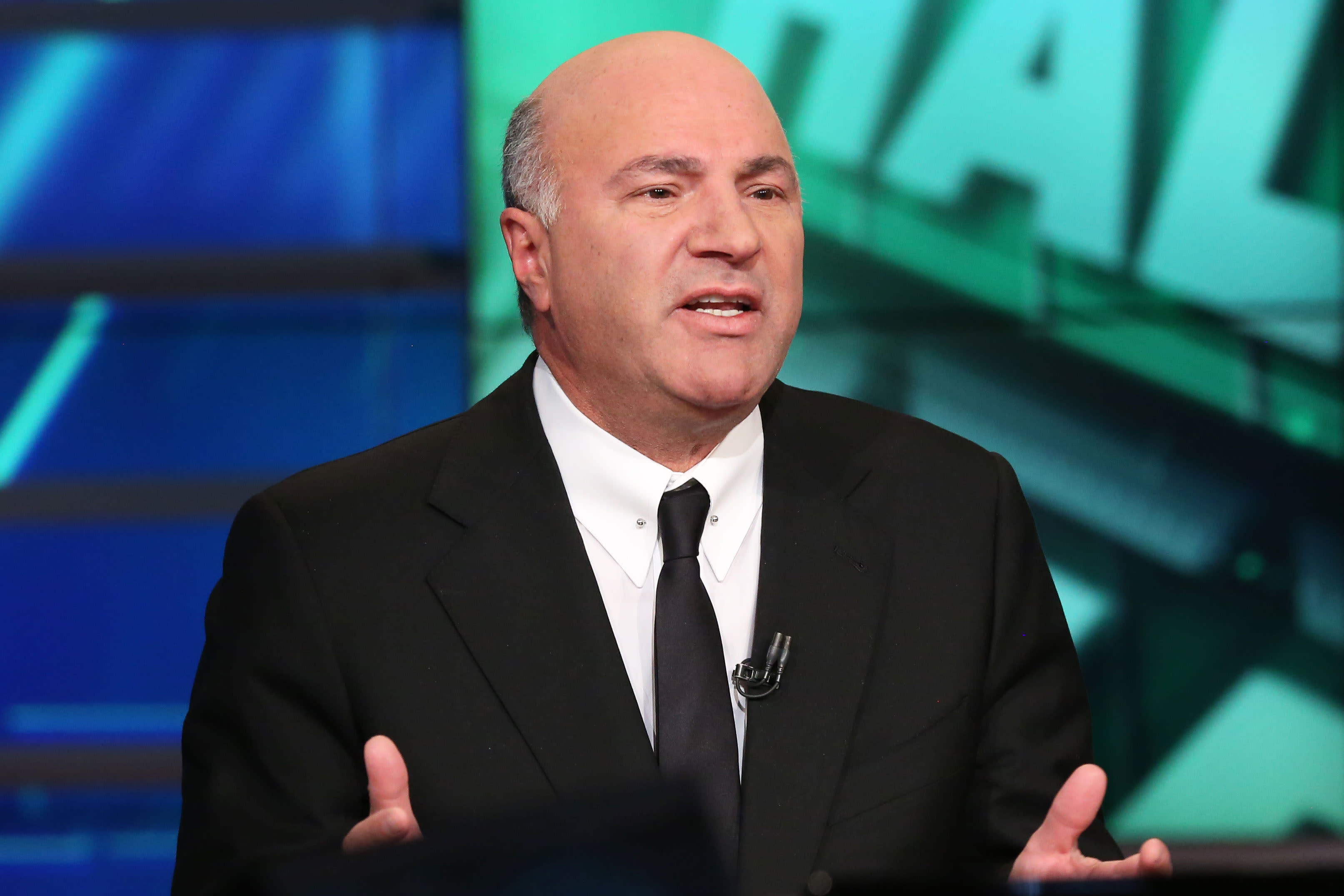

Kevin O’Leary told CNBC on Thursday that he believes around 20% of small businesses that received federal loans to weather the coronavirus pandemic won’t ultimately survive.

“They’re going to go bankrupt because this loan provision is really a Feb. 15 to June 30 event and if you haven’t figured out alternate distribution strategies by then, you will fail,” the “Shark Tank” investor said on “Squawk Box.”

Businesses tied to restaurants and food supply, as well as sporting events and entertainment, are at heightened risk of not surviving, O’Leary argued. “We can’t continue to just keep funding them in perpetuity, and I agree with that strategy.”

O’Leary said 29 of the nearly 50 small businesses that he’s invested in through “Shark Tank” have received loans through the Paycheck Protection Program, part of the $2.2 trillion outbreak relief package passed in March.

Loans received through the program, which has experienced intense demand, can be forgiven if used on expenses such as payroll, rent and utilities. Businesses are eligible to receive loans up to 2.5 times their average monthly payroll expense. The loans max out at $10 million.

O’Leary, known as “Mr. Wonderful” on “Shark Tank,” also said he believes there are “plenty” of small business owners who have figured out ways to adapt to the new business landscape in a Covid-19 world.

“There’s a permanent change in consumers’ behavior to buy direct, so if you’d set yourself up prior to this, you’re surviving,” said O’Leary, also chairman of O’Shares ETFs. “So 80% are going to make it, in my view. That means it was a great investment.”

— Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank,” on which Kevin O’Leary is a co-host.