The secret to growing your 401(k)

The Secret To A 9.5% Return: Your Clock Is Ticking

There is a secret to getting a 9.5% return, and it has to do with time.

Time allows anyone to achieve those returns through the math of compounding.

It can be done with a short funding period, as we discussed in my last post personal matching program (5 years of savings funding a Roth IRA followed by 40 years of continued investing). It can be done most easily through even modest payroll deductions to fund a 401(k) at work, as we will discuss here. Anyone can set up a savings program, but it is best done through a tax advantaged vehicle such as a Roth IRA, traditional tax deferred IRA, or a retirement plan at work.

But 9.5%? Is that reasonable?

Yes, indeed. Here is the evidence.

Starting Young: Alex At Age 25 And A 401(k) With No Match

Let’s take a 25-year-old (“Alex”) who defers $150 per payroll period (monthly) into his 401(k) and assume that he increases his deferrals by 3% every year. Even though the 401(k) has no match, Alex continues to make those contributions for 40 years until he is 65.

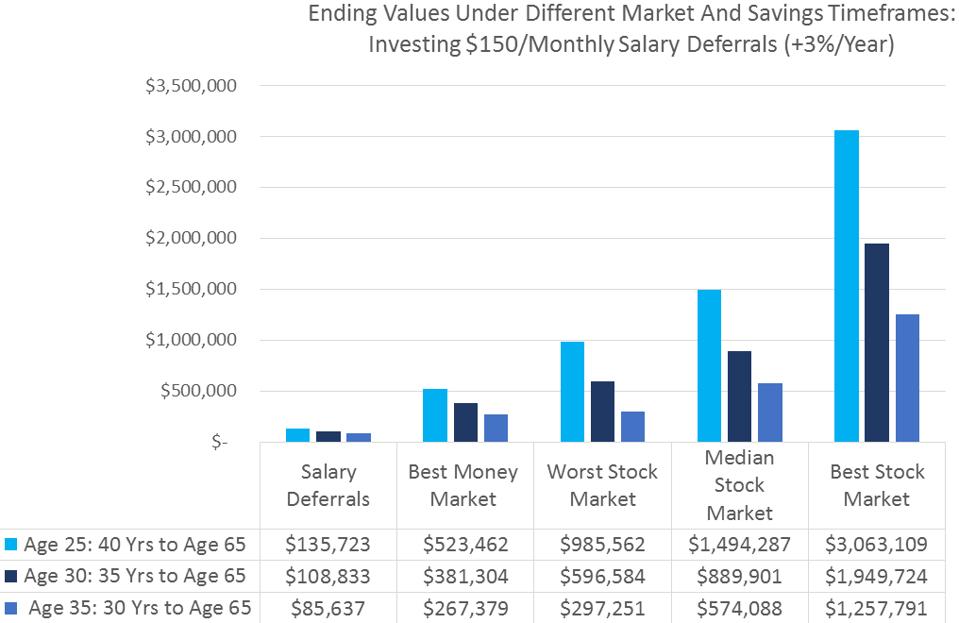

By then, he will have deferred a total of $135,723 to his 401(k) through monthly payroll deductions.

Assume Alex achieved an outstanding annual return of 9.5%. By age 65, Alex would have just under $1 million.

How Realistic Is A 9.5% Return?

Before going any further, what’s the story behind the 9.5% figure? That’s difficult to achieve, correct?

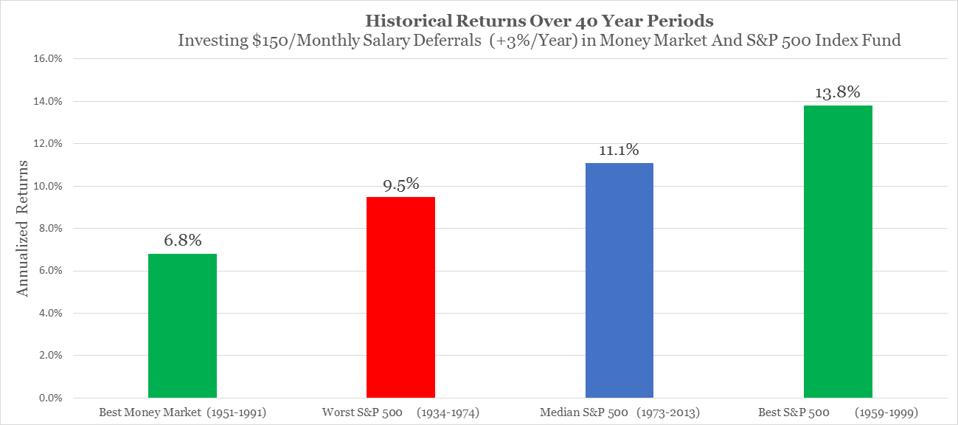

History tells us that it is not. This return (9.5%) represents the worst 40-year period (the 40 years ending 1974) for a monthly stock market investment represented by the S&P 500 Index, something that someone could invest in through most 401(k) plans.

In comparison, the best money market mutual fund tracking 90-day T-Bills’ 40-year period return (1951-1991) ended with about $523,000, an average annual return of 6.8%.

Graph showing historical returns for best money market, and worst, median and best S&P 500 returns … [+]

5 Years Later? Alex At Age 30 And 401(k) With No Match

But wait. What if Alex wasn’t ready to start at age 25? What if he started his 401(k) deferrals 5 years later at age 30? By waiting until 30, Alex would have deferred $108,833, leaving him with about $600,000 at age 65 for an average annual return of 9.4%. The return represents the worst 35-year period (the 35 years ending 1978) for a monthly investment in an S&P 500 Index fund.

