Savvy crypto users are always looking for ways to minimize taxes on cryptocurrency transactions. Since cryptocurrencies like bitcoin are treated as property per IRS Notice 2014-21, every time you sell, trade or exchange tokens into USD or other cryptocurrencies there is a taxable event where you have to pay taxes on, if there is a gain. Below are some tax strategies you can use to eliminate and reduce your tax bill on cryptocurrency profits.

Take Advantage of 0% Long-term Capital Gain Tax Rate

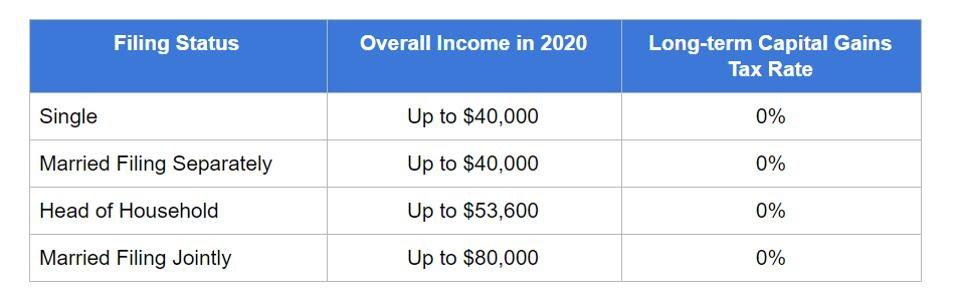

The US tax code has a relatively less known 0% tax rate for long-term capital gains. The eligibility for this 0% tax rate depends on your filing status, annual income you make, and how long you kept the cryptocurrency before selling it. The following chart shows you a summary of these three variables and its correlation with the zero tax rate. Essentially, if you are married and filing jointly, you could make up to $80,000 in crypto profits without being subject to any taxes.

0% Long-term crypto capital gain tax thresholds

Shehan Chandrasekera

Donate Long-term Crypto Assets to Charities

Crypto assets can be donated to qualified charities to get a tax deduction. When you donate crypto assets which you held for more than 12 months to a charity, you get a tax deduction equivalent to the fair market value of the asset at the time of the donation. At the same time, you do not have to pay any taxes on the capital gains of the donated property.

For example, Harry donates 1 Bitcoin (BTC) to a qualified charity. He bought this BTC at $1,000 five years ago. At the time of the donation it’s worth $10,000. Here, Sam gets to deduct $10,000 as a charitable donation on Schedule A and bypass capital gain taxes on $9,000 ($10,000 – $1,000) of gains. (If Sam were to sell his 1 BTC and donate the fiat proceeds to a charity, he would have to pay capital gain taxes on $9,000 profits)

Crypto donations can be subject to a complex set of tax rules so you should definitely consult with a qualified CPA to maximize your deduction before making large contributions.

Use Specific Identification Method (Highest-In-First Out)

As long as you can identify the following four criteria set forth by the IRS (Q39), you can pick the Highest-In-First Out (HIFO), a subset of Specific Identification method, to calculate your cryptocurrency gains and losses.

(1) The date and time each unit was acquired,

(2) Your basis and the fair market value of each unit at the time it was acquired,

(3) The date and time each unit was sold, exchanged, or otherwise disposed of, and

(4) The fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.

You need a reputed crypto tax software to do these calculations and keep electronic records of the four criteria. When you use HIFO for tax purposes, you are deemed to be selling the units for which you paid the highest price. This will result in the least amount of gains for taxes leading to a lower tax bill.

Tax Loss Harvesting

Cryptocurrencies allow you to harvest tax losses aggressively leading to higher savings, which you can reinvest in your portfolio. Since cryptocurrencies are treated as property as opposed to “stocks & securities”, they are not subject to wash sale rules. This allows you to sell your loss positions just to harvest losses for tax purposes and quickly get back into the same position without having to wait 30 days. These harvested losses can be used to offset your crypto and other capital gains.

Trade Crypto In A Self-Directed IRA (SDIRA)

Self-Directed IRA (SDIRA) is another great tool to invest in crypto and defer taxes until retirement. Although you can not completely avoid taxes, the biggest advantage of a SDIRA is that you get to compound crypto profits in your portfolio without having to pay taxes on them today. Not having to pay taxes on trades today means that you get to use tax money, which would have gone out to the government if you traded in a non SDIRA account, to compound profits. This powerful feature could increase your overall return exponentially in the long run. Moreover, if you take out the funds at your retirement when you are subject to a lower tax rate, you get tax savings from there as well.

Roll Over Crypto Profits Into Opportunity Zones (OZs)

This strategy is well suited for sophisticated high-net worth taxpayers who are sitting on a large amount of unrealized cryptocurrency gains. Tax savings come in three forms: tax deferral, tax reduction, and tax elimination. Basically, you would roll over your long-term crypto profits into a Qualified Opportunity Fund (QOF). The QOF fund would invest that money in economically distressed areas designated by the government. If you were to hold your investment in the QOF for at least 5 years, 10% of your initial crypto tax gain will be tax free. If you were to hold your investment in the QOF for at least 7 years, an additional 5% of your initial crypto tax gain will be tax free.

Finally, if you were to hold your investment in the QOF for 10 years, you can completely avoid capital gains taxes on the appreciation of QOF stocks in addition to the tax savings triggered at year 5 and 7. This ability to completely eliminate taxes on the appreciation of QOF stock is one of the biggest tax saving opportunities in the tax code.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.