Wall Street and New York Stock Exchange in New York.

Alexander Spatari

The stock market has defied gravity in recent weeks, rebounding nearly as quickly as it sold off amid the coronavirus pandemic.

The threat of another steep decline is omnipresent. But stock investors shouldn’t be concerned, experts say.

In fact, panicking and selling out of stocks if the market craters again could cost investors a lot of money.

“When the heat is on and things feel risky and scary, that’s where your biggest potential returns are going to lie as a stock market investor,” Fitzgerald said.

Stock market rebound

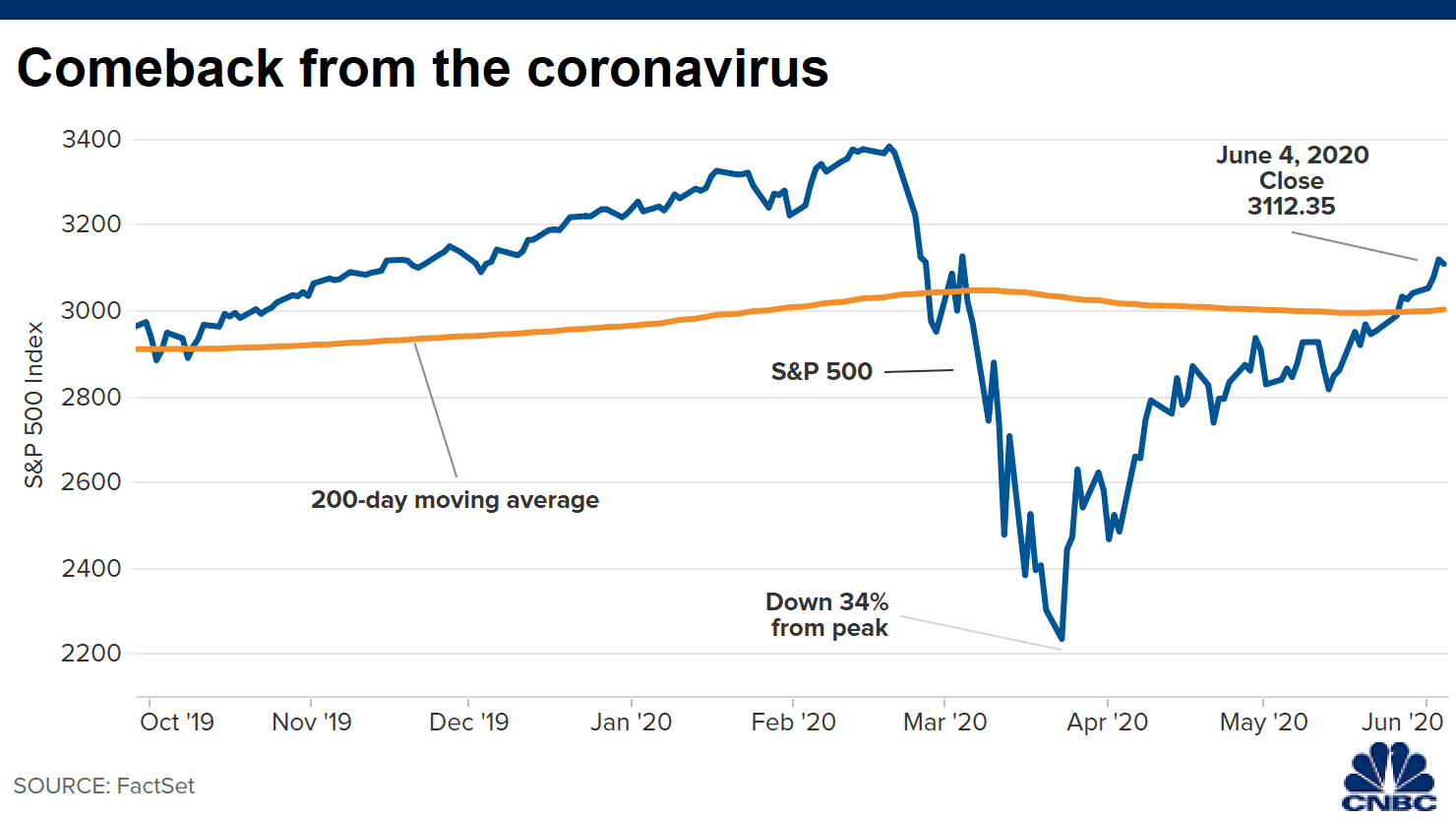

The S&P 500, an index measuring the stock performance of the largest public companies in the U.S., fell 34% between mid-February and Mar. 23 as investors grew skittish amid a worsening coronavirus pandemic.

It was the fastest decline of its kind in history.

However, it was followed by the best 50-day rally in the history of the S&P 500.

The stock index is up about 38% from its trough, within reach of fully erasing its recent losses. (Breaking even requires a larger percentage gain than the prior percentage decline.)

Indeed, fleeing the stock market for cash could cost investors in the long run.

An investor who put $10,000 in the S&P 500 index at the beginning of 1999 and didn’t touch it would have seen that investment grow to nearly $30,000 by the end of 2018, according to an analysis by J.P. Morgan.

In contrast, missing out on the 10 best-performing days during that 20-year period would have cut those returns in half.

Speculating vs. investing

Stock investors have nudged the market higher as states began reopening their economies, ushering in hope that consumer spending will increase and provide a shot in the arm to ailing businesses.

However, that sentiment could sour — and cause another big selloff — if a second wave of Covid-19 pushes states to reimpose strict social-distancing rules.

Some health officials are worried large nationwide protests over the death of George Floyd while in police custody may be a “seeding event” for further outbreaks.

“Broadly, [market] sentiment hasn’t soured so much,” said Robert Jenkins, head of global research at Lipper. “But there are potential influencers that could turn it the other way.”

Investors may also get spooked if Congress doesn’t pass additional financial-relief measures, such as extending larger unemployment payments or another round of one-time stimulus checks, that would put more money into Americans’ pockets.

Most likely, the next selloff will come from some unpredictable event, Fitzgerald said. But long-term investors should stay the course.

“Once you jump in and out, you’re speculating and flipping coins,” Fitzgerald said. “It won’t work 50% of time and it will 50%.

“Don’t be a speculator,” he added. “Be an investor.”