On Friday, May 15th, the Small Business Administration (SBA) released the application borrowers of a Paycheck Protection Program (PPP) loan must use to determine the amount of the loan that may be “forgiven” by their lender. While the application included instruction, the SBA failed to provide two additional items that would have greatly benefited borrowers:

1. Narrative-based guidance, similar to previously issued interim final rules, which ideally would clear up much of the confusion surrounding critical definitions, from what items are included in payroll costs to the treatment of guaranteed payments or self-rental payments.

2. Detailed blueprints for constructing a fully functioning time machine, so nearly two million small business owners could magically transport back to a time when this forgiveness guidance would actually be useful.

WASHINGTON, DC – MAY 08: U.S. Treasury Secretary Steven Mnuchin (R) and White House Chief of Staff … [+]

Getty Images

Lest you think that second item is a tad harsh, consider this: The application confirms (with one small exception) that only those expenses paid within the 8-week period after receiving the loan are eligible for forgiveness. Many borrowers, however, are already half-way through that 8-week period, meaning even if this most recent guidance were complete – and it is far from it – it would still be entirely too late.

Nevertheless, we’ll play the hand we’re dealt, and if this is what the application for forgiveness is going to look like, we may as well figure out how to fill it out. After all, we can always come back and fill in the blanks as more guidance inevitably trickles out from the SBA or Treasury.

And you know what? Because I struggle with pattern recognition, I’m going to give the SBA the benefit of the doubt. There HAS to be more coming that this. As a result, I’m not going to devote space in this article to highlighting all of the things we still DON’T know; rather, I’ll focus on what the application tells us, and trust that I’ll soon be updating this article for the bevy of guidance still to come.

So let’s get to it, and because this application will be used millions of times by borrowers both big and small, we’re going to do this in painstaking detail; as in, line-by-line detail.

But first, let’s remember what this is all about….

PPP Loans, In General

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Securities (CARES) Act, a $2.3 trillion relief package designed to help individuals and businesses weather the economic damage caused by the COVID-19 pandemic.

The headliner of the CARES Act was the creation of the PPP, a new loan program under Section 7(a) of the Small Business Act designed to put nearly $600 billion into the hands of small businesses for use in paying employee wages and other critical expenses over the coming weeks and months.

The reason over two million businesses rushed to the bank to grab a PPP loan, however, was not because they were eager to saddle their struggling enterprises with more debt. Rather, the idea is that these PPP loans are loans in name only; once a borrower receives the funds, the amount spent over the next 8 weeks on payroll, mortgage interest, rent and utilities is eligible to be completely forgiven.

Even better, while a cancellation of a borrower’s debt typically creates taxable income under Section 61(a)(11) of the Internal Revenue Code, the CARES Act provided that forgiveness of a PPP loan is completely tax free. Unfortunately, the IRS took the shine off that “tax-free forgiveness” by recently issuing guidance that applies a decades-old tax principle to PPP loans; a principle which provides that expenses “allocable to tax-exempt income” are not deductible by the payor. As a result, any expenses paid by a borrower – to the extent those amounts are ultimately forgiven by the lender on a tax-free basis – will not be deductible on the borrower’s 2020 tax return. While this rule reaches a logical conclusion by preventing a borrower from effectively “double dipping” by receiving both a tax deduction and tax-free forgiveness related to payment of the same expenses — it served as a sucker punch to many borrowers, who had hoped for the best of both worlds based on their reading of the CARES Act. It’s possible Congress may pass a narrow amendment to Section 265 of the Code to specifically permit a deduction and double dip, but for now, no deduction is allowed.

Applying for Loan Forgiveness

On Friday, the SBA released 11 pages comprising the application for forgiveness and the relevant instructions. The application has two critical supporting schedules: Schedule A and the worksheet to Schedule A.

We will begin, however, with the application itself; specifically, the informational section that makes up the top half of the page. All instructions will be from the perspective of the borrower.

Top of Application Instructions

The application begins by asking you to provide your name, address and EIN, as well as SBA PPP loan number and lender PPP loan number. If you struggle with this part, it does not bode well for what’s to follow.

Next, you’re asked to provide a few items that may seem innocuous, but that may factor into the amount of your forgiveness:

PPP Loan Amount: This will serve as the maximum amount of loan eligible for forgiveness, as the application seems to stick to the CARES Act – and deviate from a previous Interim Final Rule – by limiting forgiveness to the principal of the loan, rather than any accrued but unpaid interest.

PPP Loan Disbursement Date: The date you receive the funds will generally signal the start of your 8-week period to accumulate expenses eligible for forgiveness, but as we’ll see, there is 1) some flexibility in choosing the 8-week period specific to payroll costs, and 2) certain situations where expenses paid AFTER the expiration of the 8-week period will be eligible for forgiveness.

Employees at Time of Loan Application: While this doesn’t appear to have any specific application to determining forgiveness, we will see that since you’re going to have to provide your number of employees for approximately 372 other periods, it can’t hurt to provide that detail for the date of the loan application as well.

Employees at Time of Forgiveness Application: Same response as immediately above.

Economic Injury Disaster Loan Advance Amount: These amounts were generally capped at $10,000, though later borrowers were often limited to $1,000 per employee, not to exceed a total of $10,000. As we’ll see later, when we arrive at Line 11 of the application – the maximum forgiveness amount – the SBA will reduce the amount forgiven by any EIDL advance that was received.

Economic Injury Disaster Loan Application Number: Any EIDL taken out after January 31, 2020, and used to cover payroll, was likely refinanced into your PPP loan. As a result, the SBA is looking to gather than information here.

