Wells Fargo said Thursday one of its primary regulators has lifted a key penalty tied to its 2016 fake accounts scandal.

The bank said in a release that the Office of the Comptroller of the Currency terminated a consent order that forced it to revamp how it sells its retail products and services.

Shares of the bank jumped more than 6% on the news.

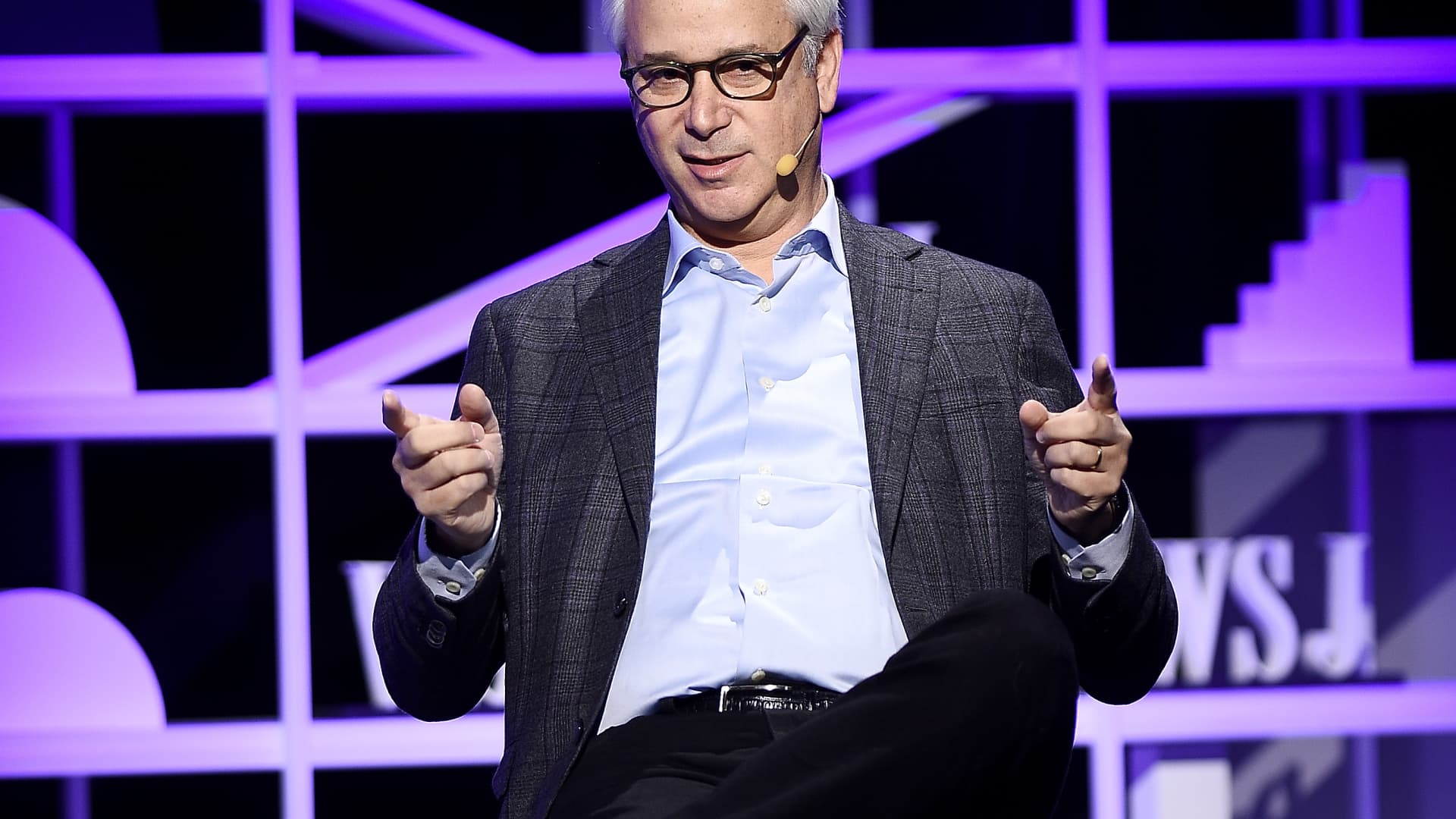

Wells Fargo, one of the country’s largest retail banks, has retired six consent orders since 2019, the year CEO Charlie Scharf took over. Eight more remain, most notably one from the Federal Reserve that caps the bank’s asset size, according to a person with knowledge of the matter.

In a memo sent to employees, Scharf called the development a “milestone” for the lender. The 2016 fake accounts scandal — in which the bank admitted to putting customers into more than 3 million unauthorized accounts — unleashed a wave of scrutiny that revealed problems related to the servicing of mortgages, auto loans and other consumer accounts.

The attention tarnished the bank’s reputation and forced the retirement of both ex-CEO John Stumpf in 2016 and successor Tim Sloan in 2019.

“The OCC’s action is confirmation that we have effectively put in place new systems, processes, and controls to serve our customers differently today than we did a decade ago,” Scharf said. “It is our responsibility to ensure we continue to operate with these disciplines.”

The termination of the OCC order “paves the way” for the Fed asset cap to ultimately be removed, RBC analyst Gerard Cassidy said Thursday in a research note.

— CNBC’s Leslie Picker contributed to this report.

Don’t miss these stories from CNBC PRO:

- Three stocks that could replace Tesla in the ‘Magnificent 7’

- Morgan Stanley hikes Nvidia price target ahead of earnings: ‘AI demand continues to surge’

- Vanguard launches two new ETFs to hit this sweet spot of tax-free fixed income

- Berkshire Hathaway topped $600,000 a share last week, aiming at $1 trillion market value