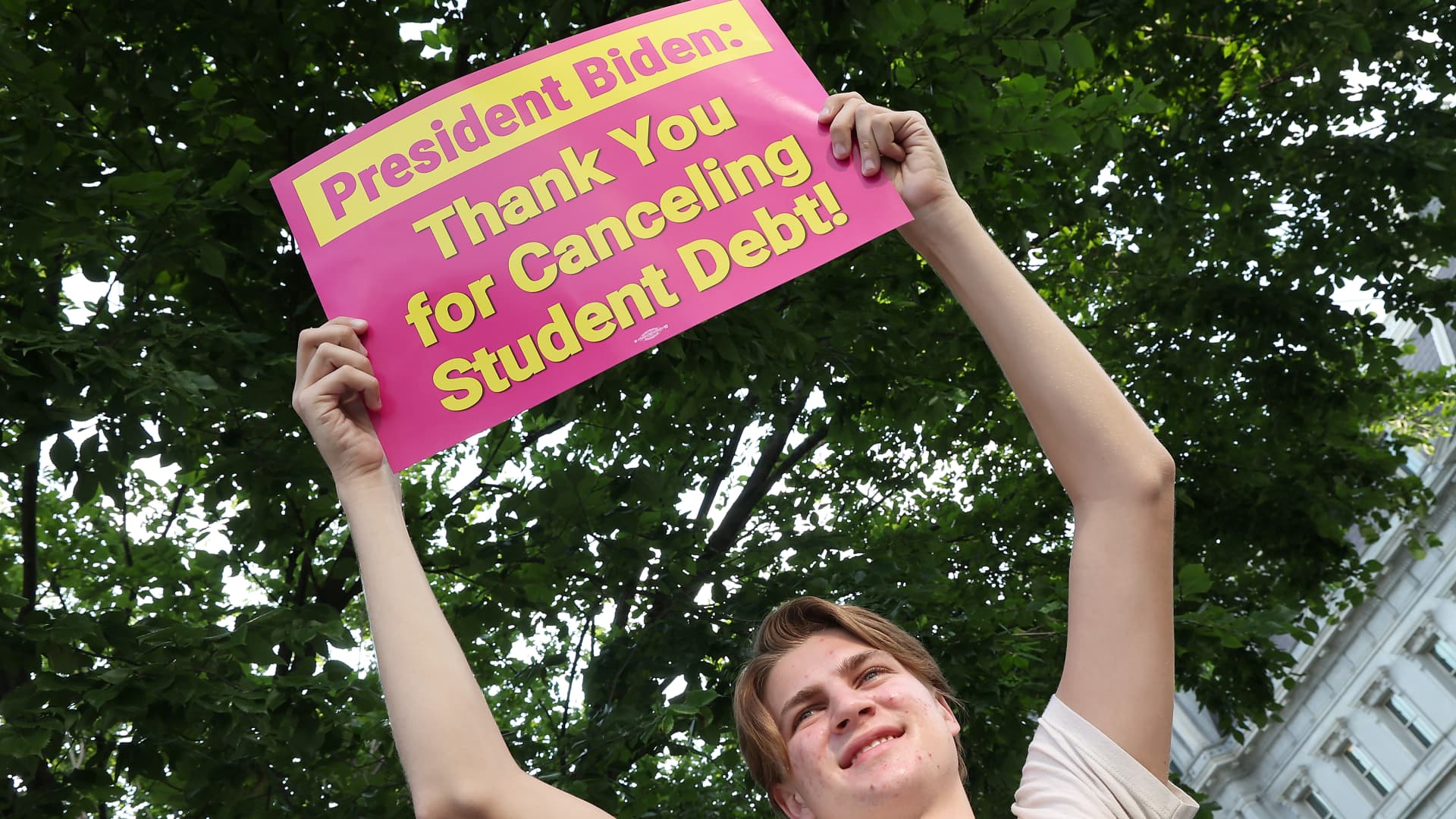

As tens of millions of Americans process the news of federal student loan forgiveness, countless questions are emerging about how it will all work.

When will borrowers see the relief? Who’s eligible? Do you have to apply? The U.S. Department of Education’s website has been slow to load this week with so many people searching for these answers.

Here’s what we know so far.

How much of my debt could be forgiven?

President Joe Biden announced Wednesday that most federal student loan borrowers will be eligible for some forgiveness: up to $10,000 if you didn’t receive a Pell Grant, which is a type of aid available to low-income undergraduate students, and up to $20,000 if you did.

