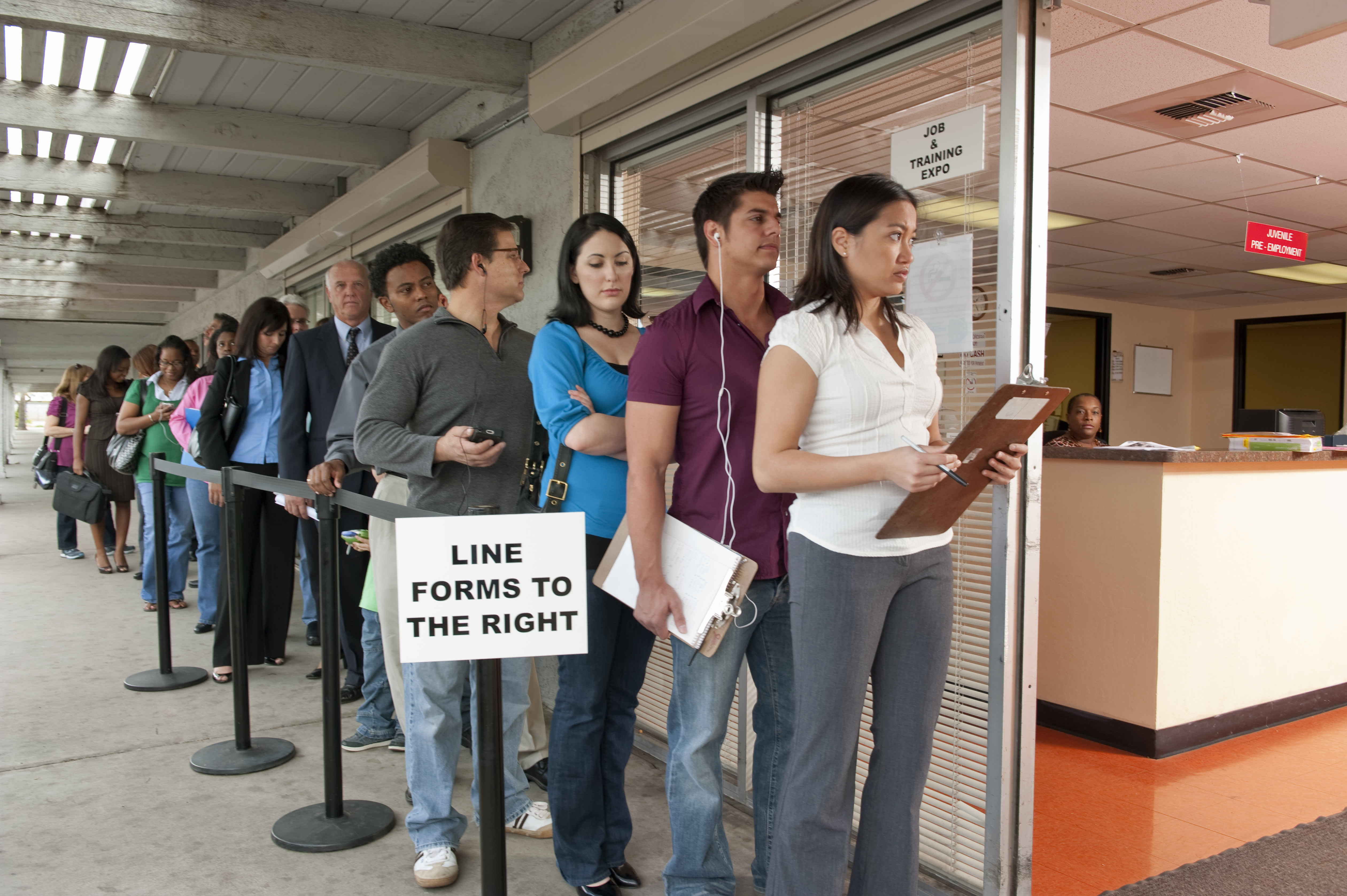

Yellow Dog Productions

What does the legislation do?