Payroll Schedule: You must select the box that corresponds with your regular payroll schedule. This will help the SBA determine when payroll costs are paid or incurred and thus eligible for forgiveness. It will also drive the computation of full-time equivalent employees for several key periods, which will in turn be used to determine if a reduction in the amount eligible for forgiveness is required.

Covered Period: This is the first critical piece of information. The “covered period” is the 8-week period generally beginning on the date you received the loan disbursement. Only the costs paid OR incurred within the 8-week period are generally eligible for forgiveness. Some latitude is permitted, however, whereby certain costs are eligible for forgiveness even though they were incurred BEFORE the covered period but paid DURING the period, while other costs may be eligble for forgiveness even though they were incurred DURING the covered period but paid AFTER the period.

Specific rules govern the “paid and incurred” treatment of payroll costs. Payroll costs are paid on the day the paychecks are distributed or the borrower originates an ACH credit transaction. Thus, you could presumably receive PPP loans on April 26 and immediately pay – as part of your regular payroll process – wages that had been earned by the employees for the previous two weeks, and include the amounts in the forgiveness calculation because the amounts had been PAID within the covered period. What is not clear, however, is how far in arrears you may pay wages with PPP funds and continue to count those wages towards forgiveness. If you had not yet paid your employees for March wages but did so immediately after receiving PPP funds in April, are those amounts eligible for forgiveness? At the moment, nothing appears to prevent such a result.

The application instructions further provide that payroll costs are incurred on the day they are earned, before providing additional flexibility by allowing the payroll costs incurred for your last pay period of the 8-week period to be eligible for forgiveness as long as they are paid no later than the next regular payroll date.

For non-payroll costs such as mortgage interest, rent and utilities, to qualify for forgiveness, these expenses must either be: 1) paid DURING the 8-week covered period, or 2) incurred during the 8-week period, and paid by its next regular due date, even if that due date is outside the 8-week period.

Once again, it would appear that by allowing all payments made DURING the period to be eligible for forgiveness, borrowers are permitted to pay rent, interest, or utilities related to periods prior to the 8-week period and have those expenses forgiven.

Alternative Payroll Covered Period, if applicable: The instructions to the application allow for as-yet-unseen flexibility in choosing your 8-week covered period specific to payroll costs. You are permitted to choose an “alternative payroll covered period,” which is the 8-week (56 day) period beginning on the first day of the first pay period following the disbursement date, allowing a business to neatly align its covered period with the beginning of a pay period. Thus, if you received your PPP loan on April 20, 2020, and the first day of your next pay period is April 26, 2020, you may elect to count the payroll costs — and only the payroll costs — for the 8-week period beginning April 26, 2020, rather than the 8-week period beginning April 20, 2020.

If Borrower (together with affiliates, if applicable) received PPP loans in excess of $2 million, check the box: Uh…if your loan was less than $2 million, you’re going to want to remember to CHECK. THIS. BOX. The SBA recently announced what is effectively – and perhaps literally — a get-out-of-jail free card by providing a safe harbor for those borrowers who received less than $2 million in PPP funds. These borrowers will be treated as having made the required certification that the loan was necessary in good faith, and thus won’t be subject to the same additional scrutiny from the SBA that borrowers of loan amounts in excess of $2 million will face.

With the informational items out of the way, it’s time to turn our attention to the actual calculation, beginning with Line 1 of the application:

Line 1: Payroll Costs (Enter the amount from PPP Schedule A, Line 10).

As you’ll see, Line 1 directs us to Line 10 of Schedule A, which we can’t compute until we’ve determined items on the Worksheet for Schedule A. As a result, we’re going to start on the ground floor, with the Worksheet for Schedule A, and then build our way back up to the application.

