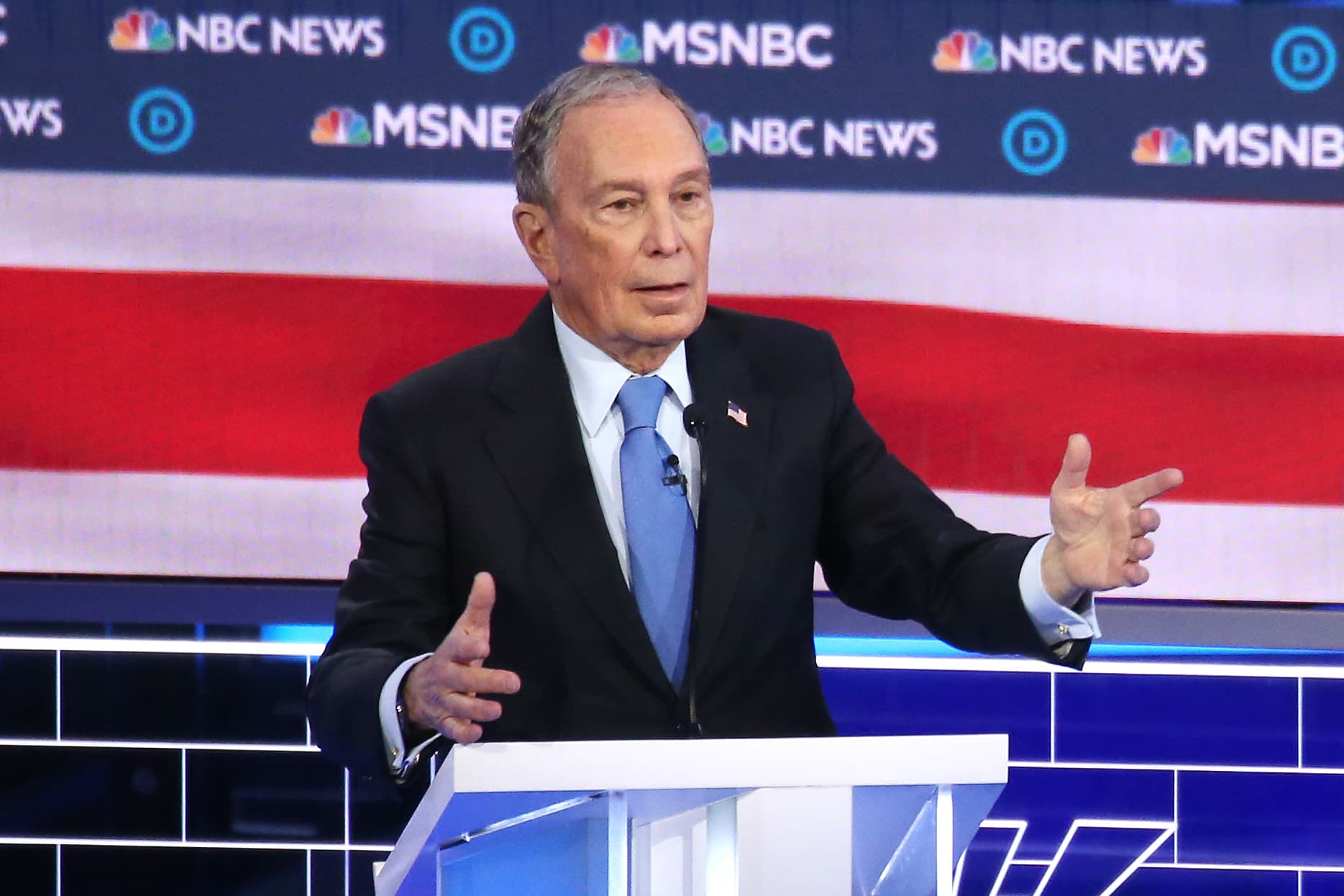

Michael Bloomberg, billionaire and former mayor of New York, is the latest Democratic presidential candidate to turn his attention to the country’s $1.7 trillion outstanding student loan balance.

