Democratic presidential candidate Michael Bloomberg — whose wealth is estimated at $60 billion — says his tax return is probably thousands of pages long and he can’t use TurboTax to finish it.

Most taxpayers don’t deal with such complications.

While preparing taxes can be a headache and may involve a lot of pages, using online software helps minimize mistakes, allows you to e-file — and often is available for free.

For about 70% of the nation’s taxpayers — those with adjusted gross income of $69,000 or less in 2019 — the IRS Free File program may be an option. That’s a partnership involving the agency and a consortium of 10 companies that includes H&R Block, Intuit (maker of TurboTax) and TaxSlayer.

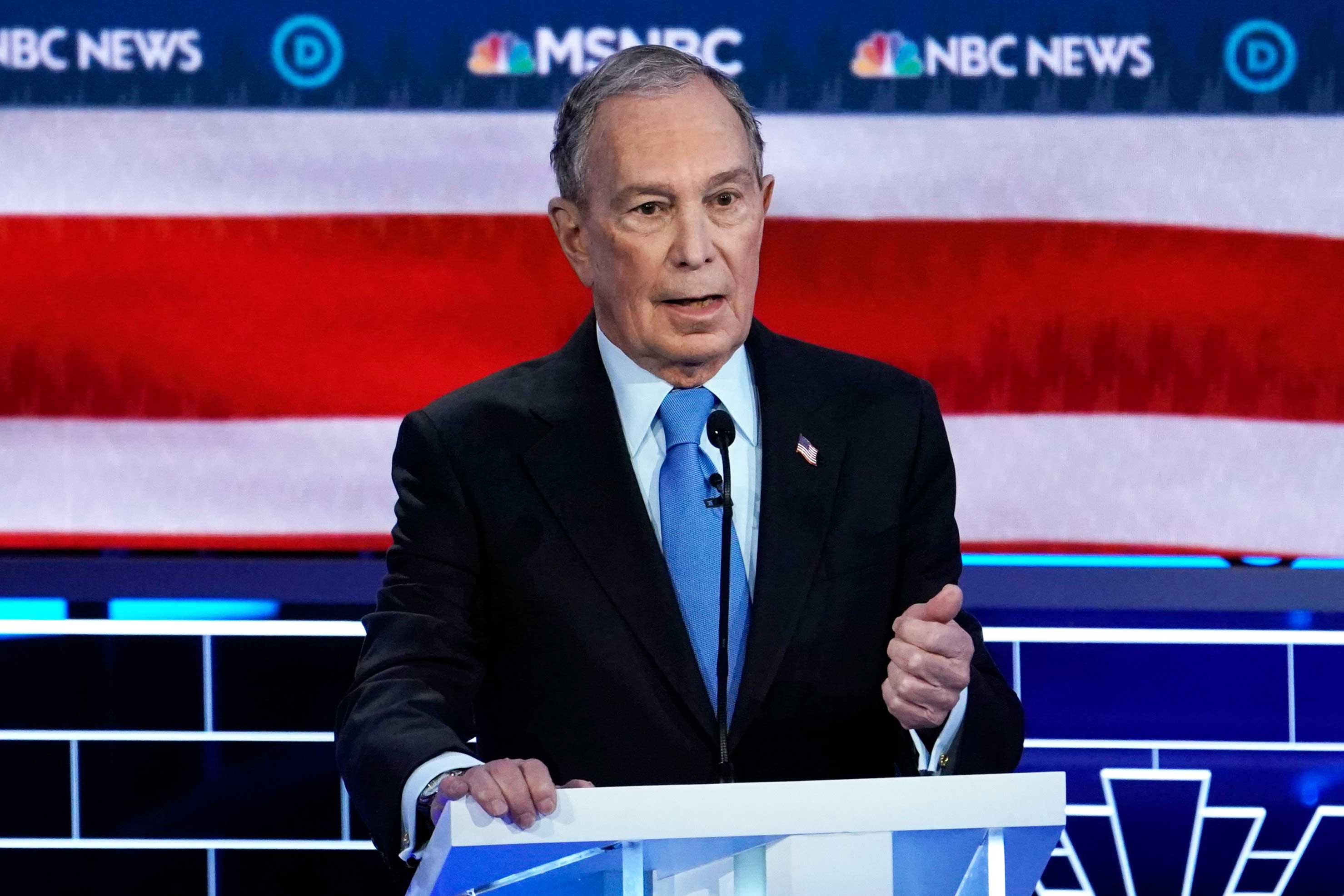

Former New York City Mayor Mike Bloomberg speaks during the ninth Democratic 2020 U.S. Presidential candidates debate at the Paris Theater in Las Vegas Nevada, U.S., February 19, 2020.

Mike Blake | Reuters

However, fewer than 2% of the eligible 105 million taxpayers use it, according to a recent report from the National Taxpayer Advocate’s office at the IRS.

That could change this year, because the companies that participate are now barred from hiding the free products on their websites — which in the past led some consumers to pay for tax preparation that they could have received for free.

Some of those online tax-software providers will also allow you to complete simple federal returns (and sometimes state returns) for free through their websites.

If you go it alone and end up baffled, remember that you might be able to find answers to your questions on the site of the service you use. And, of course, you can choose to pay for the option of extra help — some online tax-prep sites offer a package that gives you access to live assistance from a CPA if you need it. Those options can run more than $100, depending on the company.

About 50.5 million taxpayers turned to online tax-prep software in 2017, according to the IRS. The most popular way to file that year was leaving it to the pros: 78.6 million returns were filed via a professional tax preparer.

More from Personal Finance:

These high-income taxpayers will get a visit from the IRS

Americans have $21 billion in unused gift cards

Tax scams are in full swing. How to protect yourself

If you go that route, carefully choose who completes your tax returns — because regardless of who does it for you, you are ultimately responsible for its contents. While a fraudulent tax preparer would be on the hook for illegal actions, you could owe back taxes, penalties and interest for filing an inaccurate return.

This year, the IRS expects to process more than 150 million individual returns. As of Feb. 7, the agency had issued 10.9 million refunds averaging $1,952.