Some Americans may still be recovering from the disappointment they felt after receiving stimulus checks for less than anticipated.

One particular cohort that may have received reduced checks: those who were due $500 payments for children under age 17.

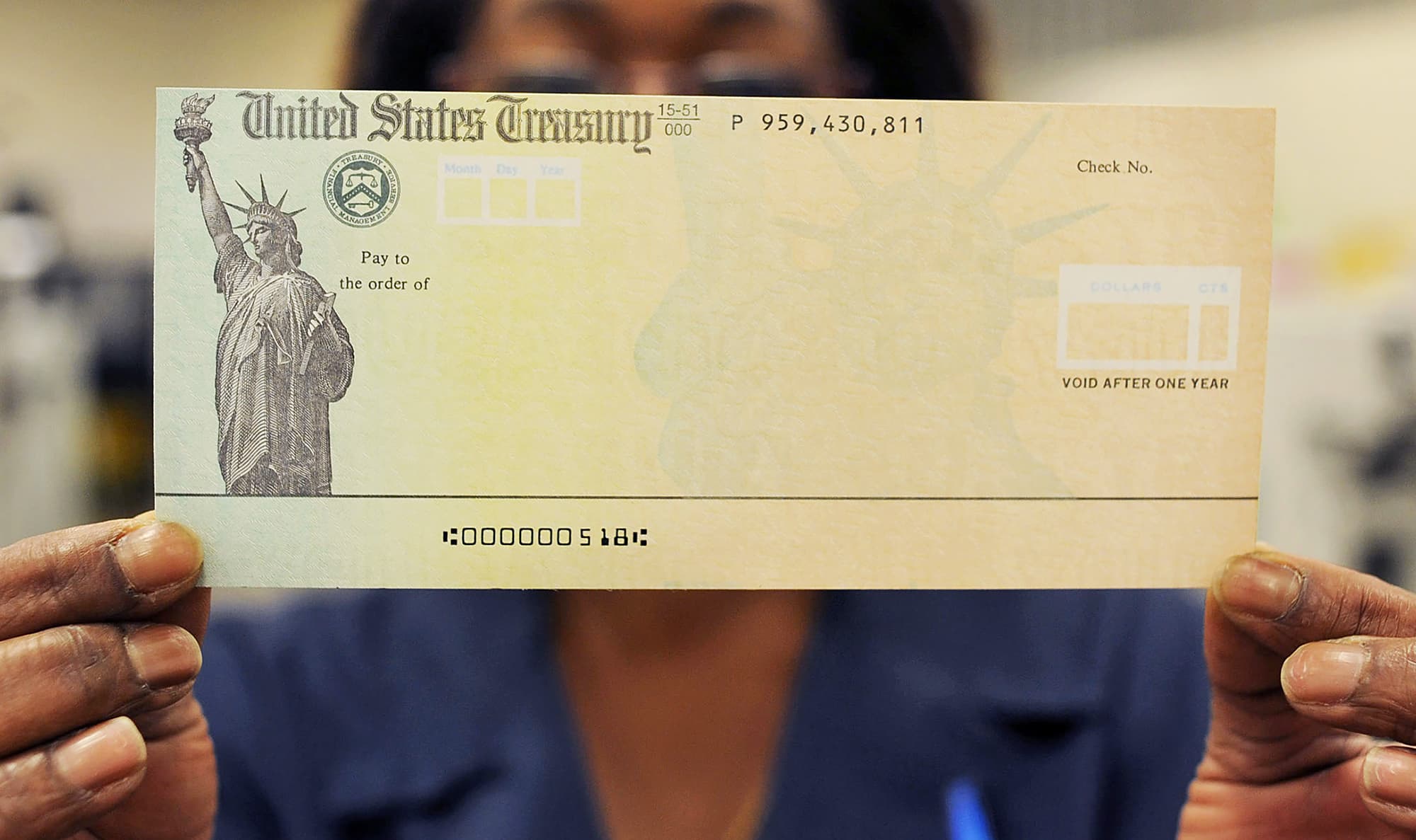

The U.S. government rushed out $1,200 stimulus checks to Americans this spring after Congress passed the CARES Act, which authorized the payments.

The legislation called for payments of up to $1,200 per individual, $2,400 per married couple filing jointly and $500 per child under 17, in keeping with the definition for the child tax credit.

More from Invest in You:

The 3 moves to make just after you’ve been laid off

Hurting without $600 unemployment boost? 5 money moves to make now

39% of younger millennials will move home amid Covid-19 recession

But some checks excluded the $500 payments for children, even though they qualified. For families with multiple children, that meant doing without $1,000 or more they had been expecting.

Now, the U.S. government is starting to make good on those payments.

That goes specifically for individuals who used the IRS non-filer tool before May 17. The tool was launched by the agency so that Americans who do not typically file tax returns, often because they receive federal benefits, could submit information to make sure their qualifying children were also included in their checks.

Starting Aug. 5, the government began sending direct deposits with those $500 payments to those families who were missing that money.

Getty Images