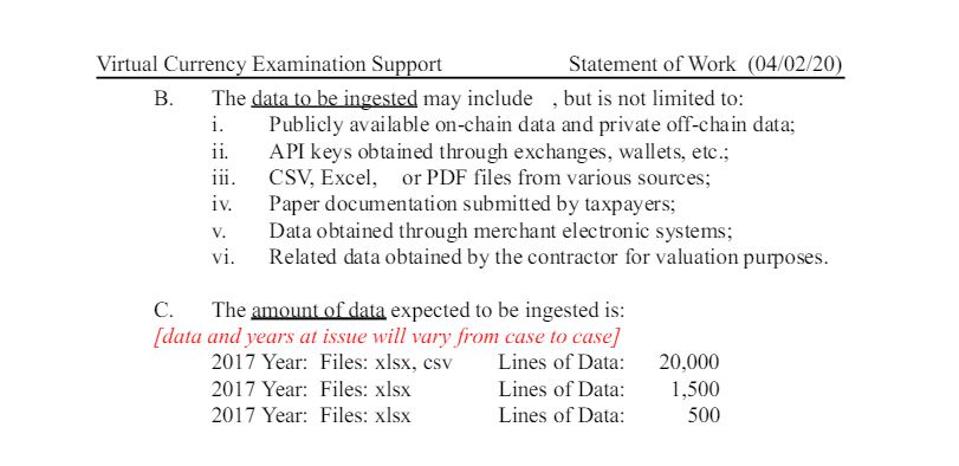

On May 12, 2020, the IRS sent out a statement of work (SOW) requesting help from independent consultants to crack down on cryptocurrency tax non-compliance. According to the SOW, the IRS is seeking help from technology companies in the crypto tax software space in reconciling taxpayers’ reported cryptocurrency gains and losses on the tax returns. The process includes using software to systematically obtain cryptocurrency transactions data through exchanges, wallets, API keys, blockchain data, and other sources and creating a detailed tax report for the taxpayers under consideration.

Obtained from IRS SOW 5/12/20

Obtained from IRS SOW 5/12/20

It is likely that the service would compare information reported by taxpayers on their tax returns with the software generated output from technology consultants. If there are any discrepancies, further conversations or audits would take place with the taxpayers. Taxpayers who would be subject to this process could range from small taxpayers to sophisticated traders. The SOW states, “Taxpayer transactions can be relatively simple, or in some instances, they can have hundreds of thousands of digital asset transactions in a year.”

What This Means For Crypto Users

The verbiage and the construction of the SOW indicate that the IRS is now fully aware of how the cryptocurrency space functions. They explicitly know that cryptocurrency exchanges and subpoenas are just the first step in clamping down on cryptocurrency tax evasion, and are now evolving to the next phase of enforcement by leveraging software to get a full picture of crypto users’ tax profiles.

It is important to note that there is no evidence that the IRS has required any crypto tax software companies to release their users’ data to the IRS. Therefore, those users who have failed to report — or underreported — their cryptocurrency taxes could still find a reputable cryptocurrency tax software and come into voluntary compliance before the IRS comes to them.

Disclaimer: this post is informational only and is not intended as tax or investment advice. For tax or investment advice, please consult a professional.