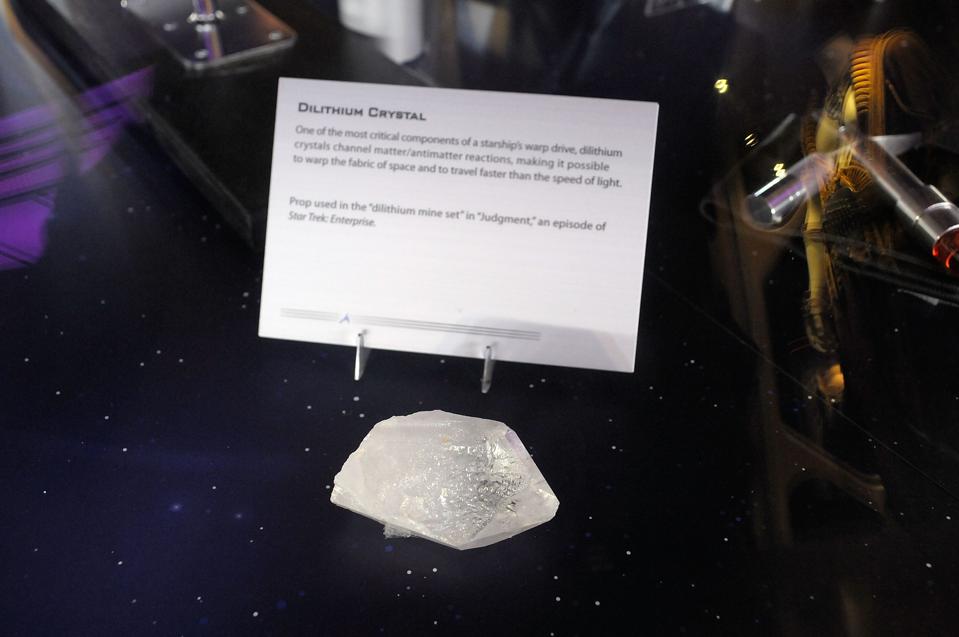

LOS ANGELES, CA – OCTOBER 10: Dilithium crystal prop on display at “Star Trek – The Exhibition” at … [+]

Getty Images

Have We Got A Deal For You?

So here is the deal. Take $100,000. Invest it in a partnership. The general partner asks you to vote a couple of weeks later. The undifferentiated raw land that you bought into at $10 million, which the partnership acquired for $2 million or so a year ago, is worth $60 million, because it is an ideal mountain retreat or maybe they can mine something there. Clay, gravel, dilithium crystals – whatever.

You get to vote on whether to just sit on the land, pull the trigger on the development plan or donate an easement to a qualified charity, which will give you a $500,000 charitable deduction. In a couple of years you will also get some pretty negligible amount of cash for the value of the now encumbered land.

When these votes are taken, you don’t have to be George Gallup to predict the outcome, it is always the easement donation. That must be because people who invest in these deals love the environment so much.

IRS All Over It

I don’t think anybody knows how many of these deals there are, but there are a lot. And they have created concern within the IRS, which has classified them as listed transactions. Department of Justice is going after Ecovest, one of the largest promoters. Senator Grassley has his Finance Committee up in arms about them. And then there is the class action lawsuit that Jay Adkisson covered on this platform.

With all this going on when I see the industry reaction, I have to go back to my sixth grade teacher at St. John’s in Fairview NJ, Sr. Jane Aloysius, to find an adequate characterization of the response. They are as brazen as brass and as bold as gold.

Who Speaks For The Industry?

The industry’s trade association (according to its Form 990 it is exempt under 501(c)(6) not 501(c)(3)) is the Partnership For Conservation (P4C)). P4C President Robert Ramsay was recently in Tax Notes with an article titled A Dirty Dozen Myths About Conservation Easements and One Sad Truth (The complete article is behind a paywall).

One of the so-called myths is really at the heart of how the industry works:

“Myth 7: A conservation easement’s value cannot exceed the current value of the land.

Reality: A conservation easement’s value is the value of the development rights that are forfeited in perpetuity when an easement is placed. Treasury’s own regulations require that these rights be valued based on the land’s highest and best use. When the existing state of land is different from its highest and best use, giving up the opportunity to develop the land forgoes substantial value. It is that value that the law permits as a deduction. The IRS ignores Treasury regulations, and years of court cases, when it asserts that a conservation easement deduction cannot exceed the value of the land itself. If the IRS wants to change these rules, it must do so through a legitimate rulemaking process, but it has not done so.” (Emphasis added)

It Is Not A Myth

The notion that an easement on land can be worth more than the land itself doesn’t even make good nonsense. Of course, that would not prevent it from being enacted into tax law, but as it happens it has not.

The Code mentions “qualified conservation contributions” as an exception to an exception. The first level exception is one that denies charitable contributions to partial interests. Qualified conservation contributions are an exception to that exception. There is nothing in the Code that gives them special valuation privileges.

The Regulations

The regulations do give a sort of break. The general rule for contributions is fair market value:

“The fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.”

Following that standard strictly would mean no deduction for most easements, since they are not something with lots of willing buyers. Give it a try. Offer to put a conservation easement on a property. Advertise. Wait for the bids to come in. And wait and wait.

So here is the break of sorts in the regulations.

“If no substantial record of market-place sales is available to use as a meaningful or valid comparison, as a general rule (but not necessarily in all cases) the fair market value of a perpetual conservation restriction is equal to the difference between the fair market value of the property it encumbers before the granting of the restriction and the fair market value of the encumbered property after the granting of the restriction.” (Emphasis added)

If both of those FMV’s are positive numbers and the “before” value is greater than the “after” value, the difference has to be less than the FMV of the property.

