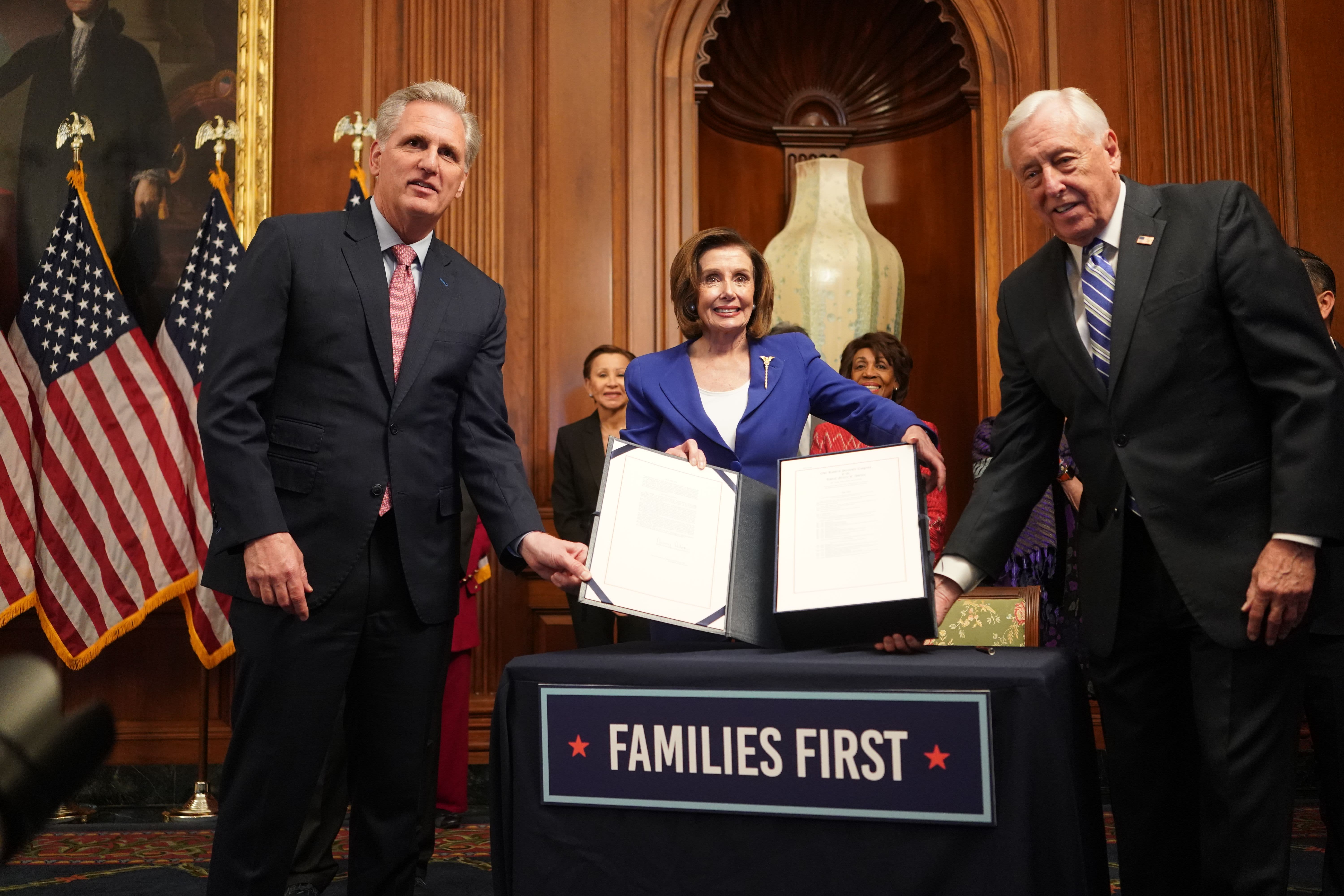

President Donald Trump signs the $2.2 trillion coronavirus aid package bill as White House Economic Council Chairman Larry Kudlow, Treasury Secretary Steven Mnuchin, Senate Majority Leader Mitch McConnell (R-KY), House Minority Leader Kevin McCarthy (R-CA), Vice President Mike Pence and Rep. Kevin Brady (R-TX) watch in the Oval Office of the White House in Washington, U.S., March 27, 2020.

Jonathan Ernst | Reuters

The $2 trillion federal stimulus package signed into law by President Donald Trump on Friday, March 27, will be a lifeline to many gig workers and freelancers.

Known as the CARES Act, the law takes unprecedented steps in including the self-employed in the social safety net. It offers freelancers unemployment insurance, for which they generally don’t qualify, on a large scale for the first time. As stipulated in the House bill, it offers freelancers an additional $600 a week in unemployment insurance, bringing weekly payouts to the $800- to $900-a-week range when state benefits are added, to workers including the self-employed, for up to four months.

“It’s an amazing win, given that there is no unemployment insurance for freelancers,” says Rafael Espinal, who recently took the helm of the Freelancers Union as executive director. “This will help inject cash flow into their homes.”

The stimulus package also offers the self-employed and small business owners a $10,000 advance on an Emergency Economic Injury Disaster Loan (EIDL) that does not have to be paid back, even if the borrower does not qualify for an SBA loan. The program provides loans up to $200,000.