“At its best, higher education serves as an engine of economic mobility and a pathway to the middle class,” the 78-year-old wrote in his $700 million proposal released this week. “Our system is not fulfilling that promise.”

Bloomberg would make community college free and double Pell Grants. The grants typically go to around 7 million students a year for families with an income below $20,000. Four-year colleges would also be “debt-free” for low-income students. His campaign says it will fund his higher education plan by raising taxes on the wealthy.

For people already saddled with student debt, Bloomberg says he would slash borrowers payments in half. Specifically, borrowers would automatically be enrolled in repayment plans that cap their monthly bills at 5% of their discretionary income. People on those plans now can pay between 10% and 20% of their income.

According to the plan, borrowers would have the option to pay their bills through their employer under the payroll withholding system. Sen. Lamar Alexander, R-Tenn., floated a similar proposal last year. However, it quickly drew criticism from consumer advocates, who called it “mandatory wage garnishment.”

After 20 years on Bloomberg’s repayment plan, borrowers can get up to $57,000 of their remaining debt cancelled tax-free. Currently, debt forgiven under these programs is considered taxable income.

Bloomberg would also cancel the debt of students who went to predatory, for-profit colleges and end the government’s collection of defaulted borrowers’ Social Security checks and tax refunds. The candidate would also do away with the collection charges on past-due loans for low- and middle-income borrowers.

Lastly, Bloomberg says he would fix the challenged public service loan forgiveness program by “extending debt relief to all qualifying public servants who’ve applied for forgiveness in good faith.” The Consumer Financial Protection Bureau estimated that one-quarter of American workers could be eligible for that program. Most borrowers in public service jobs believe they’re paying their way to loan forgiveness, only to discover at some point in the process that they don’t qualify for one technical reason or another.

“Noticeably absent is any proposal concerning the restoration of bankruptcy rights for student loans,” said higher education expert Mark Kantrowitz.

At least one Republican, in addition to a host of Democratic lawmakers and presidential candidates, wants to allow student debt to be discharged in normal bankruptcy proceedings. Currently, borrowers can have to exhibit a “certainty of hopelessness” to walk away from their student debt in court.

Federal Reserve Chairman Jerome Powell has said he’s “at a loss to explain” why student loans are treated differently than other types of debt in bankruptcy.

There’s no sound reason struggling borrowers shouldn’t be able to get a fresh start, Kantrowitz said.

“Credit cards can be discharged, but not student loans?” he said.

Student debt has become a central issue in the 2020 presidential campaign.

Americans are now more burdened by loans they took out for their education than credit card or auto debt. The average college graduate leaves school $30,000 in the red today, up from $10,000 in the 1990s, and 28% of student loan borrowers are in delinquency or default.

More from Personal Finance:

The biggest things you don’t know about Roth IRAs

Still working at 65? How to handle Medicare

These high-income taxpayers are getting a visit from the IRS

Among other Democratic presidential contenders, Sen. Bernie Sanders, I-Vt., said he plans to erase the country’s $1.7 trillion outstanding student loan tab, releasing some 45 million Americans from their debt.

Under a proposal from Sen. Elizabeth Warren, D-Mass., borrowers with household incomes less than $100,000 would get $50,000 of their student debt forgiven. People who earn between $100,000 and $250,000 would be eligible for forgiveness on a sliding scale – the cancellation amount reduces by $1 for every $3 a person earns over $100,000.

“The Bloomberg education plan is typical of what one would expect from a centrist candidate,” Kantrowitz said. “It does not offer blanket student loan forgiveness, like senators Sanders and Warren, but more targeted, and less expensive, forgiveness.”

Still, Kantrowitz added: “Given Bloomberg’s past philanthropic efforts in college access and success, it’s surprising that there isn’t more innovation in his proposals.”