“ If before and after valuation is used, the fair market value of the property before contribution of the conservation restriction must take into account not only the current use of the property but also an objective assessment of how immediate or remote the likelihood is that the property, absent the restriction, would in fact be developed, as well as any effect from zoning, conservation, or historic preservation laws that already restrict the property’s potential highest and best use.”

So it is not a myth at all, it is what the regulations state, which, at least this once, corresponds with common sense.

How Can People Think Otherwise?

There is a strong desire to think otherwise, because syndicated conservation easements as a business model won’t work if it is true. The market for undeveloped land is an imperfect one, but it is not a bunch of idiots. You can not routinely buy land for less than its fair market value, and people will not pay you money so that they will be able to take a deduction for less than the amount of money they paid you.

You can, to some extent, blame the IRS, because in its attacks on conservation easements, it has tried to deny them entirely based on technical foot-faults and there not being enough conservation purpose.

There were three decisions this week about that approach which have already been covered by Lew Taishoff, the fastest tax blogger in the east, here, here and here. I will be getting to those cases in the next few days. Regardless, that approach by IRS means there is not a lot of case law that shows that “Myth 7” is the down to earth truth.

There is some though notably Whitehouse Hotel Limited Partnership, which quoting another case notes:

‘‘The concept of ‘highest and best use’ is an element in the determination of fair market value, but it does not eliminate the requirement that a hypothetical willing buyer would purchase the subject property for this indicated value.’’

Why This Is Critical

When the syndicators buy a piece of property what they pay for it is good evidence of what it is worth. That was noted in in recent TOT Holdings Tax Court decision.

“In December 2013—days before the contribution of the easement—PES indirectly acquired a 99 percent interest in the property for $1,039,200, suggesting a 100 percent value of roughly $1.05 million. Mr. Barber’s before value ($1.128 million) corresponds roughly to this figure, and Mr. Wingard’s before value ($3.9 million) is not at all close to it.”

The syndications rely on the before value being a substantial multiple of what was recently paid for the property.

Other Comments

I heard form my source Factual Freddie who is passionate in his concern about overvaluation wrote me:

“The Valuation Methodology used by this cottage industry, and admittedly successfully presented to date in tax court cases, can best be described as Hypothetical HBU Projected DCF Foregone using the assumptions that, combined, result in the Highest Value. This is to be compared with the above definition and statement. HBU is not a value, and it must be demonstrated by “…an objective assessment of how immediate or remote the likelihood is the property, absent the restriction, would in fact be developed…” Section 1.170A-14(h)(3)(ii), emphasis added. This Objective Assessment has been lacking or non-existent in the values used by this cottage industry.”

Stephen Small has submitted an article to Tax Notes along with some others. His focus will be on “Myth Number 7”.

Perhaps the best critique of the IRS approach combined with an affirmation about valuation comes form Judge Holmes in his dissent in the recent Oakbrook Land Holdings decision.

“Conservation-easement cases might have been more reasonably resolved case-by-case in contests of valuation. The syndicated conservation-easement deals with wildly inflated deductions on land bought at much lower prices would seem perfectly fine fodder for feeding into a valuation grinder. Valuation law is reasonably well known, and valuation cases are exceptionally capable of settlement. …… Yet we’ve come to a point where we are disallowing a great many conservation-easement deductions altogether, not for exaggeration of their value or lack of conservation purpose, but because of very contestable readings of what it means for an easement to be perpetual.” (Emphasis added)

From Partnership For Conservation

I had a bit of back and forth with P4C. I have to give them credit for being willing to engage with someone who must be a bit of a pain in the you know. My final summation was –

“Just to be clear the thing I am particularly interested in is the notion that the “before value” does not have to have any current market support. To go a step further with that the implication of that seems to be that the deduction for granting an easement can be much greater than the deduction for donating the entire property.”

Mr. Ramsay’s response was:

“There is market support, but remember recent sales are only evidentiary of the fair market value at highest and best use, not the sole determinant of that value.”

“P4C has proposed solutions to enhance the integrity of valuations and offered open arms for a substantive discussion with policymakers and stakeholders about alternative standards that may provide greater clarity and prevent the potential for abuse. But for now, the ‘highest and best use’ standard applies to all conservation easement appraisals, including for individuals and families, not just for partnerships.”

“To the extent there is concern about the currently applicable ‘highest and best use’ standard, then stakeholders and policymakers should come to the table for an open and honest conversation about alternatives that could strengthen the integrity of the conservation easement donation incentive, without targeting an entire class of land ownership or imposing a punitive retroactive tax increase on Americans who followed the law.”

Guess we will just have to agree to disagree on what the law currently is.

What Is Happening Now?

The problem with reporting mainly based on court decisions is that they don’t give much indication of what is happening on the ground now. For that I would like to introduce you to this story by Becky Gillette in the Eureka Springs Independent.

“ The Legacy Mining property was purchased for $1,000,000. There were unknown expenditures for the exploratory drilling, and then there was a gross offering for three syndicated conservation easements for a total of $26 million, according to information on the website of the Securities and Exchange Commission. (See Independent Feb. 5 “No quarry mining near Kings River.”)

But the cost to taxpayers for preserving the Kings River property was far more than $26 million. The investor/taxpayers are provided with a preliminary appraisal valuation that is four times greater than the amount of the gross offering. The amount of the preliminary deduction, therefore, is estimated on a reasonable basis to be about $100 million.”

If an individual has a federal and state tax rate of 45 percent, the investors/taxpayers realize close to two or more times their investment. This makes the cost to the taxpayers roughly $45 million.”

More Coming

As I noted there have been several decisions on conservation easements this past week. I will be back to them after doing something on the HEROES Act.