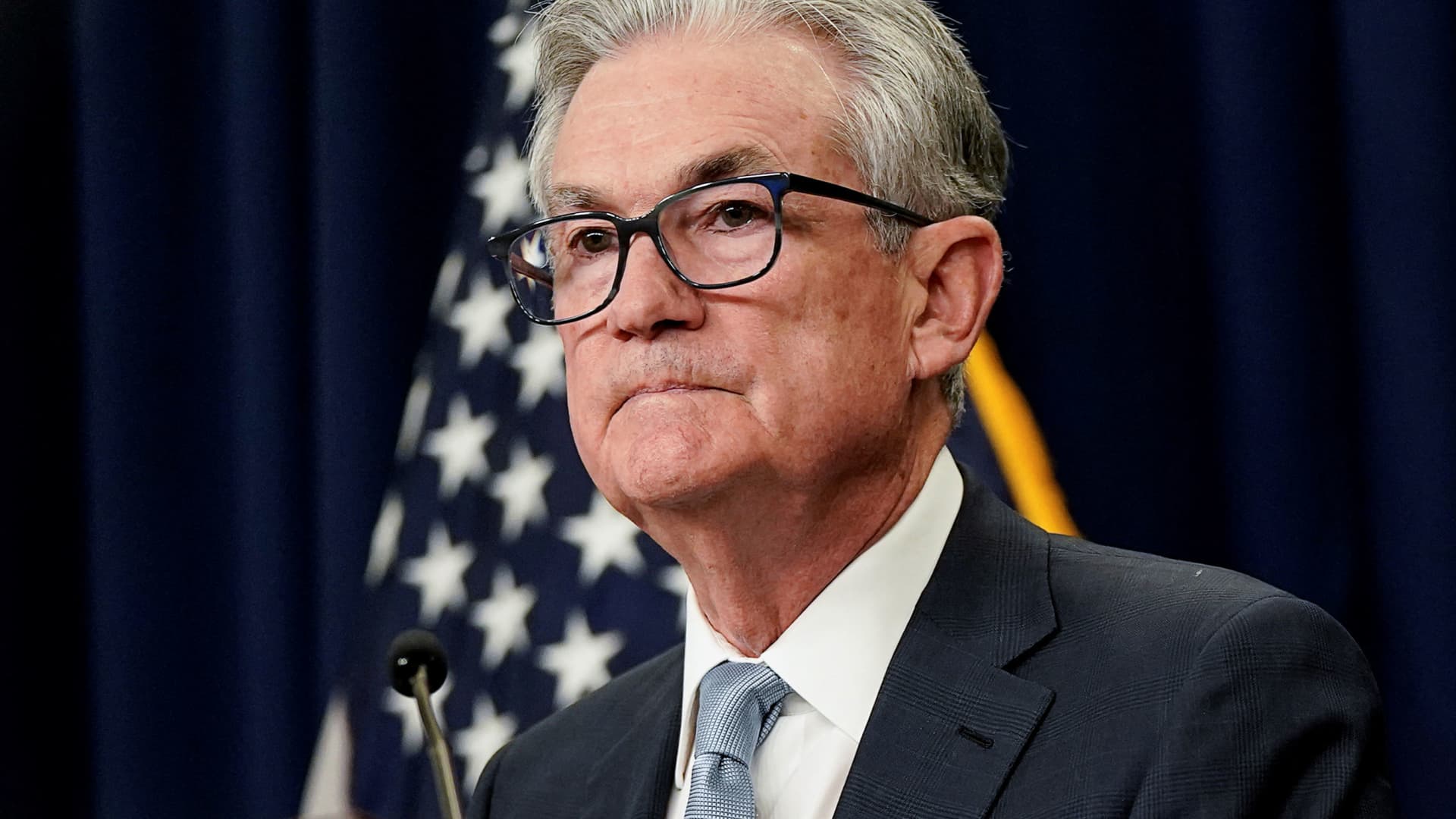

Federal Reserve Chair Jerome Powell in an appearance Thursday emphasized the importance of getting inflation down now before the public gets too used to higher prices and comes to expect them as the norm.

In his latest comments underlining his commitment to the inflation fight, Powell said expectations play an important role and were a critical reason why inflation was so persistent in the 1970s and ’80s.

related investing news

“History cautions strongly against prematurely loosening policy,” the central bank leader said in a Q&A presented by the Cato Institute, a libertarian think tank based in Washington, D.C. “I can assure you that my colleagues and I are strongly committed to this project and we will keep at it until the job is done.”

The event was Powell’s last scheduled public appearance before the Fed’s next meeting on Sept. 20-21.

Markets largely took the comments in stride, with major averages little changed in the early going on Wall Street. Treasury yields were mostly higher, with the two-year note, the most sensitive to Fed rate hikes, rising by nearly five basis points to 3.49%. A basis point equals 0.01 percentage point.

The Fed has raised benchmark interest rates four times this year, with the fed funds rate now set in a range between 2.25%-2.50%.

Markets widely expect the rate-setting Federal Open Market Committee to enact a third consecutive 0.75 percentage point increase this month. In fact, that probability rose to 86% during Powell’s remarks, according to the CME Group’s FedWatch tracker of fed funds futures bets. Both Goldman Sachs and Bank of America told clients to expect that three-quarter point hike.

One reason for acting aggressively is to make sure that inflation running around its highest rate in more than 40 years doesn’t become ingrained in the public consciousness, Powell said.

“The Fed has the responsibility for price stability, by which we mean 2% inflation over time,” he said. “The longer inflation remains well above target, the greater the risk the public does begin to see higher inflation as the norm, and that has the capacity to raise the costs of getting inflation down.”

There have been some signs lately that at least the monthly path of inflation is abating. In particular, gasoline prices have been falling steadily after briefly rising above $5 a gallon earlier in the summer.

The Fed gets its last look at inflation data before the meeting next week, when the Bureau of Labor Statistics releases the August consumer price index data. Economists are expecting a 0.2% headline increase in the CPI after it was flat in July, according to FactSet. However, the year-over-year increase in July was 8.5%, and many areas outside energy saw sizable increases.

Powell said the inflation pressures have come largely from pandemic-specific causes. When inflation first began to rise in the spring of 2021, Powell and his colleagues dismissed it as “transitory” and did not respond with any major policy moves before starting to hike rates in March 2022.

However, he said it’s incumbent now on the Fed to keep acting until inflation falls and avoid the consequences of the 1970s when a failure to implement an aggressive policy response allowed public expectations for high inflation to fester.

“We need to act now, forthrightly, strongly, as we have been, and we need to keep at it until the job is done to avoid that,” he said.

Powell noted the strong labor market, with robust levels of hiring persisting despite the rate increases, even as Fed officials expect the official unemployment rate to drift higher. He warned last month that the economy could experience “some pain” from tighter policy but said slowing growth is necessary to tame inflation.

“What we hope to achieve is a period of growth below trend which will cause the labor market to get back into better balance and that will bring wages back down to levels that are more consistent with 2% inflation over time,” he said.