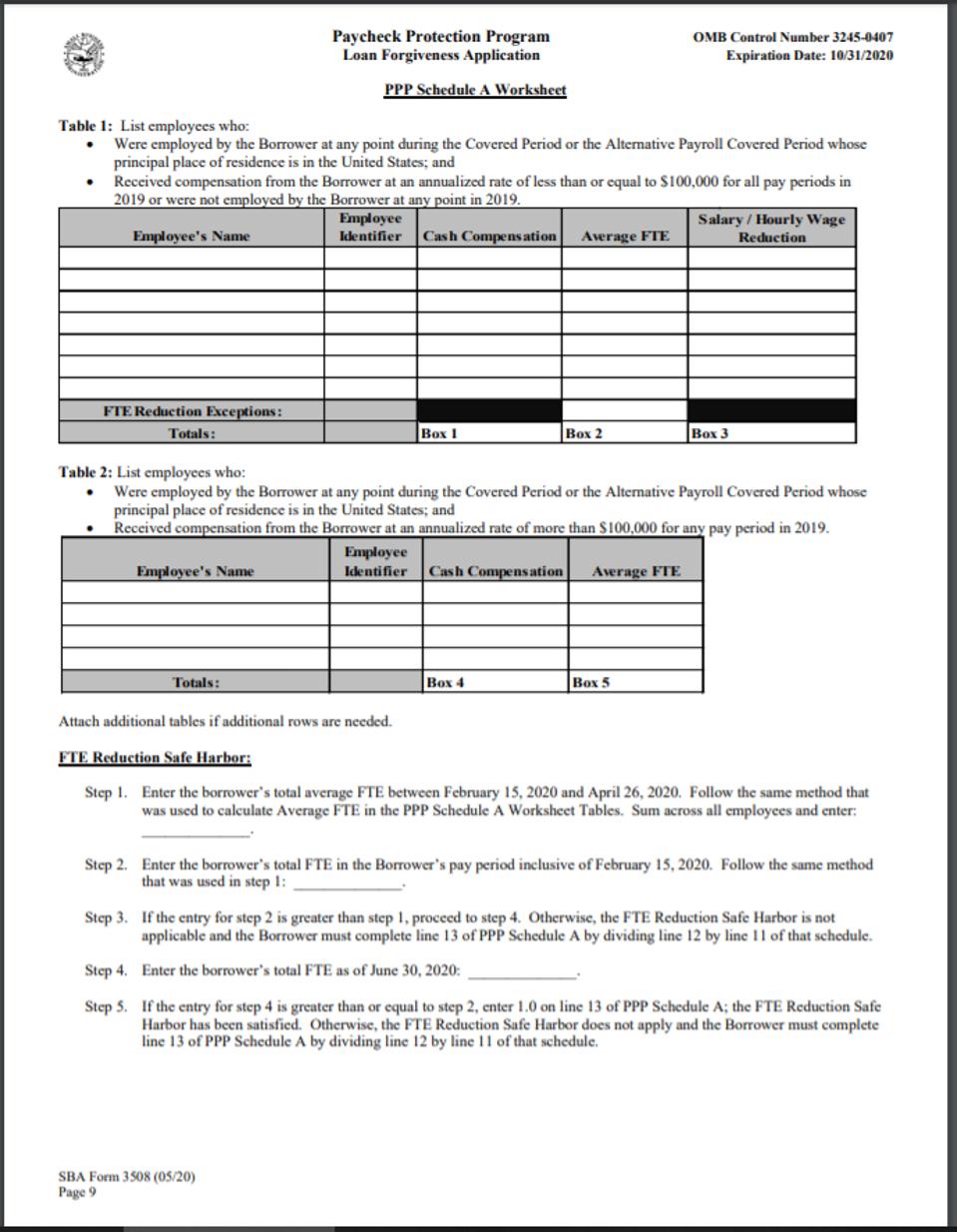

Worksheet to Schedule A

The Worksheet to Schedule A looks like so:

worksheet

SBA

The worksheet allows us to perform four critical computations:

- Most importantly, it is here where we will compute eligible compensation for each employee,

- We will make sure to cap the compensation of employees at $100,000 on an annualized basis,

- In addition, we will determine the number of full-time equivalent employees (FTEs) for the covered period (or alternative payroll period, if elected), and

- We will use the FTEs determined in 3 above to determine if a reduction in the amount eligible for forgiveness is required because FTEs were reduced during the covered period.

Let’s get started. We begin by identifying each employee, but we do NOT include:

- Independent contractors,

- Owner-employees,

- Self-employed individuals, or

- Partners.

Payments to independent contractors are not eligible for forgiveness. For self-employed individuals, until told otherwise, previously issued interim final rules provide that forgiveness related to payroll costs is purely mechanical, and is based on 8/52 of Line 31 of the individual’s 2019 Schedule C, rather than any amounts paid or incurred in 2020. As for payments to owner-employees and partners, we’ll see these amounts are pulled – with no real additional guidance – into Schedule A and included as costs eligible for forgiveness.

Employees are segregated into two tables: Table 1 is for those with annualized compensation for ALL pay periods in 2019 of less than $100,000. The reason these employees are isolated is because as we’ll see, if their salaries are reduced during the covered period, a reduction in the amount eligible for forgiveness may be required. What is not clear is how strict the “any pay period” limits are applied: what if an employer was paid a salary of $80,000 in 2019, but received a bonus of $5,000 during one two-week pay period. Isn’t the annualized salary for that two week period in excess of $100,000, even though the employee only received total compensation of $85,000?

Table 2 is reserved for those taxpayers with annual compensation in excess of $100,000 during 2019. These employees are isolated because the amount of compensation eligible for forgiveness for any one employee cannot exceed $100,000 on an annualized basis. Thus, for the 8-week period, the total compensation costs CANNOT exceed $15,385.

Now that we understand the difference between the tables, let’s fill them out:

Table 1

Cash Compensation

The CARES Act provides that the amounts spent on “payroll costs” during the 8-week covered period are eligible for forgiveness. Including in payroll costs are certain compensation amounts; specifically, the sum of payments of any compensation with respect to employees that is a:

- Salary, wage, commission, or similar compensation;

- Payment of cash tip or equivalent;

- Payment for vacation, parental, family, medical, or sick leave; or

- Allowance for dismissal or separation.

Compensation does not include, however:

- The compensation of an individual employee in excess of an annual salary of $100,000, as prorated for the covered period. As a result, in no situation should you enter more than $15,384 in this column for either Table 1 or Table 2.

- Any compensation of an employee whose principal place of residence is outside of the United States;

- Qualified sick leave wages for which a credit is allowed under section 7001 of the Families First Coronavirus Response Act (Public Law 116–127); or

- Qualified family leave wages for which a credit is allowed under section 7003 of the Families First Coronavirus Response Act (Public Law 116–127).

Average FTE:

To determine the average full-time equivalent employees (FTEs) for the 8-week covered period (or the alternative payroll covered period, if elected), for each qualifying employee, determine the average number of hours worked per week and divide by 40, before rounding to the nearest tenth. The maximum amount for each employee is 1.0. Alternatively, you can skip the math and use 1.0 for every employee who worked 40 hours per week and 0.5 for every employee who didn’t meet that standard. Either way you get there, you will ultimately arrive at the average FTE throughout the relevant covered period.

Example. X Co. borrowed a $100,000 PPP loan on April 10, 2020. X Co. incurred $100,000 of costs eligible for forgiveness over the next 8 weeks.