Waiting 10 Years: Alex At Age 35 And A 401(k) With No Match

What if Alex started at age 35? Alex’s 401(k) deferral would have been about $85,000, and his age 65 balance would have been about $300,000 for an average annual return of 8.25%. That return represents the worst 30-year period (the 30 years ending 1974) for a monthly S&P 500 Index fund investment.

There are two things at play here: Time and the market.

Graph comparing $150 monthly salary deferrals (+3% per year) over different market and savings … [+]

What If You Added A Company Match?

Say a friend of Alex’s (Mary) started her salary deferrals at $150 a month, increased by 3% per year, just like Alex. But Mary worked for a company that offered a 401(k) with a match of 50%. That means for every dollar Mary defers, her company adds 50 cents (for each salary deferral of Mary’s ($150 a month), her employer puts in $75 a month as a match that vests in accordance with a vesting schedule). How would Mary’s outcomes compare?

Mary Enrolls At Age 25 (50% Matched 401(k))

Starting at age 25, Mary’s salary deferrals are the same as Alex’s (about $135,000). The market return is the same as Alex’s, again assuming the worst 40-year period return for the S&P 500 Index. But because of her company match of 50%, her age 65 value is 1.5 times Alex’s or $1.5 million.

Mary Waits Until Age 30 (50% Matched 401(k))

If Mary waits to age 30, her salary deferral would be equal to Alex’s ($108,000), but her age 65 value would be about $900,000 (1.5 times Alex’s value), representing the worst 35-year period for a monthly S&P 500 Index fund investment.

Mary Enrolls At Age 35 (50% Matched 401(k))

Mary’s age 35 start date means she deferred the same amount as Alex (about $85,000). As in Alex’s case, that market return represents the worst 30-year period for a monthly S&P 500 Index fund investment. However, Mary’s age 65 balance (about $450,000) would be 1.5 times Alex’s, due to her company match.

Opportunity Cost Of Waiting

If you are wondering about Mary’s cost of waiting to start modest contributions to a 401(k), take a look at the following table for a 401(k) with a 50% match.

The table below shows the opportunity Mary loses by waiting 5 or 10 years to start investing in her 401(k).

Opportunity Cost Of Waiting 5 And 10 Years: Investing $150/Monthly Salary Deferrals (+3%/Year) In S&P 500 Index Fund

Table showing Mary’s cost of waiting to start participating in her 401(k) at work.

Mary would lose $25,043 of matching contributions by waiting 10 years to age 35 to start her 401(k) contributions of $150 a month. More importantly, she would be behind by over $1 million in the worst market period or over $2.5 million in the best period.

The next chart shows you more detail.

Graph comparing $150 monthly salary deferrals (+3% per year) plus 50% company match over … [+]

For example, starting at age 35 instead of age 25 lowers the amount deferred by the participant and contributed by the company through a match from $203,585 to $128,456. That’s a significant amount of money that is not invested over time.

The 10 year wait also means dramatic differences in historical returns.

The 10-year differential (age 25 – 35) for the worst historical stock market is roughly $1 million. That’s significant. But, what’s even more is the lucky participant who experiences the best historical stock market period where the difference is over $2.7 million (roughly $4.5 million vs. $1.8 million).

For example, during the worst stock market, waiting 10 years (age 25 to 35) to start contributing $150 a month (plus 3% annual increases) to the 401(k) plan with a 50% match cost about $1 million in lost opportunity (about $2.7 million in the best historical stock market period).

Don’t Be Fooled: It Takes Time

Don’t be fooled. It takes a lot of time – decades – to maximize the math of compounding work in your favor. Plus, the other ingredient is investing in the right vehicles. If you hope to achieve solid returns, don’t be faked out of a long-term plan when you experience the market’s volatility.

If you jumped into the market on October 3, 2018, by the end of December 24, 2018, you would have lost 19.63% (without dividends, since this is an intra-quarter drawdown). If you started at the beginning of the year, however, your loss for 2018 would have been 4.38% (with dividends).

If you started investing in the S&P 500 Index Fund in January 2019, you would have a profit of 28.85% (with dividends) so far this year (through 12/12/19).

Think Long-Term

Retirement is a long-time away if you are in your 20s. To maximize your compounding opportunities, think long-term.

Additional Considerations

When you participate in a 401(k) with a match, there will be limits on the match and vesting requirements that we have not touched on here, as well as limits on when you can withdraw fund from the 401(k). These are built in to every 401(k) plan and they need to be understood.

To learn more, read “Tune Up Your 401(k) For 2019.”

Keeping The Secret? Or Sharing It?

Now that you know the secret to achieving a 9.5% return, what will you do with this information? Will you share? Let me know. Click here to take a quick survey.

Could You (Or Someone You Know) Be One Of Three 2020 401(k) Champions?

If you are participating in a 401(k) at work and are optimizing your opportunities by maximizing the match and investing for the long-term, would you like to compete to be recognized as a 401(k) Champion? This is a nationwide contest that I sponsor to encourage 401(k) financial literacy. Applications are being accepted now. Click here to apply to be named one of three 2020 401(k) Champions.

What Happens After Retirement?

In another post, I’ll talk about how to turn 401(k) assets into a retirement income stream and how to address income taxes.