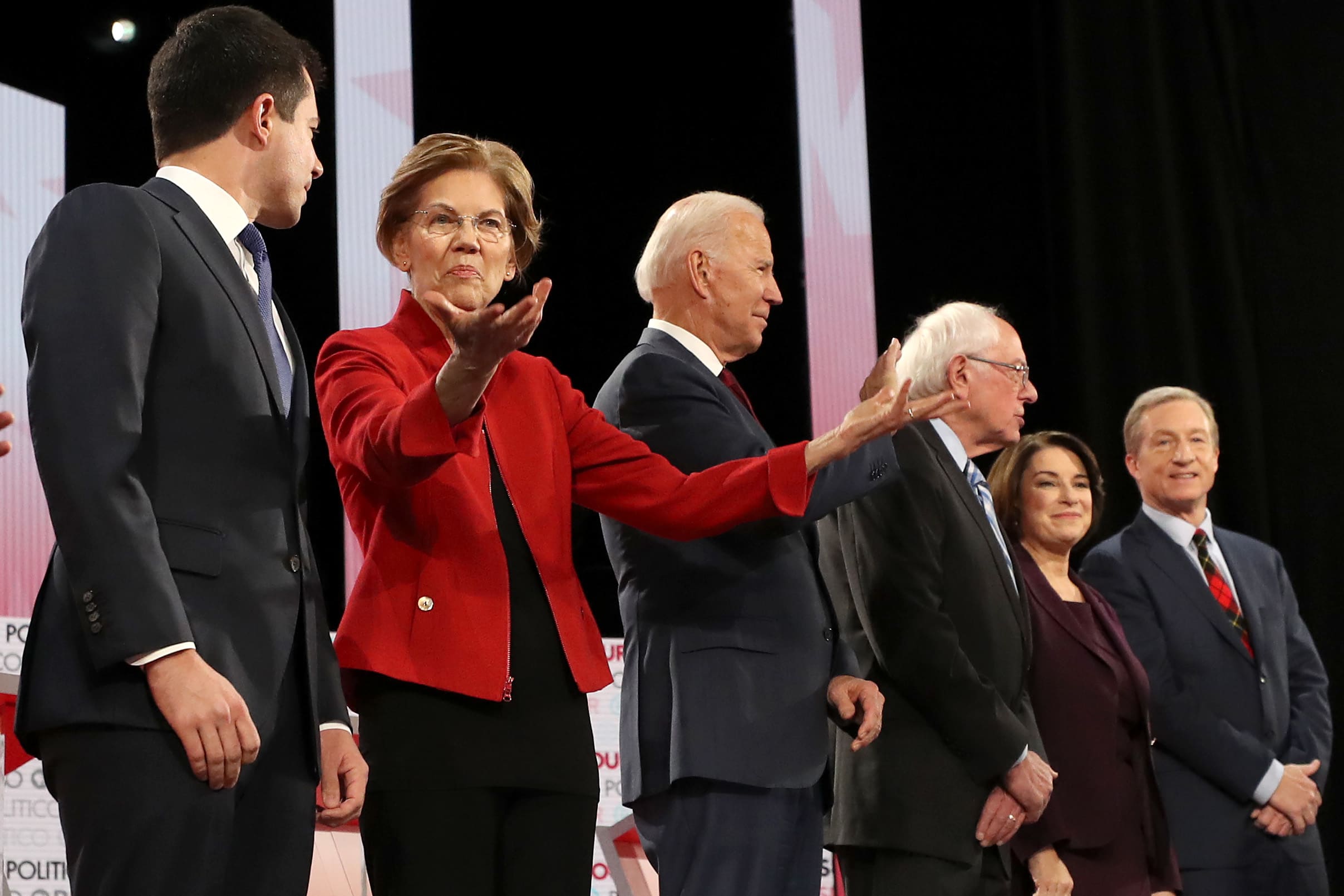

Sen. Elizabeth Warren (D-MA) gestures as democratic presidential candidates (L-R) South Bend, Indiana Mayor Pete Buttigieg, former Vice President Joe Biden, Sen. Bernie Sanders (I-VT), Sen. Amy Klobuchar (D-MN), and Tom Steyer await the start of the Democratic presidential primary debate at Loyola Marymount University on December 19, 2019 in Los Angeles, California.

Mario Tama | Getty Images

Discussion on Social Security reform has been largely absent from the Democratic debates.

That could all change Tuesday night, as six of the candidates are scheduled to take the stage in Iowa.

Focus on the program has intensified as Sen. Bernie Sanders, I-Vt., criticized former vice president Joe Biden’s record on the issue in recent days.

“Joe Biden has been on the floor of the Senate talking about the need to cut Social Security or Medicare or Medicaid,” Sanders recently said.

It’s a pivotal time for the program, which many Americans rely on for most, and sometimes all, of their retirement income.

In 2019, about 64 million Americans received more than $1 trillion in Social Security benefits.

Meanwhile, Social Security’s trust funds are projected to be depleted in 2035, according to most recent estimates. At that time, just 80% of promised benefits would be payable.

Most of the Democratic candidates have plans to solve those long-range financing difficulties, said Melissa Favreault, senior fellow at the Urban Institute, a nonpartisan research organization.

