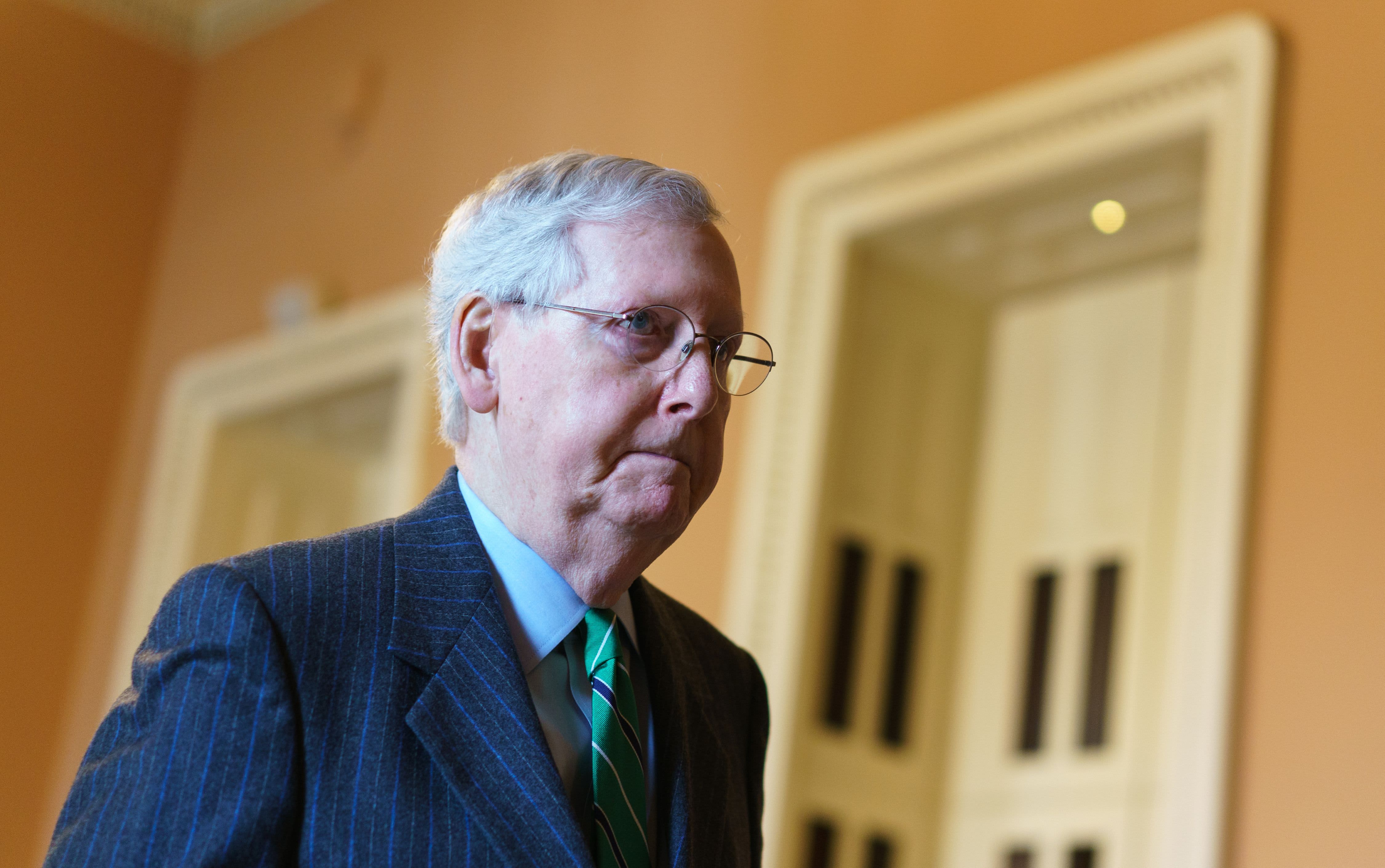

Senate Majority Leader Mitch McConnell, R-KY,

Mandel Ngan | AFP | Getty Images

This is a live blog. Check back for updates

7:52 am: Gundlach says S&P 500 will rebound to 2,700 on this snap back

DoubleLine Capital CEO Jeffrey Gundlach said he expects the S&P 500 to rally to 2,700 on this market rebound. ”I can see the S&P 500 making it to around 2700 on this snap back,” Gundlach tweeted on Tuesday. This implies about a 10% from Tuesday’s closing level of 2,447.33. Stocks rallied on Tuesday on hopes of stimulus package from the U.S. government, which passed on Wednesday. The S&P 500 rallied 9.4% for its best day since October 2008 on Tuesday. – Fitzgerald

7:39 am: Spain reports record number of coronavirus deaths

Spain recorded a record number of deaths in one day from the virus, with 504 people passing away on Tuesday. Since the pandemic began, a total of 2,991 have died in the second-worst hit country in Europe.

There have been 42,058 confirmed cases of coronavirus in Spain, with the country’s capital, Madrid, home to the highest number of infections.

Given the unprecedented pressure on hospitals, funeral homes and crematoriums around Madrid, an ice rink in the city has been transformed into a temporary morgue. Palacio de Hielo, as it is known, received the first coffins on Monday. The freezing temperatures are expected to protect the bodies until funeral homes have the capacity to bury or cremate them. – Amaro

7:36 am: Cruise line stocks rise on stimulus hopes

Cruise lines, one of the hardest hit industries from the spreading coronavirus, rose in premarket trading on Wednesday after the White House and Senate agreed on a stimulus bill. Shares of Norwegian Cruise Lines jumped 12% premarket, after gaining 42% on Tuesday. Shares of Royal Caribbean Cruises rose 11% after rallying 22% on Tuesday and Carnival jumped 10% following its 14% gain on Tuesday. – Fitzgerald

7:31 am: Mortgage applications tank 29% as coronavirus sidelines homebuyers

