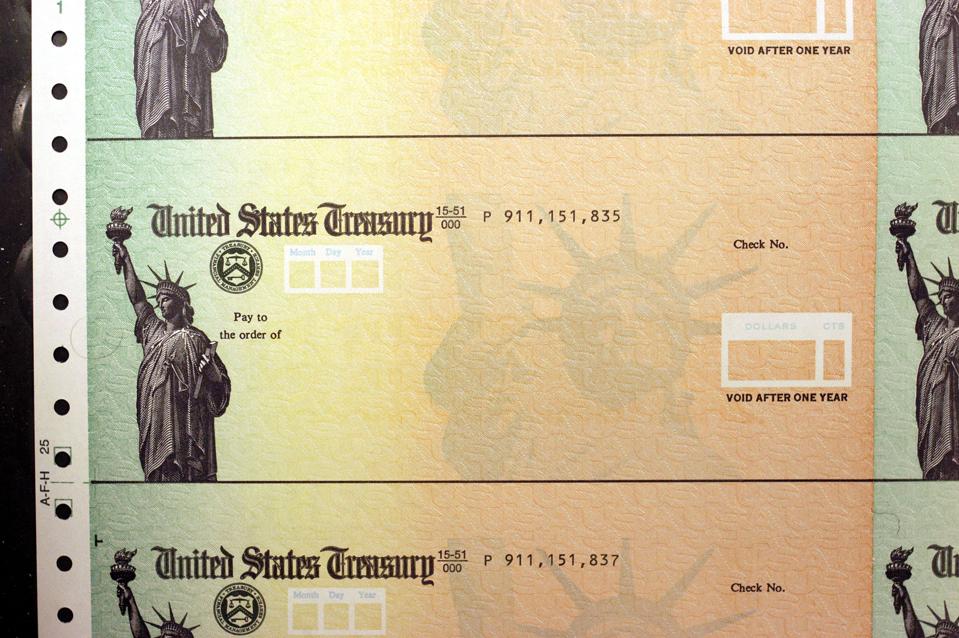

Blank United States Treasury checks are run through a printer at the U.S. Treasury printing … [+]

Getty Images

The IRS has already processed over 80 million stimulus checks during the first week of sending out payments. However, there are still approximately 60 million stimulus checks that still need to be issued – and some of them may not be coming for months.

But just because you haven’t received yours yet doesn’t mean it isn’t coming soon. Here are some reasons you haven’t yet received your stimulus check and what you can do to receive it more quickly.

1. You Aren’t Eligible for the Stimulus Check.

This should go without saying, but there is a lot of confusion regarding eligibility. The IRS uses three factors to determine your eligibility. You are eligible if you are a U.S. citizen or resident alien who:

- Has a valid Social Security number,

- Could not be claimed as a dependent of another taxpayer, and

- Had adjusted gross income under certain limits.

You can read more about the 2020 economic stimulus check eligibility and FAQs here.

2. You Chose to Have a Paper Check Mailed to You

The IRS will send your stimulus payment to you in the same manner up opted to have your most recent tax refund sent to you. If you chose to have your check mailed to you, then you may be waiting a long time.

The IRS is currently only processing direct deposits. They will likely start processing paper checks in the next few weeks. But the wait time will likely be weeks or months before they can send all the checks in the queue.

Solution: Visit the IRS Get My Payment Page and request to have your check sent via direct deposit instead of by mail. Be sure to have your bank account information available.

3. The IRS Doesn’t Have Your Bank Account Information

Even if you filed your tax returns in both 2018 or 2019, the IRS may not have your bank account information. If you didn’t receive a tax refund, you may not have been required to provide the IRS with your bank’s direct deposit information.

Solution: Visit the IRS Get My Payment Page and enter your banking information. This will move your stimulus check payment to the “direct deposit” queue instead of the “mailed check” queue.

4. You Didn’t File Your 2019 Tax Return Electronically

The IRS processes electronic tax returns much more quickly than paper tax returns. This shouldn’t be a problem if you filed your 2018 tax return by paper, as the IRS should have processed this last year.

However, the IRS has not yet processed all paper tax returns from 2019. And because many IRS agents are working remotely, they will not be able to process these returns until social distancing guidelines are eased.

Solution: Unfortunately, the only thing you can do here is to wait it out. Filing your tax return electronically is faster, safer, and reduces errors. And you can now add having your stimulus check process more quickly as yet another reason to file your tax return electronically.

5. You Did Not Have Your Most Recent Tax Refund Sent to Your Bank

Many tax return organizations set up prepaid debit cards or intermediary bank accounts for their clientele. This allows customers to avoid paying anything out of pocket, as the tax preparation firms take their fee from the proceeds, then distributes the remainder to the customer.

This can also be a benefit for the unbanked or those who do not have the proper identification to cash a large check. But it’s not an efficient way for the IRS to send stimulus checks.

Solution: Contact the tax firm that filed your return this year to see if they have any guidance. An alternative is to visit the IRS Get My Payment Page and enter your banking information or mailing address if you prefer a paper check.

6. You Weren’t Required to File a Tax Return in 2018 or 2019

The IRS does not require certain individuals to file a tax return, for example, if their income is too low, or if they do not have taxable income. If that is the case, the IRS may not know you qualify for a stimulus check. This article shows you if you qualify for the stimulus check, even if you didn’t file a tax return.

You weren’t required to file a tax return in 2018 or 2019 if your Adjusted Gross Income was under $12,200 ($24,400 for married couples).

The IRS has posted guidelines stating they will automatically send the stimulus check to:

- Individuals who receive Social Security retirement, disability (SSDI), or survivor benefits

- Individuals who receive Railroad Retirement benefits

This still leaves out a number of individuals who do not file a tax return because they primarily receive their income from non-taxable sources such as VA service-connected disability benefits or Supplemental Security Income (SSI).

Solution: Visit the IRS Non-Filers: Enter Payment Info Here page and enter your information. Be sure to have your personal information as well as your banking information if you want to have your stimulus check directly deposited into your bank account.

Where to Get More Stimulus Check Information

You can find more information at the IRS website, or on this Stimulus Check Overview.