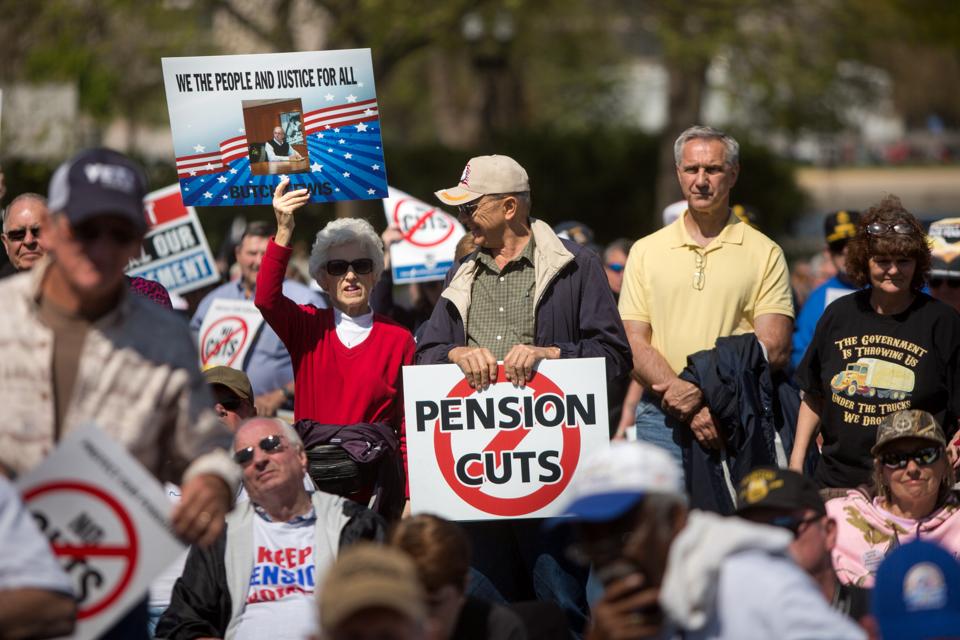

WASHINGTON, D.C. – APRIL 14: Attendees rally on the West Front of the U.S. Capitol building with … [+]

Getty Images

The HEROES Act, it turns out, is more than another round of “stimulus” checks, or the extension of supplemental unemployment benefits, or COBRA subsidies, or any of the other components which have garnered so much attention thus far. Tucked away in the bill is Division D, Title I, the Emergency Pension Plan Relief Act of 2020, which provides benefits for single- and multi-employer pension plans.

The provisions for single-employer plans are fairly standard, including the same sort of “funding relief” which Congress customarily provides in recessions, and which were omitted from the final version of the CARES Act back in March. But the multi-employer provisions? That’s a whole ‘nother story.

When Democrats in the House proposed their alternative to the Senate’s CARES Act, it included the Butch Lewis Act. I’ve criticized this repeatedly as a bailout which merely pretends not to be, with low-interest loans which wouldn’t necessarily save these plans, and, in any case, are forgivable after 30 years. But the Emergency Pension Plan Relief Act is far more expansive. I’ve said repeatedly that a rescue package for multiemployer pension plans will need to be a compromise, with give-and-take on all sides. This proposal is all “give” and no “take” (or all “take” and no “give” depending on your perspective).

What’s in the bill?

It’s a special “partition program” for plans in “critical and declining” as well as merely “critical” status, including those that fall into those classification now, and at any time up through 2024. “Partitioning” means that the PBGC takes over the liabilities for enough of the participants of a plan that the plan, taking into account the liabilities for the remainder of the participants, becomes financially healthy.

Ordinarily, under the Multiemployer Pension Reform Act (MPRA) of 2014, the partition would be paired with benefit cuts. (See my prior description of the program here.) But the Emergency Pension Plan Relief Act promises that there will be no benefit cuts for any participants. In addition, benefit cuts which had already been implemented for plans using MPRA to avoid insolvency would be restored for plans applying for a “special partition” (including retroactive payments) and no new benefit cuts would be permitted in any case.

What’s more, current law restricts benefits covered when PBGC takes over insolvent plans to a fairly low maximum. This bill would nearly double that limit (section 40106). Specifically, the current maximum is 100% of the first $11 of the monthly benefit rate, plus 75% of the next $33 of the monthly benefit rate, times the years of credited service. For a worker with 30 years of service, that works out to a maximum of $12,870 annually; for 40 years of service, that’s $17,160 annually. The new limits move to $24,300 and $32,400, respectively. But this increase in benefits is not paired with any increase in the required contributions/premiums plans make to the PBGC.

How much would this cost? There is literally no limit to the money to be expended: “there is appropriated from the general fund such amounts as necessary.”

Now, regular readers will recall that including a multi-employer pension rescue package in a bigger “stimulus” package may indeed have the “Jane the Actuary” seal of approval, but that’s only if it’s a bill that has bipartisan consensus and has been tacked-on to such a bill merely to ease the procedural difficulties in the way of passage.

This bill is far from that bipartisan bill and, in fact, I fear it makes that consensus all the harder to reach, by promising unrealistic giveaways that have nothing to do with pandemic relief.

As always, you’re invited to comment at JaneTheActuary.com!