Banks are grabbing a couple of billion that was meant for accountants and others who helped business people sort out the complexity of the Paycheck Protection Program. I spoke with Michael Adler of GrayLaw Group, Inc who has started the ball rolling on a class action law suit. There are 19 lawyers involved including the firm of Geragos & Geragos. The case is American Video Duplicating Inc et al v Citigroup et al. The complaint was filed in the United States District Court for the Central District of California.

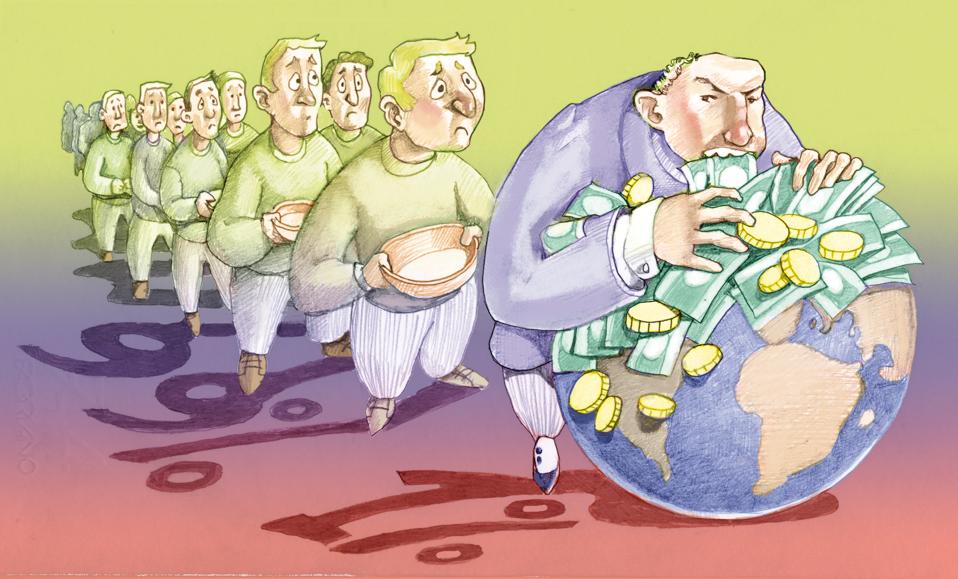

a line of people waits that an arrogant banker finishes eating the planet

Getty

Background

According to the complaint, the unpaid agent fees could amount to $3,848,082 (19.14% of the fees payable to the banks).

When the Paycheck Protection Program rolled out many small and not so small businesses naturally turned to their accounting firms to figure out the program and help them with the applications. And many accountants jumped right in, often not giving much thought as to how much or even whether they would get paid. #TaxTwitter transformed itself into almost all Paycheck Protection all the time.

It is not unusual for accountants to be a business owner’s most trusted adviser. Accounting practices thrive on very long term relationships, sometimes multi-generational. That accounts for the quick reaction and focus on service. As my first managing partner Herb Cohan of blessed memory used to say “The world is longer than a day”.

Dashed Hopes

So it was really good news that the banks would be getting larger fees for processing Paycheck Protection loans with the notion that they would be cutting a piece of the fee to “agents” who helped the business owners with the applications. For a loan under $350,000 the bank would be getting 5% and cutting 1% to the agent.

Only there was a fly in the ointment. The fee was up to 1%. And many of the banks decided that they would go with 0%, which to be fair to them is less than 1%. On the other hand it was pretty clear that Congress expected the banks to be sharing.

What Were They Thinking?

It is curious that so many of the banks made the decision to not pay the agents. There is the fact that they make more money that way and they are, you know, banks. So maybe that’s the way it is.

I understand how accountants are. For the most part they are incredibly loyal to their clients often to a ridiculous extent. There are people who make a living explaining to accountants how to make more money. One of the really good tips is to stop working for people who don’t pay you. If somebody has not paid you in a couple of years, they are not actually a client.

So the banks could be confident that people would have the help they needed to get the applications done whether they could afford it or not. And that seems to be how it went.

As Michael S. Popok, Managing Partner of Zumpano, Patricios and Popok put it:

“It is the agent who is closest to the main street/mom and pop borrower, not the bank. Without the “labor” of the agent, many of the businesses would fail altogether to apply for the loan under the 851 page legislation of the CARES Act, believing they were not entitled to it, or that the money wasn’t truly without strings attached, thus defeating the intent of the program. The banks who participated in the program and were paid their guaranteed fees from the Government, did not have the right to exercise any discretion to reject agents and not pay their fees just because they wanted to maximize their own net revenue. That the bank had “plenty of applicants” or “their own applicants” and didn’t “need agents” or as a policy “doesn’t pay agents for their loans” (as we have already heard) is of no moment. The PPP created a class of participants called “agents” who served an important (perhaps the most important) role in implementing and effectuating the plan’s intent, and mandated that they be paid (“will be paid by the Lenders”) on a “reasonable “fee scheduled set by the SBA Final Interim Rule under the CARES Act.”

The people that Michael Adler has signed up so far put between fifty and one hundred hours into figuring out the program. The fees that are seeking range from $20,000 to $110,000. If successful, he expects that the legal fees will come from the banks. If it works out that way the banks will learn that Reilly’s Eleventh Law of Tax Planning – Pigs get fed. Hogs get slaughtered. – has broader application.

James McDonough, one of the attorneys on the team sums it up like this.

“Unfortunately, this is another case where the banks saw an opportunity to take from the very businesses that were intended to benefit from the PPP program—like the small CPA and accounting businesses that are our clients in these lawsuits—in order to fatten their wallets. We look forward to the Courts making the banks pay our clients for their work in getting funding into the hands of those who needed it the most.“