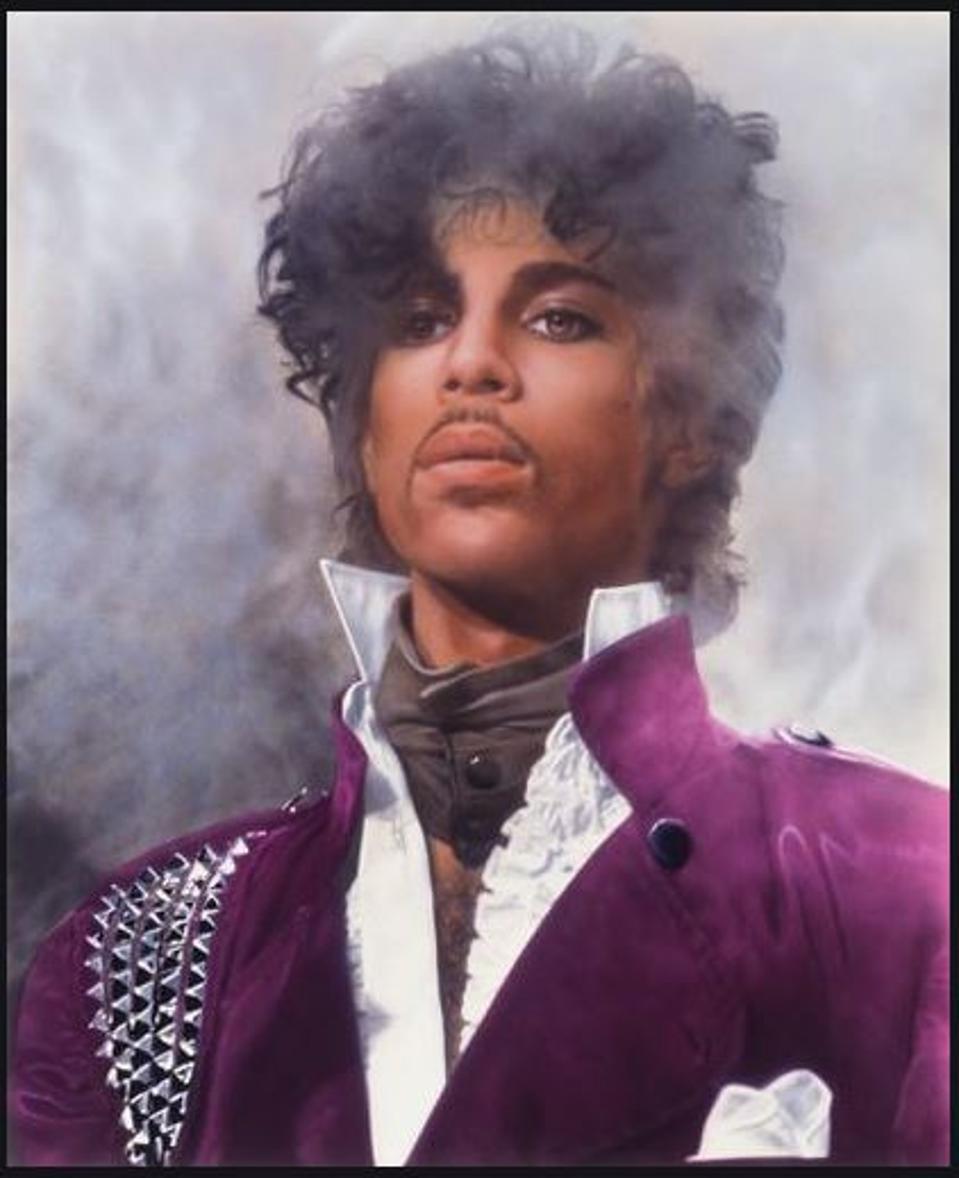

Chicago Tribune:Allen Beaulieu

Are investors ready for another Housequake?

Depending on your age, your view of the Nasdaq is different. If you are a baby boomer or older, you remember the time when “Nasdaq” might have been a slang term for Nirvana (the concept or the band, or both).

If you are under 50 years old, the Nasdaq is where the big, stable companies sit. Amazon

AMZN

, Microsoft

MSFT

, Apple

AAPL

, Facebook, Google

GOOGL

, etc. They are the big, ubiquitous stocks and business that run our lives.

Let’s Go Crazy!

However, back in 1990s and the first part of this century, the Nasdaq was the Wild West of the stock market. Brazen young upstart businesses took the markets by storm.

The gains were so amazing, they were considered “one-decision stocks: you buy them and don’t have to sell them.” 1999 was essentially a one-type market. It was all-Nasdaq, all the time.

Then, in March of the year 2000, the Nasdaq 100

NDAQ

(QQQ) fell by over 79% in just under 3 years. Oh, it fully recovered…by the year 2015! Enough said.

Delirious

Now, of course nothing like this could ever happen again. OK, of course it could. But you don’t need a garden-variety 80% selloff to see that the same type of “Nasdaq will save us” attitude has quietly crept back into the stock market. Now, much of today’s investor base did not experience 1999, 2000 and the 15 long years that followed for the Nasdaq Index. So, all of this history is lost on them.

RSP_^SPXTR_SPY_QQQ_OEF_XLG_DIA_chart

Ycharts.com

And that’s how we get graphs like the one above. This is simply the latest snippet of time that shows that the Nasdaq is in a world of its own. Since the quick little spill 5 weeks ago (in which the Nasdaq 100 ETF held its ground pretty well), the stock market at large has been pretty mediocre, or worse.

Sign ‘O The Times

The average S&P 500 stock was down over 10% from June 8 – July 7. The Dow was down over 6%. But the Nasdaq 100? It was up 6%.

One of 2 things is happening here. A new paradigm, or something that will be remembered as the second-coming of the Dot-Com Bubble. Fool me once, shame on you. Fool me twice, shame on me.

Baby, I’m a Star

Better yet, as The Who said, we won’t get fooled again. So don’t. Know what you own and why you own it. And recognize that one of the most powerful axioms in investing is this: if it looks easy, that’s when the risk is highest.

Comments provided are informational only, not individual investment advice or recommendations. Sungarden provides Advisory Services through Dynamic Wealth Advisors.