The bill — the Coronavirus Aid, Relief and Economic Security Act — expands unemployment insurance, a program enacted in 1935 to provide temporary income support for workers who lose their jobs.

The legislation does three primary things: offers bigger unemployment checks, increases the duration of those payments and extends jobless benefits to previously ineligible groups of workers, like gig workers and freelancers.

How much will benefits increase?

The legislation offers an additional 13 weeks — roughly three months — of unemployment insurance, funded by the federal government. The bill also gives an additional $600 a week for up to four months.

This would be in addition to current jobless benefits offered by the states, which administer their own unemployment insurance programs.

Expanded benefits would last through December 2020.

So, how much unemployment will I get?

This depends on several factors, including your prior wages and the state in which you live.

States generally base payments on a worker’s prior four quarters of wages.

In January, state programs paid an average $385 weekly to unemployed workers, according to the Center on Budget and Policy Priorities.

The new legislation restricts the maximum duration of unemployment benefits to 39 weeks — or, almost 10 months.

So, under the new legislation, a typical worker could expect $985 a week for four months ($600 in extra relief plus state benefits), followed by up to 23 weeks of $385 a week in standard state benefits. Unemployment benefits are taxable.

However, state benefits vary widely. Some are more generous and some (typically southern states) far less so.

Who qualifies for unemployment?

If you were laid off by your employer, you are eligible to collect unemployment.

Furloughed workers can also collect — they are on temporary layoff, and those on temporary layoff are eligible for benefits, said Susan Houseman, director of research at the W. E. Upjohn Institute for Employment Research.

The legislation extends benefits to previously ineligible workers. This includes self-employed workers, people seeking part-time work, workers who can’t reach their place of work as a result of COVID-19 and those don’t have sufficient work history to otherwise qualify for benefits.

Significantly, it also applies to those who quit their job as a “direct result of COVID-19.” People who quit their jobs don’t normally qualify for unemployment.

Unfortunately, just because you apply doesn’t mean you’ll receive benefits — the share of laid-off workers who receive unemployment range from a low of 10.5% in North Carolina to more than 50% in New Jersey, according to the W.E. Upjohn Institute for Employment Research.

Can gig workers get benefits?

Yes, the legislation extends unemployment checks to gig workers, like Uber and Lyft drivers, who are generally independent contractors rather than the salaried employees typically eligible for unemployment.

The Labor Department should publish guidance shortly about the specific mechanics relative to gig workers, such as the documentation needed to prove wages and work history, experts said. Tax forms such as 1099s and some sort of payment stub should suffice, they said.

The guidance should also stipulate if and how gig workers can get benefits for a severe decline in income, rather than outright job loss. Gig workers and contractors are likely to be able to get partial benefits if they don’t earn too much, said Stephen Wandner, a labor economist at the Upjohn Institute.

How do I apply for unemployment?

Generally, you’ll need to file an unemployment claim in the state where you worked. File a claim as soon as possible after becoming unemployed.

Many unemployment offices around the country have closed as a result of rules put in place by state governors, ruling out in-person applications for several Americans. However, you can also apply online or by telephone.

Here’s a resource to help you get started in your particular state.

How long will it take to receive benefits?

It typically takes two to three weeks after filing a claim to receive your first benefit check. Some states require a one-week waiting period. However, some states may waive the waiting period — the Senate legislation offers federal funding for the first week of unemployment benefits for states that choose to pay recipients as soon as they become unemployed.

There may be long wait times when applying. Nearly 3.3 million people filed first-time claims for unemployment last week — shattering the previous record, set in 1982, by around 2.6 million people, according to the Labor Department.

“Unemployment insurance offices have been completely overwhelmed with claims and are having a tough time handling the volume,” Houseman said. “People will need to be patient, and it might be advisable for those who don’t need UI benefits urgently to hold off filing a claim until some of the backlog clears.”