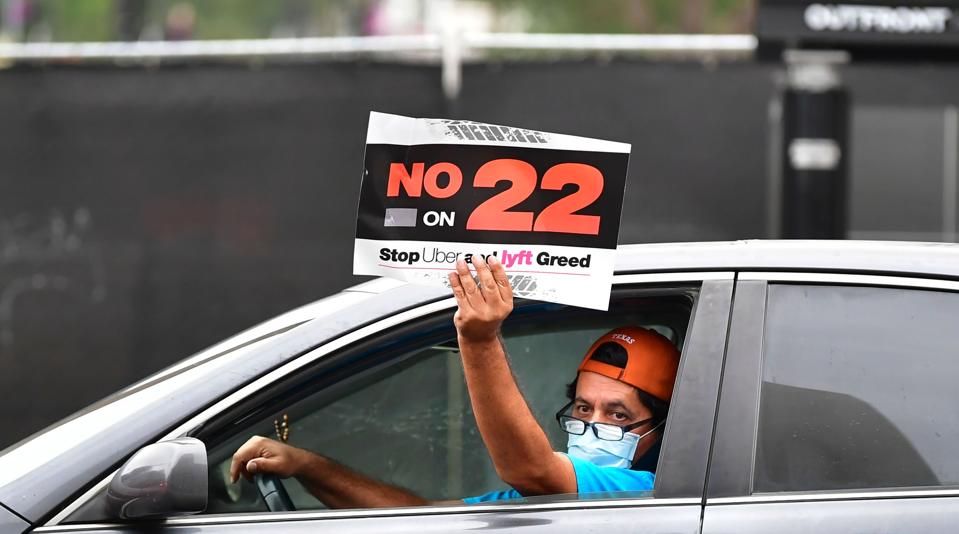

App-based drivers from Uber and Lyft protest in a caravan in front of City Hall in Los Angeles on … [+]

AFP via Getty Images

It’s not just the federal race that made news on Election Day: state and local initiatives were on also on the ballot. In California, that included a vote on whether gig drivers like those who work for Lyft

LYFT

, Uber

UBER

, and DoorDash, should be considered employees: 58% of voters decided that they should instead be classified as independent contractors.

According to the California Secretary of State, the initiative measure – officially known as Proposition 22 – “establishes different criteria for determining whether app-based transportation (rideshare) and delivery drivers are ‘employees’ or ‘independent contractors.’” By law, independent contractors are not entitled to certain protections afforded employees, including minimum wage, overtime, unemployment insurance, and workers’ compensation.

The Proposition also notes that, “companies with independent-contractor drivers will be required to provide specified alternative benefits, including: minimum compensation and healthcare subsidies based on engaged driving time, vehicle insurance, safety training, and sexual harassment policies.”

A yes vote meant that rideshare and delivery companies could hire drivers as independent contractors. A no vote meant that the companies would have to hire drivers as employees.

Those opposed to Proposition 22 argued that the existing lack of benefits for gig workers made them increasingly vulnerable, especially during an economic downturn. Those in favor of Proposition 22 cited the costs of compliance, including paying workers more and responsibility for a healthcare stipend depending on driving time.

The win on Proposition 22 means that the controversial Assembly Bill 5 law won’t apply to gig drivers. A.B. 5 was signed into law at the end of 2019 and went into effect at the start of 2020. It granted full employment, including minimum wage protections, health care and such benefits as unemployment and sick leave.

Some rideshare companies, like Lyft and Uber, argued that AB 5 didn’t apply to their workers. In response, the California Attorney General sued – and won – arguing that the law did apply to them. An appeals court agreed. Further appeals had been in the works by the rideshare companies, but those will likely be shelved following this vote.

An analysis of the economic impact of Proposition 22 noted a “minor increase in state income taxes paid by ride share and delivery company drivers and investors.” The thinking is that if companies did not have to pay more for employee benefits, they could charge lower prices. Assuming that translates into more customers, profits would go up, resulting in tax revenue. Additionally, that should mean more income for drivers and thus more state income taxes paid by drivers.

However, classifying workers as employees would probably mean increased tax compliance which would also boost revenue. Studies have shown that independent workers face significant compliance issues: I would echo those by suggesting that at least 80% of my clients who are in tax trouble reported non-employee income. When taxes are automatically withheld from your paycheck, the burden shifts to the employer to remit those funds. When you’re responsible for making estimated tax payments on your own, there’s more room for error.

California has approximately one million gig workers, the most in the country. So it may not be surprising that the battle over Proposition 22 was the most expensive ballot initiative in California’s history, costing nearly a quarter of a billion dollars. Nearly ten times more money was funneled towards support of the measure than funds to oppose it.

You can bet that other states are watching to see what happens, as the gig economy continues to expand, raising questions about worker benefits and tax revenues.

Meanwhile, investors seem pleased with the news: shares of Uber and Lyft went higher on Wednesday following the election results.