For the 8-week period beginning April 20, X Co. had the following employees:

- A, who averaged 45 hours per week during the period,

- B, who averaged 40 hours per week during the period,

- C, who averaged 28 hours per week, and

- D and E, who averaged 20 hours per week.

For the 8-week covered period, X Co. had 3.7 FTEs:

- A: 45/40 capped at 1.0

- B: 40/40 = 1.0

- C: 28/40 = .7

- D &E: 20/40 = .5 each

If X Co. chose instead to use the simplified method, it would have 3.5 FTEs:

- A: 45/40 capped at 1.0

- B: 40/40 = 1.0

- C: 28/40 = .5

- D &E: 20/40 = .5 each

Salary/Hourly Wage Reduction

Here’s where things go off the rails a bit. The total amount of loan forgiveness will eventually be reduced by the amount of any reduction in total ANNUAL salary or AVERAGE wages of any employee during the covered 8-week period who did not receive, during any single pay period during 2019, wages or salary at an annualized rate of pay of more than $100,000. The reduction in forgiveness amount is required if the reduction in wages over the 8-week period is in excess of 25% of the total salary or wages of the employee during the period from January 1, 2020 through March 31, 2020. Again, this is why employees with annualized salary of less than $100,000 are isolated in Table 1; by definition, only these employees can experience a reduction in salary during the covered period that necessitates a corresponding reduction in the amount eligible for forgiveness.

To determine the amount of reduction required, you must go through the following steps for EACH employee:

- Step 1: Determine the average annual salary or hourly wage for each employee during the covered period (or alternative payroll period, if elected).

- Step 2: Determine the average annual salary or hourly wage for each employee during the period from January 1, 2020, through March 31, 2020.

- Step 3: Divide Step 1 by Step 2.

- Step 4: If Step 3 is greater than 75%, no reduction is required. Do not fill out the column in Table 1 for this employee.

- Step 5: If Step 3 is LESS than 75%, a reduction is required, but as we’ll see shortly, the reduction may be reinstated. The reduction is tentatively determined by multiplying the amount determined in Step 2 by 75%, and then subtracting from that result the amount from Step 1. For a salaried employee, take this result and multiply it by 8. Then divide the amount by 52. This is the amount of the required reduction.

- For an hourly worker, the amount of the reduction is determined by first multiplying the average number of hours worked per week from January 1, 2020, through March 31, 2020, by the amount determined by subtracting the amount determined in Step 1 from 75% of the amount determined in Step 2. The result is then multiplied by 8 to arrive at the total reduction in forgiveness.

You’re lost, aren’t you? Let’s do an example.

Example. Employee A was paid an annual salary of less than $100,000 for 2019. A was paid $8,000 during the 8-week covered period. A was paid $20,000 for the period January 1, 2020, through March 31, 2020.

- Step 1: A’s average annual salary was $52,000 for the 8-week covered period ($8,000/8*52).

- Step 2: A’s average annual salary was $80,000 for the period January 1, 2020, through March 31, 2020 ($20,000 *4).

- Step 3: $52,000/$80,000 = 65%.

- Step 4: n/a

- Step 5: Before application of the safe harbor, A’s employer would reduce forgiveness attributable to A by the following amount: $80,000 * 75% = $60,000. $60,000 – $52,000 = $8,000. $8,000/52*8 = $1,230.

The reduction is not required, however, if a safe harbor is met. Whether the safe harbor is met is determined via the following steps:

- Step 1: Determine the employee’s annual salary or hourly wage as of February 15, 2020.

- Step 2: Determine the average annual salary or hourly wage for the period from February 15, 2020 through April 26, 2020.

- Step 3: If Step 2 is greater than Step 1, the safe harbor does not apply. Compute the reduction in forgiveness as determined in Step 5, above. If Step 2 is less than Step 1, proceed to Step 4.

- Step 4: Determine the average annual salary or hourly wage for the employee as of June 30, 2020. If that amount is equal to or greater than Step 1, the safe harbor has been met. In other words, the SBA will ignore a reduction in salary during the covered period relative to the 1st quarter of 2020, but ONLY IF that salary is restored to what it was on February 15, 2020, by June 30, 2020.

Example. Continuing the previous example, assume that on February 15, 2020, A was being paid an annual salary of $75,000. After the arrival of COVID-19, however, A’s average salary for the period February 15, 2020 through April 26, 2020, was reduced to $55,000. It was further reduced for much of May, which is what resulted in A being paid only $8,000 for the covered period. By June 30, 2020, however, A’s annual salary was increased to $75,000. Even though A’s salary has returned only to the amount he was paid on February 15 ($75,000) and not the amount he was paid throughout the first quarter ($80,000), the safe harbor is met and no reduction is required.

If the safe harbor had NOT been met, A’s employer would enter $1,230 in the “Salary/Hourly Wage Reduction” column in Table 1.

Table 2

Nothing new in Table 2, and you’ll notice that there is no column for “Salary/Hourly Wage Reduction,” because again, by definition, the rules don’t apply to any employee who earned more than $100,000 in 2019, and those employees aren’t included in Table 2.

FTE Reduction Safe Harbor

The amount of loan forgiveness may ALSO be reduced if the borrower reduces headcount during the covered period. Just as we saw with the reduction resulting from reduced salary, however, the reduction may be ignored if a safe harbor is satisfied.

Your forgiveness is reduced if your average number of full-time equivalent employees (FTEs) during the covered period is less than the average number of FTEs for any of the following periods, at your election:

- The period beginning on February 15, 2019 and ending on June 30, 2019; o

- The period beginning on January 1, 2020 and ending on February 29, 2020, or

- For a seasonal employer, as determined by the SBA, either of the two previous periods or any 12-week period between May 1, 2019 and September 15, 2019.

