As a bond provides a contractual right to a series of future payments received at specified points of time, the price for a bond is simply the present discounted value of the future cash flows. The face value of a bond will be repaid at maturity.

A zero-coupon bond provides only a bond’s face value, and it will be sold at a discount to the face value in order to provide a return and compensate for the risks related to holding it. A coupon bond provides the face value at maturity in addition to a series of coupon payments (often on a semiannual basis) until the maturity date. The coupon rate is contractually defined as a percentage of the face value.

Getty

The yield to maturity is the internal rate of return an investor will earn by holding a bond to maturity and receiving its cash flows. The yield to maturity for a new investor differs from the coupon rate whenever the bond sells for a different price than its face value.

Click here to download our resource, 12 Principles of Intelligent Investors.

Exhibit 1.1 provides a simple example to understand the pricing process for bonds. The bond being considered is a ten-year coupon bond with a face value of $1,000 and a coupon rate of 3 percent. In this simple example, one coupon payment of $30 (3 percent of $1,000) is made at the end of each year for ten years to the bond’s owner(s) on those dates, and the face value is paid in full at the end of the tenth year. These can be seen in the exhibit’s Cash Flows column. The next three columns provide the discounted value of these cash flows for different interest rates: 3 percent, 3.5 percent, and 4 percent. When the discount rate is 3 percent, we see that the total discounted cash flows add to $1,000, which is the same as the face value. This is an important point: When the interest rate is the same as the bond coupon rate, the price of a coupon bond will match its face value.

Let’s be clear about what the discounted value of the payments means. In year ten, for instance, the discounted value of the payment with a 3 percent interest rate is $766.42. Imagine placing this amount in a bank account that earns an annually compounded 3 percent return each year. After ten years, it will grow to be $1,030, which is the amount of the cash payment provided in year ten. In other words, an investor would need to set aside $766.42 today in order to have $1,030 in ten years if the funds grew at a 3 percent annually compounded return.

If interest rates in the economy are 3.5 percent, then an investor would not be willing to pay $1,000 for this bond that provides only 3 percent coupon payments. The investor would prefer a new bond that presumably is now offering a 3.5 percent coupon. To entice an investor to purchase the bond in this exhibit, the bond would have to be sold for a lower price. In a competitive and active market, bonds with the same maturity and risk characteristics must offer the same potential return for both parties to agree to a trade. In this case, the future cash flows are discounted at 3.5 percent, and the sum of these discounted cash flows (and potential selling price) is $958.42.

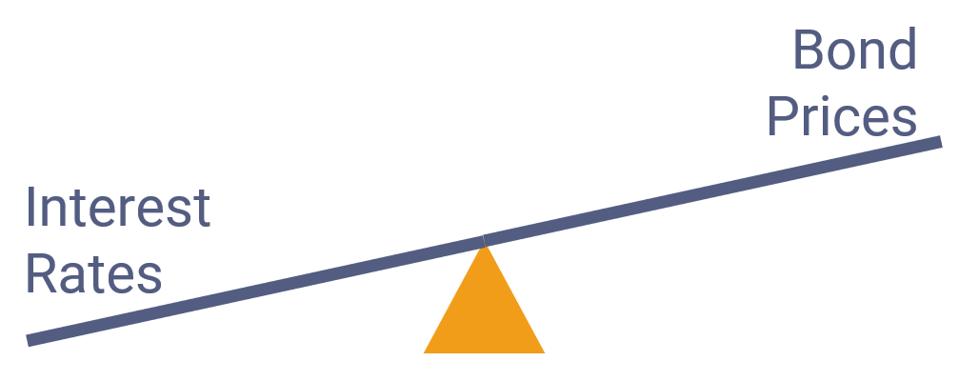

Whoever owns the bond is entitled to the predefined cash flows of $30 per year plus $1,000 more in the final year. These cash flows do not change with interest rates. What changes is the selling price of the bond. For an investor who pays $958.42 for the bond, the yield to maturity received by the investor on this smaller investment is 3.5 percent. Note that a 0.5 percent increase in interest rates reduced the selling price of the bond by 4.2 percent. If the investor sold the bond, the return received by the previous owner is defined in terms of any coupon payments received less the capital loss associated with the interest rate rise. Increasing interest rates lower the prices for existing bonds. The same phenomenon is also shown for an interest rate of 4 percent. In this case, the bond’s price would have to be set at $918.89 to adequately entice an investor. The 8.1 percent price reduction provides a yield to maturity of 4 percent to the new purchaser that then matches the overall higher interest rate in the economy.

Exhibit 1.1

Basic Pricing for a Ten-Year Coupon Bond

Retirement Researcher

The yield to maturity can differ from the coupon rate as bonds are bought and sold at prices other than face value, exposing the investor to interest rate risk—the risk that a bond price will fall due to rising interest rates.

Coupon rates are one of the most confusing aspects of bonds for people to understand. When the bond is issued, it pays a set coupon rate. For a regular Treasury bond, if the coupon rate is 3 percent and face value is $1,000, then the bond pays coupons of $30 per year. Usually these are paid semiannually—two coupon payments of $15 in this case. Note that the coupon rate never changes. Interest rates can change, but that will affect the yield, not the coupon rate. If interest rates rise, then the price the bond can be sold at will decrease, raising the underlying yield to maturity to match the increasing interest rate. But if I buy a $1,000 face value bond on the secondary market for only $700 and it has a 3 percent coupon, it is important to understand that my coupon income will be based on 3 percent of $1,000, not 3 percent of $700. Though this may seem basic and simple as I explain it, it has proved to be a major source of confusion.

The yield is the yield to maturity based on the ask price paid by the investor—the return the investor would get for buying the bond today and holding it to maturity. If the ask price matches the face value, then the yield will be the same as the coupon. If the ask price is higher, then the yield will be less than the coupon, and if the ask price is lower, then the yield will be higher than the coupon. Why? This gets back to the point I was stressing before about how the coupon rate never changes. The bond provides a promise for a fixed set of payments. It pays all the fixed coupon amounts and repays the face value at the maturity date. These payments do not change. But bonds can be sold and resold on secondary markets prior to the maturity date. If I pay $900 for a bond providing a fixed set of promised payments, then I’m going to get a higher return on my $900 investment than if I paid $1,100 for the same set of promised payments. Lower ask prices imply higher yields, and vice versa.

Exhibit 1.2

The Seesaw for Bond Prices and Interest Rates

Retirement Researcher

This is an excerpt from Wade Pfau’s book, Safety-First Retirement Planning: An Integrated Approach for a Worry-Free Retirement. (The Retirement Researcher’s Guide Series), available now on Amazon.