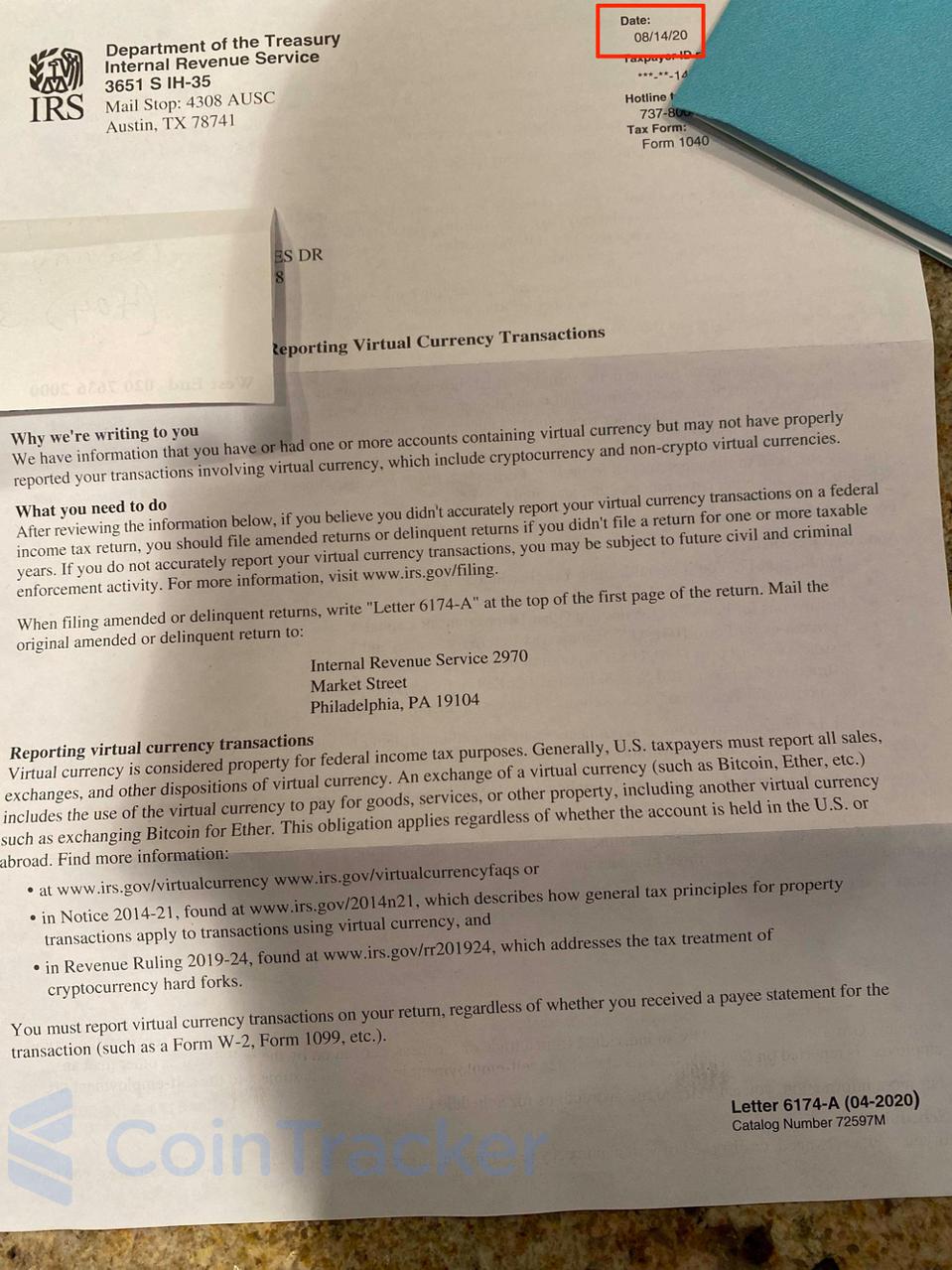

The IRS has begun sending out another round of crypto tax warning letters (dated August 14, 2020) to US taxpayers according to several posts on Reddit and other social media. These letters along with the new placement of the crypto question on Form 1040 show IRS’s continuous effort in regulating the crypto tax space. At the time of this posting, the IRS has not released any communication pertaining to this new wave of crypto tax warning letters.

2020 Crypto 6174-A letter originally posted on CoinTracker.io blog on August 25, 2020

CoinTracker.io

The IRS first started sending out these warning letters in July 2019 to 10,000 US crypto users. In 2019, these notices came out in 3 variations: IRS Letter 6173, IRS Letter 6174, IRS Letter 6174-A.

Letter 6173

Letter 6173 is the most serious letter among the three. It requires your response by the date mentioned in the letter. If you do not respond, your tax profile will be examined.

You can respond to this letter in following ways;

- File the missing tax return with your virtual currency transactions

- If you filed a tax return but you mistakenly did not report cryptocurrency gains and/or incorrectly reported them, you can amend that return

- If you think you filed your crypto taxes correctly, you should respond to the letter by attaching a detailed explanation of how you arrived at the income reported

It is always a good idea to respond to the letter 6173 correctly on time to avoid getting into a tax examination. If you need additional time to respond to the letter, you can request more time from the IRS.

Letter 6174 & 6174-A

Letter 6174 and 6174-A are no action letters. These are meant to educate the recipient. These letters alert you about crypto tax filing obligations and show relevant tax forms, schedules and additional IRS resources. After reviewing this information, if you think you misreported, under reported or completely omitted crypto transactions from your previous tax returns, you are supposed to file an amended (or delinquent) tax return and write “Letter-6174” or “Letter- 6174-A” on the top of it. If you believe you filed everything correctly, no action is needed from your end.

At the time of this post, it is unknown how many taxpayers received these letters in 2020 or how the IRS got information about those taxpayers. It is logical to think that the data might have gone to the IRS thru any US based cryptocurrency exchange that collects user information as a part of Know your customer (KYC) procedures.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.