Sole proprietors, ESOPs, cooperatives, businesses with no more than 500 employees and tribal small business concerns can apply. Under the EIDL program, administered by the U.S. Small Business Administration, applicants will not have to submit a tax return and will be evaluated based on their credit score. The SBA will provide the funding within three days of a successfully completed application as an advance payment.

There is no personal guarantee required for the loans. The SBA is waiving the requirement that businesses have one year of operations prior to the disaster, but businesses are not eligible if they were not in operation on January 1, 2020. The bill authorizes $10 billion in appropriations for these loans.

I suspect with most states it will be very hard to get enrolled and get money. Their systems aren’t set up to deal with the magnitude of unemployment they are about to get.

Steve King

partner, Emergent Research

“I’m very, very pleased the one-third of the American workforce that has been ignored for many years was recognize as a critical part of the economy’s recovery, post-pandemic,” said Carl Camden, founder and president and founder of the Association of Independent Professionals and the Self-Employed .

But Espinal and other advocates for freelancers and the self-employed say it is imperative that economic aid arrive quickly for freelancers. Often in a downturn, clients delay paying freelancers for work already done, leaving them with little or no income for extended periods of time.

Some organizations are offering grants to tide them over.

The Freelancers Union just introduced the Freelancers Relief Fund, which offers a $1,000 emergency grant to freelancers for necessities like rent and groceries that need to be covered before aid is delivered.

Hello Alice, a funding provider, has also just offered $10,000 emergency grants to small businesses, in conjunction with nonprofits and government agencies, with the aim to deliver them in three weeks.

MBO Partners, a firm in Herndon, Virginia, that provides back office services to independent workers and studies the independent workforce, has been talking with senior leaders at the U.S. Treasury and major U.S. banks to make sure that independent workers can access the resources available through the law, according to Gene Zaino, chairman of MBO Partners.

“The issue is going to be how do you make sure the money is going to the right people?” Zaino says.

More from Invest in You:

What you can learn from a tanking market: some good financial habits

Panic shopping and fleeing to cash seem to go hand in hand

How to prepare for a family member with COVID-19

For the time being, it may be challenging for the self-employed to access unemployment, according to Steve King, a partner in Emergent Research, a firm in Lafayette, California, that studies the independent workforce,

“I suspect with most states it will be very hard to get enrolled and get money,” says King. “Their systems aren’t set up to deal with the magnitude of unemployment they are about to get. They have no systems for dealing with the self-employed. While the good news is that the self-employed are going to get that money, it’s going to be a struggle before anyone sees the money.”

Many self-employed professionals have been living by their wits since the crisis began.

Alicia Schiro, owner of Aced It Events, a one-person event-planning firm in New York City, has seen much of her work grind to a halt since the coronavirus crisis. She’s quickly shifted to focusing on online events and enhancing the Zoom webinars that her corporate clients are holding, recruiting celebrities for some events. “I’m not making as much as I would, but right now it’s about survival,” she says.

Worried about the lack of revenue coming in, Schiro applied right away for a grant New York City offered to small businesses with less than four employees that are seeing a reduction in revenue because of COVID-19. She already received a $1,300 grant, but has a long way to go to make up for her lost income.

Some are looking at the loan program cautiously. Elizabeth Davis, a former construction technology engineer, now runs Shedavi, a one-woman business selling hair-care products out of Atlanta. While she would entertain the idea of taking a loan if she needed one, she looks at loan programs cautiously.

“Taking on loans affects your credit, and you have to be sure you can pay it back,” Davis says. “I’d err on the side of caution with that.”

Elizabeth Davis, a solo hair-care entrepreneur, says entrepreneurs need to be mindful that any loans they take for disaster relief must be paid back.

Shekeidra Booker

Some players in the freelance economy are trying to open the spigot of work for those who’ve lost other projects. Moonlighting, a platform that matches freelancers with remote work, has made use of the platform free. “People are scared and need something to replace in-person work,” says Jeff Tennery, founder and CEO.

Once the crisis passes, some experts on the freelance economy believe the the bipartisan support for providing unemployment to freelancers could signal a new era for independent workers — one in which the idea of providing a government safety net to people outside of traditional jobs goes more mainstream.

”It’s quite a shift in thinking,” says King. “They’ve effectively, at least for the crisis, detached unemployment insurance from employment. I don’t think we’ve ever done that before. They’ve signaled that people doing freelancing and independent work aren’t employees but should get some of the benefits.”

He believes it could usher in a new way to classify workers outside of the two categories used now — W2s and contractors. “It increases the possibility we’ll get a third classification or portable benefits,” says King.

King believes that while, California’s legislators won’t have the time to address AB-5 during the coronavirus crisis but it will put more pressure on the State of California to relax AB-5. The law, which took effect Jan. 1, requires that many freelancers be reclassified as employees. It sparked a massive outcry from freelancers, many of whom say they are losing work or have been put out of business because employers can’t afford to put them on payroll.

The stimulus bill’s attention to the self-employed could change the conversation among lawmakers, King believes. “A lot of the protections they want for gig workers suddenly get covered in the stimulus law,” he says.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: 7 side hustles you can do while working full time that can pay as much as $150 per hour via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.