As you’ll remember, we determined FTEs above in the instructions to Table 1. But just to reinforce the concept, let’s build out this example again.

Example. X Co. borrowed a $100,000 PPP loan on April 10, 2020. X Co. incurred $100,000 of costs eligible for forgiveness over the next 8 weeks.

For the 8-week period beginning April 20, 2020, X Co. had the following employees:

- A, who averaged 45 hours per week during the period,

- B, who averaged 40 hours per week during the period,

- C, who averaged 28 hours per week, and

- D and E, who averaged 20 hours per week.

For the 8-week covered period, X Co. had 3.7 FTEs:

- A: 45/40 capped at 1.0

- B: 40/40 = 1.0

- C: 28/40 = .7

- D &E: 20/40 = .5 each

Using the simplified method, X Co. would have only 3.5 FTEs, so doing the math benefits X Co. by resulting in a larger number.

Assume further that for the periods February 15, 2019 through June 30, 2019, and January 1, 2020 through February 29, 2020, X Co. had the following employees:

- A, who averaged 45 hours per week during the period,

- B, who averaged 40 hours per week during the period,

- C, who averaged 40 hours per week,

- D and E, who averaged 28 hours per week, and

- F and G, who averaged 40 hours per week.

For those 8-week periods, X Co. had 6.4 FTEs:

- A: 45/40 capped at 1.0

- B: 40/40 = 1.0

- C: 40/40 = 1.0

- D &E: 28/40 = .7 each

- F & G: 40/40 = 1 each

Thus, before considering any safe harbor or reinstatement, X Co.’s amount eligible for forgiveness of $100,000 must be reduced by multiplying $100,000 by 3.7/6.4. Thus, the forgiveness is tentatively capped at $57,813.

A borrower may ignore the required reduction, however, if a safe harbor is met. To satisfy the safe harbor, the borrower must first use the methodology described above to determine FTEs for two additional periods:

- The period from February 15, 2020, through April 26, 2020, and

- For the pay period that includes February 15, 2020,

If the average FTEs for the first period is less than the FTEs for the second period, the borrower must then compare the average FTEs for the second period to the total FTEs as of June 30, 2020. If the FTEs on June 30, 2020 are greater than the FTEs on February 15, 2020, the safe harbor is met and no reduction is required.

Example. Continuing the example above, assume X Co. had 4.2 FTEs for the period February 15, 2020, through April 26, 2020, and 4.5 FTEs on February 15, 2020. X Co. then reduced the hours of some of their employees and terminated others, resulting in only 3.7 FTEs for the covered period. Because X Co. had more employees on February 15, 2020, then during the period February 15, 2020, through April 26, 2020, X Co. must then compare the number of FTEs on February 15, 2020 – 4.5 – to the number on June 30, 2020. Provided the number of FTEs on June 30, 2020 is equal to or greater than 4.5, no reduction in forgiveness is required.

To make sense of this reduction/restoration computation, think of it like this: the SBA will first determine if during the 8-week covered period, a business employs fewer FTEs than it did during the elected reference period: either from 2019 or earlier in 2020. If the answer is no, then the business employs MORE people than in the look-back periods, so no reduction is required.

If, however, the number of FTEs has gone down relative to the look-back period – which one would expect given the current unemployment numbers – the SBA is going to reduce the forgiveness amount, presumably because the borrower has not met the goals of the PPP of keeping employment at pre-COVID-19 numbers.

But…if the borrower can, at the very least, return its number of FTEs at June 30, 2020 to the level it was prior to the COVID-19 pandemic beginning (February 15, 2019), the forgiveness will NOT be reduced, even if the February 15th, 2019 numbers are less than they were in 2019 or the average of the first two months of 2020.

There’s one final bailout as well. If an employer can show that it made a good-faith, written offer to rehire an employee during the covered period but was rejected by the employee, then that reduction in headcount will not result in a reduction in forgiveness. The same is true if an employee was fired for cause, voluntarily resigned, or voluntarily required and receive a reduction in hours.

Make sense? No, it does not. But that’s how it’s going to work.

With that, we have finished completing the Worksheet to Schedule A, and can now turn our attention to Schedule A itself.