For many candidates, that means raising the limit on maximum taxable earnings. Currently, income up to $137,700 is subject to Social Security taxes.

However, the longer it takes for any changes to go through, the less time baby boomer or even Generation X taxpayers will be required to contribute to a long-range solution. That could ultimately place more of a financial burden on younger generations.

“It’s absolutely critical that we start thinking about this, and critical that we start talking about it,” Favreault said. “The longer we wait, the more constrained our options.”

A number of the Democratic candidates are proposing to expand benefits and not just shore up the system, said Nancy Altman, president of Social Security Works, an advocacy organization.

“It’s an issue of extreme importance to everyone so, to me, it has all the components of a perfect question for the debate,” Altman said.

Here is what we know about where the candidates in the Iowa debate stand.

U.S. Democratic presidential candidate and former U.S. Vice President Joe Biden.

Steve Marcus | Reuters

Joe Biden

The former vice president and senator has been on the receiving end of criticism for his views on Social Security reform.

But Biden’s campaign website outlines a different plan for the program and calls for increasing benefits.

That would include a new minimum benefit, where workers who have put in at least 30 years of work would get a benefit equal to at least 125% of the federal poverty level.

Other individuals who would get bigger benefits include Americans who have received retirement benefits for at least 20 years as well as widows and widowers.

To pay for those changes, Biden calls for raising taxes on wealthy Americans. More specific details on what a new tax rate would be are not yet included.

Democratic presidential candidate and mayor of South Bend, Indiana Pete Buttigieg responds to a question during a forum held by gun safety organizations the Giffords group and March For Our Lives in Las Vegas, Nevada, October 2, 2019.

Steve Marcus | Reuters

Pete Buttigieg

Pete Buttigieg, the former mayor of South Bend, Indiana, wants to expand benefits as well.

“Social Security does face a fiscal imbalance that needs to be addressed – without raising taxes on working- and middle-class Americans,” Buttigieg’s campaign website states.

Instead, Buttigieg calls for “ensuring the most fortunate pay their fair share” and automatically adjusting tax rates for high earners.

Benefit increases would be used to keep seniors out of poverty. The plan also calls for counting years spent caring for children, elderly or disabled dependents towards your benefit amount.

Senator Amy Klobuchar (D-MN) speaks at a conference in Washington, April 10, 2019.

Yuri Gripas | Reuters

Amy Klobuchar

Amy Klobuchar, senator from Minnesota, calls for raising the Social Security payroll tax to income above $250,000.

Because the cap is currently set at $137,700, that could create a so-called doughnut hole, where earnings are not taxed between the current maximum and the new level, said Favreault.

Klobuchar also proposes expanding benefits for widows and those who take time out of the work force to take care for children or aging or sick family members.

2020 Democratic U.S. presidential candidate and U.S. Senator Bernie Sanders speaks during the Presidential Gun Sense Forum in Des Moines, Iowa, August 10, 2019.

Scott Morgan | Reuters

Bernie Sanders

Bernie Sanders has also outlined a plan to expand Social Security as part of his “secure retirement” platform.

He proposes lifting the Social Security payroll tax to apply to all income over $250,000. Increased revenue from that tax increase would help the program pay benefits for the next 52 years, according to his campaign.

Sanders also proposes giving a $1,300 per year increase to seniors with annual incomes of $16,000 or less.

He also calls for raising benefits for low-income workers when they retire, as well as increasing annual cost-of-living adjustments. More details on the size of those increases are not currently available.

Tom Steyer

Michael Brochstein | SOPA Images | LightRocket | Getty Images

Tom Steyer

Details on where Tom Steyer, a billionaire business executive and activist, stands on Social Security have not been as readily available to date, in part because he has never held public office.

In an emailed statement, Steyer called Social Security “a promise that America has made to our seniors.”

“American workers have put money into the system for their whole working lives and are depending on it to be there for them when they need it,” Steyer said. “Great countries don’t break their major promises to their citizens.

“Under all circumstances, my administration will live up to the promise to protect Social Security, including by raising the income cap.”

More details on Steyer’s plan, including how much he would raise the income cap subject to Social Security payroll taxes, were not available.

Democratic 2020 U.S. presidential candidate Sen. Elizabeth Warren speaks at a Democratic Party fundraising dinner, the Liberty and Justice Celebration, in Des Moines, Iowa, November 1, 2019.

Eric Thayer | Reuters

Elizabeth Warren

Elizabeth Warren, senator from Massachusetts, has come out with the most specific proposal for how she would save Social Security. That includes a calculator on her campaign website that shows how much an individual’s benefits would increase.

Her plan would raise benefits for all current and future beneficiaries by $200 per month, or $2,400 per year.

Warren also calls for increasing benefits for low-income workers, women, disabled individuals, public sector workers and minorities.

In order to finance that, families in the top 2% would have to pay more.

That includes a 14.8% payroll tax on incomes above $250,000, which would be split evenly between employees and employers.

In addition, Warren’s plan also calls for a 14.8% tax on net investment income for individuals who take in more than $250,000 in annual income and for couples earning more than $400,000.

More from Personal Finance:

Elizabeth Warren would bypass Congress on student loan debt

Why Social Security’s not enough to pay for basics

Lawmakers renew push for mailed Social Security statements