An increase in interest rates, combined with a massive shutdown of the economy caused homeowners and potential homebuyers to back away from the mortgage market. Total mortgage application volume fell 29.4% last week from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. “Several factors pushed rates higher, including increased secondary market volatility, lenders grappling with capacity issues and backlogs in their pipelines, and remote work staffing challenges,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. – Olick

7:30 am: Airlines surge on coronavirus stimulus package

Airline stocks rallied in premarket trading on Wednesday after the White House and Senate agreed on a $2 trillion coronavirus stimulus bill. Senate Majority Leader Mitch McConnell said the bill would “stabilize key national industries” to prevent as many layoffs as possible. Airline stocks have been among the hardest hit by the coronavirus as travel has slowed. Shares of American Airlines jumped 9% in premarket trading, after gaining 34% on Tuesday. United and Delta Air Lines rose more than 9%, after gaining 34% and 25%, respectively, on Tuesday. – Fitzgerald

7:15 am: Stock futures point to mixed picture at the open

The much awaited $2 trillion coronavirus stimulus bill got the greenlight early Wednesday morning, and the Street cheered the progress, sending Dow futures higher and pointing to an 800-point rally at the open. But gains started to fade around 7 a.m. ET, and futures turned negative. The Dow Jones Industrial Average is set to open 83 points lower. The S&P 500 and Nasdaq are also poised for modest losses at the open.

Stocks staged a historic rally on Tuesday, with the Dow gaining 11.37% in its best day since 1933, and its fifth best day in history. The 30-stock index’s 2,112.98 point gain was its largest on record. Meanwhile, the S&P 500 rose 9.38% in its best day since Oct. 2008.

Driving the gains was the hope that Congress was close to agreeing to a stimulus bill. The deal, which the White House and Senate leaders eventually agreed to early Wednesday, is a massive $2 trillion relief bill — said to be the largest rescue package in American history — to combat the economic impact of the coronavirus outbreak.

The Senate has yet to release the final terms of the deal. Senate Majority Leader Mitch McConnell said the Senate will vote and pass the legislation later Wednesday. – Stevens

– CNBC’S Diana Olick and Silvia Amaro contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.