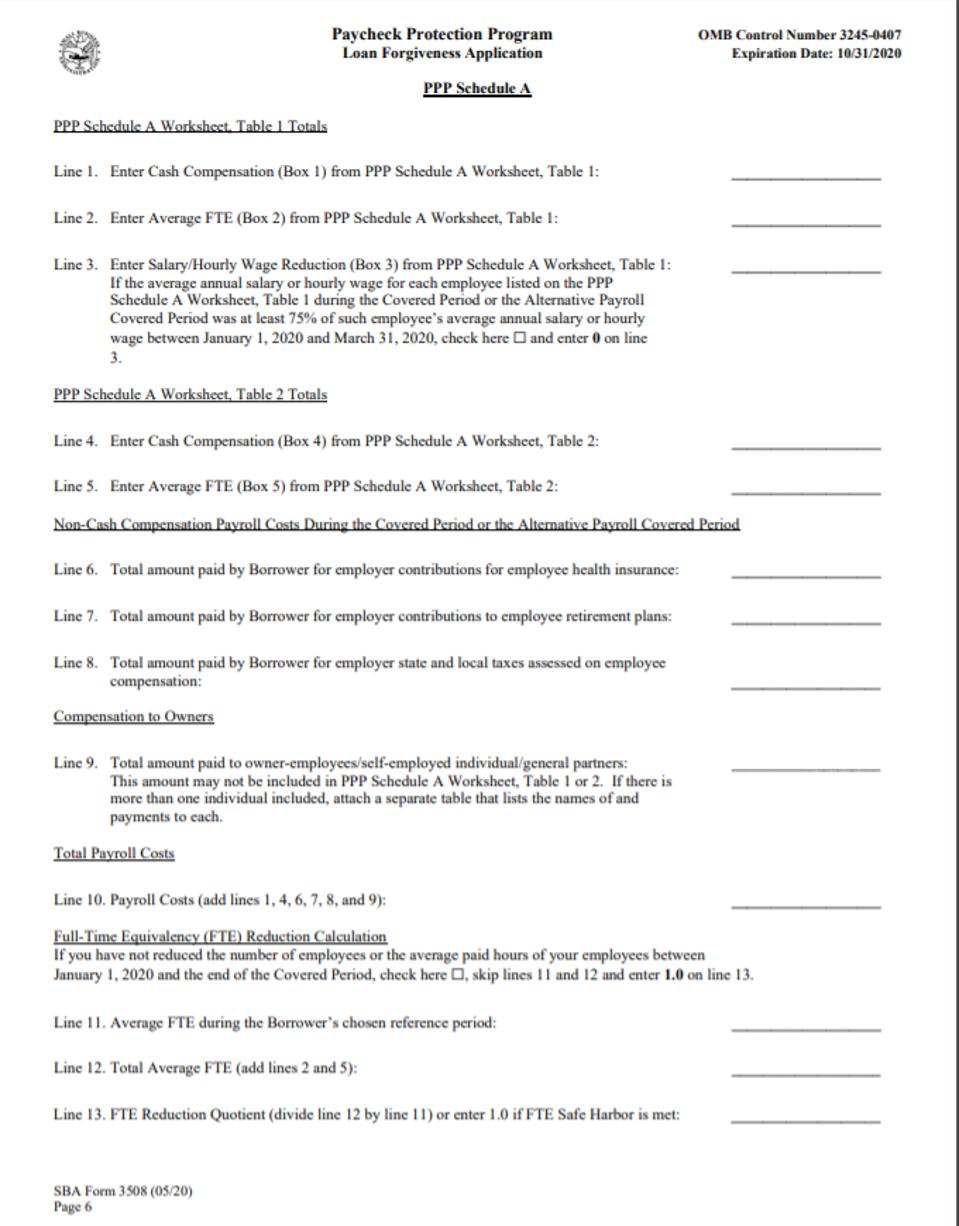

Schedule A

Schedule A looks like this:

sch A

SBA

Information from Schedule A is used to populate several lines on the forgiveness application. Let’s take Schedule A line-by-line.

Line 1: Enter Cash Compensation (Box 1) from PPP Schedule A Worksheet, Table 1: Self-explanatory. Take the total amounts you entered on this column of Table 1, but only Table 1 (at this point).

Line 2: Enter Average FTE (Box 2) from PPP Schedule A Worksheet, Table 2: Also self-explanatory. Drop in the total FTEs for the covered period from Table 1.

Line 3: Enter Salary/Hourly Wage Reduction (Box 3) from PPP Schedule A Worksheet, Table 1: You get the idea. Take the total from this column in Table 1 and drop it onto Line 3.

Line 4: Enter Cash Compensation (Box 4) from PPP Schedule A Worksheet, Table 2: Same concept plays out now for Table 2. Enter the total cash compensation paid. And remember, it cannot exceed $15,384 for any one employee.

Line 5: Enter Average FTE (Box 5) from PPP Schedule A Worksheet, Table 2: Drop in the FTEs you computed in Table 2.

Lines 6 – 8: Non-Cash Compensation Payroll Costs During the Covered Period or Alternative Payroll Covered Period

First, some background. In addition to cash compensation, “payroll costs” include:

- Payment required for the provisions of group health care benefits, including insurance premiums;

- Payment of any retirement benefit; or

- Payment of State or local tax assessed on the compensation of employees.

Schedule A asks us to put the first item on Line 6, the second on Line 7, and the third on Line 8. These amounts are in ADDITION TO the annualized compensation cap of $100,000. Thus, an employee could have up to $15,384 of compensation from Table 1 or 2 included on Schedule A, as well as amounts allocable to that employee reflecting his or her share of health costs, retirement benefits, or state and local taxes on Lines 6-8.

Line 9: Total amount paid to owner-employees/self-employed individual/general partners: This line is going to create some confusion. Presumably, these individuals are not included in Table 1 or 2 of Worksheet A because health care and retirement costs attributable to the owners/general partners are NOT forgivable, but the instructions to Schedule A do not make that clear. Making matters more confusing, this line does not require that the amounts be paid as “compensation,” thus, presumably, guaranteed payments to partners would be included.

This line also adds something new to the equation: it states that the amount is capped at $15,384 OR THE 8-WEEK EQUIVALENT OF THEIR APPLICABLE COMPENSATION FOR 2019, whichever is lower. This would prevent an owner from increasing their compensation during the covered period to maximize forgiveness by limiting the amount included in the forgivable amount to 8/52 of the owner’s compensation for 2019.

Line 10: Payroll costs (add lines 1, 4, 6, 7, 8, and 9): Do as they say.

Between lines 10 and 11, things get interesting again. It states that if you have not reduced the number of employees or the average paid hours of your employees between January 1, 2020 and the end of the covered period, to skip the rest of Schedule A. The remainder of Schedule A, however, is designed to compute the reduction in forgiveness caused by a reduction in headcount during the covered period relative to one of several optional look-back periods, a calculation we performed in detail above.

