Before you start your federal tax return, know the changes in key IRS forms that affect you

getty

Tax Season 2021 has begun. When you dig into your tax return for reporting 2020 income, you’ll notice that Form 1040 has changed yet again. In 2018, the IRS condensed Form 1040 significantly, completely revamping the prior traditional version, and introduced additional schedules that funnel information to Form 1040. While the IRS did not modify the 2020 Form 1040 as drastically, there are differences from last year’s form that you need to know about.

Below I explain key tax-return topics that can apply to executives and employees who have income from stock compensation—such as stock options, restricted stock units, or an employee stock purchase plan (ESPP)—or who have gains from sales of company stock.

The Changes In Brief

- After being condensed to just 24 lines in 2018, the IRS Form 1040 for 2020 has expanded to 38 lines.

- New lines include those for the Recovery Rebate Credit (stimulus check) and for estimated tax payments, sometimes made by taxpayers who have stock compensation.

- Total capital gain or loss from Schedule D is entered on a different line of Form 1040.

- The totals on Schedule 2 and Schedule 3 are entered on different lines of Form 1040. This applies to anyone with incentive stock options (ISOs) who has triggered the alternative minimum tax (AMT).

- For nonemployees, such as outside directors getting stock grants, income is now reported on IRS Form 1099-NEC, not Form 1099-MISC

Capital Gain Or Loss

If you sold shares during the 2020 tax year, you enter each sale on Form 8949 and report the total on Schedule D. You now report that Schedule D total on Line 7 of Form 1040.

Line 7 (capital gain or loss) of IRS Form 1040

IRS

MORE FOR YOU

This moved from Line 6 on the 2019 form—making this the third straight year capital gains reporting has changed on Form 1040.

Alternative Minimum Tax

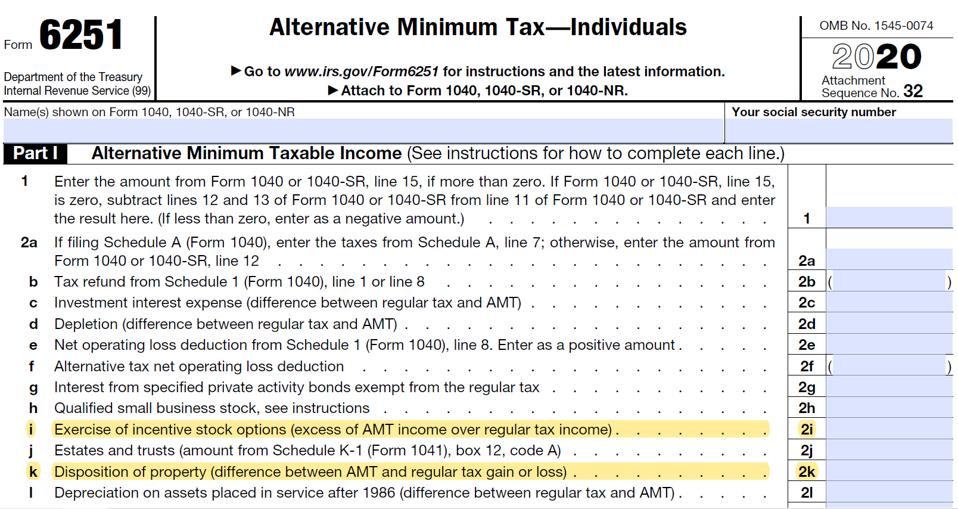

A concern for anyone with ISOs, the alternative minimum tax (AMT) is calculated on Form 6251. The spread at ISO exercise, when the shares are held through the calendar year of exercise, is reported on Line 2i.

When the ISO stock that triggered the alternative minimum tax is sold, the difference from regular tax is reported on Line 2k. You enter your Form 6251 calculation on Line 1 of Form 1040’s Schedule 2 (“Tax”). You attach Form 6251 to Schedule 2. The totals from Part I of Schedule 2 go into Line 17 on Form 1040. This has changed from Line 12b on the 2019 form.

IRS Form 6251

IRS

The AMT credit that is generated for an ISO exercise that triggers the AMT is recouped through Form 8801, as it was in the past. The amount from Line 25 of Form 8801 goes into Schedule 3 (“Non-Refundable Credits”) on Line 6 (check box b). The totals from Part I of Schedule 3 go into Line 20 of Form 1040. This has changed from Line 13b on the 2019 form.

Recovery Rebate Credit

To mitigate the economic impact of the pandemic, Congress provided two stimulus checks/economic-impact payments that were based on income from 2019 tax returns (or 2018 if your 2019 return was not available for the first check). The amount received for the first check and/or the second payment is phased out according to income in that prior year.

Because of income spikes from stock compensation in recent years, you may not have qualified for this federal assistance, even if you were laid off or furloughed during 2020. Should this be your situation, you can instead claim the Recovery Rebate Credit on Line 30 of Form 1040.

In further good news, you have no recapture of the stimulus checks you received, should your 2020 income be higher than in the past, perhaps (again) from stock compensation or shares you sold after your company’s IPO. See the Form 1040 instructions for the Recovery Rebate Credit Worksheet. If you received IRS Notice 1444 (“Your Economic Impact Payment”) for the first stimulus check or IRS Notice 1444-B for the second, have these available when completing the worksheet to do the calculation.

Estimated taxes

The flat rate for federal supplemental withholding that applies to stock compensation, such as a vesting of restricted stock or RSUs (22% and 37% for amounts over $1 million), may not cover the actual taxes you owe according to your marginal tax rate. You may then have paid estimated taxes. On the 2020 Form 1040, estimated tax payments are now reported on Line 26. This differs from last year,when they were reported on Schedule 3.

Rules Of Cost-Basis Reporting For Stock Sales

For stock sales, there is still no change in the IRS rules on how the cost-basis information is reported on Form 1099-B and Form 8949. For grants made in 2014 and later years, brokers are prohibited from including equity compensation income (which appears as part of Box 1 on Form W-2) as part of the cost basis reported on Form 1099-B. This creates tax-return confusion and complications, as only the exercise cost (i.e. what you paid for the shares) appears on the 1099-B. To avoid the risk of overpaying taxes, you need to make an adjustment on Form 8949.

This means that for restricted stock/RSUs, confusingly, the cost basis reported on Form 1099-B is zero or the box is left blank. However, the correct cost basis is the value of the shares at vesting. That is what you need to report on Form 8949.

Additional Tax-Reporting Resources

For guidance on the tax-return reporting for stock compensation and sales of company shares, including annotated diagrams of Form W-2, Form 8949, Schedule D, Form 3921, and Form 3922, see the Tax Center on myStockOptions.com.