TOPLINE

Tens of millions of Americans have filed for unemployment in recent weeks and although the data is sobering, jobless claims have declined from their peak earlier this month giving a slight boost to investors who are desperate for positive news.

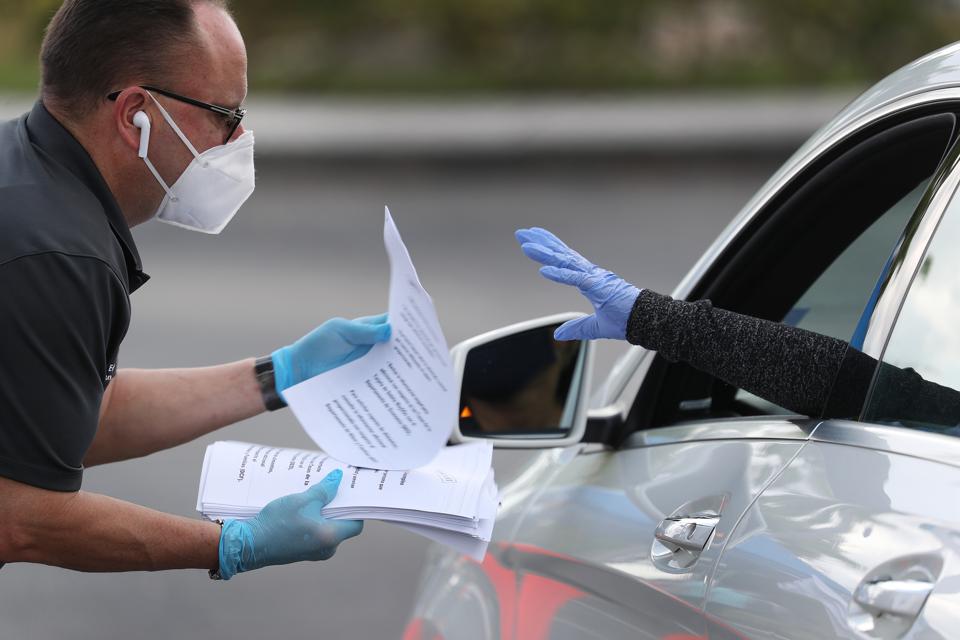

Job loss claims may have peaked as the market looks towards re-opening the economy.

Joe Raedle/Getty Images

KEY FACTS

In the latest sign of just how badly the coronavirus has hit the U.S. economy, another 4.4 million Americans filed for unemployment claims last week, down from 5.2 million the week prior, according to data released by the Labor Department on Thursday.

The total number of workers who have filed for unemployment since late March has surpassed 26 million.

Despite the sobering economic data, stocks brushed off the weekly unemployment numbers and moved slightly higher on Thursday, rising more than 1%.

Though the jobs numbers are historically worse compared with the 2008 financial crisis, they’re in line with expectations and are declining, points out Jamie Cox, managing partner for Harris Financial Group.

Weekly unemployment claims topped 6 million earlier this month, but have decreased since: It appears that the “lion’s share” of these jobless claims were on the front-end of the coronavirus crisis, meaning that markets are looking ahead to a gradual reopening of the economy, Cox says.

“I think it’s almost confirmation of the recent trend that we’ve been seeing as of late… [a] resetting of expectations,” says Peter Essele, head of portfolio management for Commonwealth Financial Network. “Things will continue to look bad, but it’s all about expectations—and what we’re seeing are things looking less bad for the last couple of weeks.”

The recent pullback in unemployment claims is “really buoying the markets,” he says; “Data continues to improve, which reconfirms the momentum that we’ve seen in markets off the bottom in March.”

Big number

22.4 million. That’s how many jobs were added to payrolls since November 2009, when the U.S. economy began to recover from its last recession—but that has now been effectively wiped out in just the last five weeks.

What to watch for

Essele predicts that the economy could see a “similar situation” to what happened after the 2008 financial crisis. For most of 2009, he points out, jobs were still being lost, but the “market took off” as the number of losses decreased. “Markets are going to rebound before the [jobs] numbers look and feel good,” Essele says, while also adding that the “true litmus test” will be whether next month’s payroll number confirms data seen so far—that the fallout is mostly constrained to the leisure and service industry—or if losses will be more widespread.

Crucial quotes

“In spite of week 5 of employment Armageddon, markets continue to look beyond the economic damage that is being incurred,” says Ron Temple, head of U.S. equity at Lazard Asset Management. “Monetary and fiscal stimulus have put a floor under the economy, however the unprecedented disruption to business and household finances inflicted by COVID-19 will leave lasting scars even after testing, therapeutics and a vaccine are widely available.”

Crucial statistics

Around 90% of job losses came from the food service industry, and while that’s “certainly painful,” those areas tend to be “fairly fluid”—jobs are quickly lost but can be quickly regained as well, Essele says. “That means it’ll be a quicker turnaround than if losses had occurred more broadly across all sectors.”

Key background

While the large number of job losses has undoubtedly had an effect on consumer spending and confidence, “you can see that the consumption engine is starting to rev back up” in recent weeks, says Cox. “The longer this drags on, the propensity to go spend money will increase,” he predicts, as pent-up consumer demand continues to build up during widespread stay at home and business shutdowns. Once a gradual reopening process does occur, there will still be a large amount of consumers with money to spend.

Further reading

Here Are 29 ‘Get Out And Go’ Stocks For The End Of The Coronavirus Quarantine (Forbes)

How Bad Will Unemployment Get? Here’s What The Experts Predict (Forbes)

Just How Bad Is It? Here’s The Economic Damage The Coronavirus Will Cause, According To Major Banks (Forbes)

Full coverage and live updates on the Coronavirus