Did I receive a Pell Grant?

There’s a good chance you received one as part of your financial aid package while at college: Of the estimated 43 million borrowers who will benefit from the administration’s forgiveness plan, more than 60% are Pell Grant recipients, according to the White House.

If you’re unsure whether you received a Pell Grant as part of your financial aid package, you can check your account on studentaid.gov. On the main page of your account, there’s a section titled “My Aid.”

Alternatively, you can check with the financial aid office of the college you attended to see if it can provide you with that information, said higher education expert Mark Kantrowitz.

More from Personal Finance:

Biden cancels $10,000 in federal student loan debt for most borrowers

Timeline: Key events on the path to student loan forgiveness

Student loan payment pause extended through December. What to know

Here’s what President Biden’s student loan forgiveness means for your taxes

Student loan forgiveness plan draws pushback from some lawmakers, groups

Who’s eligible?

The relief will be limited to borrowers who make less than $125,000 per year, or married couples or heads of households earning less than $250,000.

If your income was below these caps in either 2020 or 2021, you should be eligible.

Which loans qualify?

Big picture, the vast majority – roughly 37 million borrowers – will be eligible for the forgiveness based on their loan type (and then as long as they also fall under the income cap), because their debt is under what’s called the William D. Ford Federal Direct Loan Program. That includes Direct Stafford Loans, and all Direct subsidized and unsubsidized federal student loans. Under the Direct program, Parent Plus and Grad Loans, are also eligible for the relief.

Then it gets more complicated.

As of now, the Education Department is saying that any loans it holds qualify. That means the roughly 5 million borrowers who have a commercially held Federal Family Education Loan (FFEL) may be excluded. (About the same number of borrowers have FFEL loans that are with the government and they need not worry.)

Borrowers eager to know if their FFEL loans are commercially held can go to Studentaid.gov and sign in with their FSA ID. The information should be available at the “My Aid” tab.

Even if your FFEL loan is with a private company, all hope may not be lost.

An Education Department spokesperson said borrowers with those loans can call their servicer and consolidate them into the Direct Loan Program to become eligible for forgiveness.

There’s currently no deadline by which they need to do this, but presumably there will be one. As a result, experts recommend borrowers in this situation act quickly.

Another type of loan may also be excluded from forgiveness because it’s not in the government’s hands. Kantrowitz said: certain loans from the Federal Perkins Loan Program. Some of these loans are with the Education Department, but most are held by colleges.

If you pay your monthly loan bill to one of the government’s loan servicers, you should be able to get the forgiveness, Kantrowitz said, but if your payments are sent to another private lender, you’re probably out of luck.

All private student loans are also excluded.

What if I owe less than is being forgiven?

The relief is capped at the amount of a borrower’s outstanding eligible debt, per the Education Department.

When is the loan cutoff date for cancellation?

Student loans taken out after June 30, 2022, won’t be included in the relief.

Do I have to do anything to get forgiveness?

The Education Department said it will launch an application in which borrowers can input their income data and request the loan forgiveness. The application will be available before the end of the year, the department said, and borrowers can sign up now on its website for updates about the process.

The department also said it already has the income data for nearly 8 million borrowers because they were enrolled in income-driven repayment plans that already required this data. These people may get automatic cancellation.

Will the loan forgiveness trigger taxes?

Student loan forgiveness won’t trigger a federal tax bill.

That’s because the American Rescue Plan of 2021 made student loan forgiveness tax-free through 2025 — and the law covers Biden’s forgiveness, too, according to a fact sheet from the White House.

You may, however, still be on the hook for state levies, Kantrowitz said.

Some states automatically conform to federal rules, but others may count the forgiven balance as income, meaning it’s still possible you’ll have a state bill. The amount “may be the equivalent of a few student loan payments,” Kantrowitz said.

If you’re unsure, contact a local tax professional for an estimate before filing your state tax return.

How do I make sure I really get forgiveness?

Experts recommend taking a photo or screenshot of your current student loan balance. That way you can make sure it drops by the correct amount once forgiveness happens.

What’s going on with the payment pause?

In addition to Biden’s announcement on student loan forgiveness, he said he’d extend the payment pause on federal student loans until Dec. 31. Payments will resume come January.

It’s the seventh extension of the pandemic-era relief policy started under the Trump administration and it will likely be the final one.

– CNBC’s Sarah O’Brien and Kate Dore contributed reporting.

What will student loan forgiveness mean to you? If you’re willing to speak for a story, please email me at annie.nova@nbcuni.com