Here, the SBA appears to be providing a second, simple safe harbor, which holds that even if FTEs have been reduced relative to the elected look-back period, no reduction is required provided FTEs are the same at the end of the covered period as they were on January 1, 2020. Presumably, this means that a business could have the following FTEs and experience no reduction in forgiveness:

- Average for covered period: 6

- Average for February 15 – June 30, 2019: 8

- Average for January 1 – February 29, 2020: 8

- FTEs on January 1, 2020: 7

- FTEs on the last day of the covered period: 7

Because the FTEs at the end of the period returned to the same level as January 1, 2020, the reduction DURING the covered period is ignored. Why this rule is necessary when we already have the rehiring-before-June 30 rule relative to February 15th is beyond me, but we’ll take it.

Line 11: Average FTE during the Borrower’s chosen reference period: Let’s assume we DON’T satisfy either the rule discussed immediately above OR the safe harbor for rehires before June 30, 2020. In that case, we’re going to have to compute the reduction in forgiveness. As a result, the SBA wants to know our FTEs for the relevant base period we chose. Pick your base period, compute your FTEs, and provide the numbers here.

Line 12: Total Average FTE (add lines 2 and 5): Again, we’re doing this to compute the reduction in forgiveness when headcount is cut and not replaced. The formula is to divide the FTEs for the covered period by the number in Line 11, and so on this line we enter the FTEs for the covered period.

Line 13: FTE Reduction Quotient: On this line, we simply divide Line 12 by Line 11 to arrive at the reduction quotient. If the safe harbor is met, this amount should be 1.0, and no reduction is required.

Ok, now, were going to take much of what we did on Schedule A and move it to the application. The application will require some new information as well, however. Let’s take a look:

Application for Forgiveness

Here she is:

application

SBA

Five thousand words ago, we covered the informational top half of the application for forgiveness. Now we jump back into the application, picking up on Line 1.

Line 1: Payroll Costs: This work has been done. Simply drop in the amount from Schedule A, Line 10, which summarizes the compensation, health care costs, retirement benefits, and state taxes for each eligible employee.

Line 2: Business Mortgage Interest Payments: As a reminder, in addition to payroll costs, the CARES Act permits forgiveness for three other classes of expenses paid during the covered period.

- Any payment of interest on any covered mortgage obligation (not including any prepayment of or payment of principal on a covered mortgage obligation). The term “covered mortgage obligation” means any indebtedness or debt instrument incurred in the ordinary course of business that is a liability of the borrower, is a mortgage on real or personal property, and was incurred before February 15, 2020,

- Any payment on any covered rent obligation. The term “covered rent obligation” means rent obligated under a leasing agreement in force before February 15, 2020,

- Any covered utility payment. The term “covered utility payment” means payment for a service for the distribution of electricity, gas, water, transportation, telephone, or internet access for which service began before February 15, 2020.

As we discussed in our “paid or incurred” section, it appears mortgage interest owed in arrears can be paid during the covered period and be forgiven, and mortgage interest incurred DURING the covered period but paid before or on the next scheduled due date will also be forgivable, even if that date is after the end of the covered period.

Enter the amount of mortgage interest “paid or incurred” during the covered period on Line 2.

Line 3: Business Rent or Lease Payments: Enter the amount of business rent or lease payments paid or incurred during the covered period on Line 3. The same rules used for mortgage interest expense apply in determining whether the expenses are paid or incurred during the covered period.

Line 4: Business Utility Payments: Enter the amount of utility payments paid or incurred during the covered period on Line 3. The same rules used for mortgage interest expense apply in determining whether the expenses are paid or incurred during the covered period.

IMPORTANT: As we’ll see in Line 10, no more than 25% of the loan forgiveness amount may be attributable to non-payroll costs reported on Lines 2, 3, and 4.

Example. X Co. borrowed $100,000 in PPP proceeds on April 10, 2020. Over the next 8 weeks, X Co. spent $50,000 on payroll costs and $30,000 on rent and utilities. X Co.’s loan forgiveness is limited to $66,667, $50,000 of payroll costs and $16,667 of rent and utilities.

Line 5: Total Salary/Hourly Wage Reduction: Lines 1-4 compute the TOTAL amount eligible for forgiveness. As we’ve learned, however, this amount is reduced if salaries are cut (as determined in Table 1 of the Worksheet to Schedule A) or FTEs are reduced (as determined at the bottom of the worksheet to Schedule A). Here, any amount attributable to a reduction in salaries as reported on Table 1 are reported on Line 5, reducing the total amount eligible for forgiveness.

Line 6: On this line, we simply net the reduction on Line 5 with the sum of costs eligible for forgiveness on Lines 1-4 to arrive at the maximum amount eligible to be forgiven.

Line 7: FTE Reduction Quotient: One Line 13 of Schedule A, when the safe harbor for reduction in headcount was not satisfied, we divided our FTEs for the covered period by the FTEs for the base period to arrive at the quotient that must be multiplied by the maximum amount eligible for forgiveness to determine the required reduction. That quotient from Line 13 is inserted onto Line 7 of the application.

Line 8: Modified Total: In Lines 8-10, we will determine the forgiveness amount. It is the LESSER of three amounts:

1. Line 8: The net amount from Line 6 (total costs less salary reduction amount) multiplied by the quotient on Line 7 for headcount reduction,

2. Line 9: the principal balance of the loan, and

3. Line 10: The payroll costs (Line 1 of the application) divided by 75%. This line ensures that no more than 25% of the total forgiveness is attributable to non-payroll costs.

Line 9: PPP Loan Amount: Enter the PPP loan amount.

Line 10: Payroll Cost 75% Requirement: Here, divide the total payroll costs from Line 1 by 75%.

Line 11: Forgiveness Amount: We’ve done it! The lesser of Lines 8, 9, and 10 is your forgiveness amount.

If you’ve stuck with me this long, you’re exactly the type of glutton for punishment who would like nothing more than to take EVERYTHING we just did and work through a real-life example. Let’s do it.

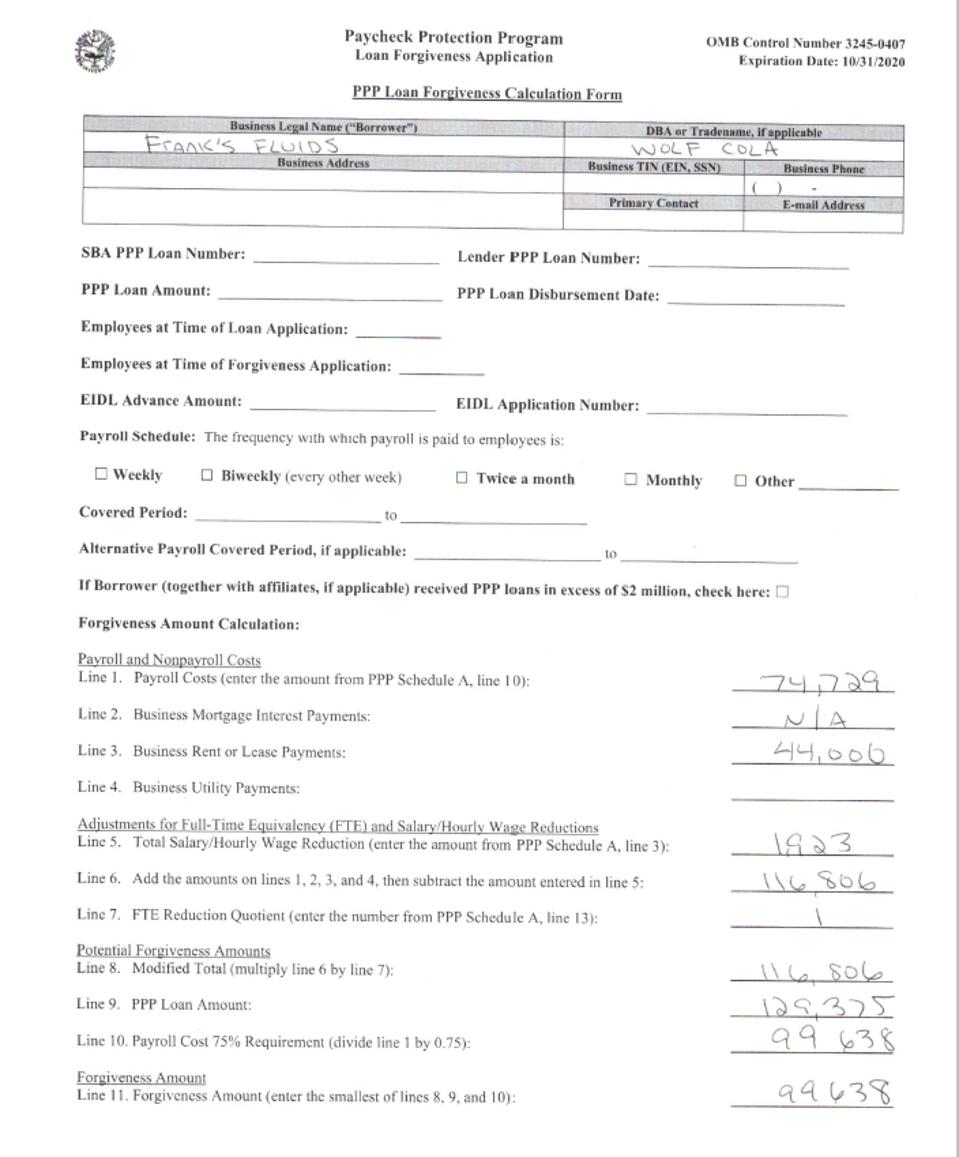

CASE STUDY

During 2019, X Co. had 6 employees. F is the sole shareholder of X Co. The total costs X Co. incurred for all payroll costs were as follows:

Total 2019 costs

Nitti

Thus, total payroll costs were $741,000. The total salaries of B and F are capped at $100,000, however, resulting in total payroll costs of $621,000 for purposes of determining X Co’s loan amount. In addition, X Co. paid rent and utilities of $129,000, for total costs of $750,000.

- A, B, C, E and F work 40 hours a week. D works 20 hour a week.

- On March 15, 2020, X Co. let A go because of dwindling work caused by the COVID-19 pandemic.

- On April 1, 2020, C’s salary was cut from $90,000 to $55,000.

- On April 10, X Co. borrowed $129,375 ($621,000 in payroll costs/12*2.5) in PPP loan proceeds. X Co. received the money on April 16, 2020, which corresponded nicely with the beginning of X Co.’s twice-monthly pay period.

For the 8-week period beginning April 16, 2020, X Co. incurred the following costs:

Costs incurred during covered period

Nitti

All of these costs were either paid within the 8-week period, or earned within the period and paid within a few days of the end of the period on X Co.’s regular payroll due date.

- On April 25, X Co. paid March rent and utilities of $11,000. They made additional $11,000 payments for April, May and June, with the June payment made on June 1st. Thus, total non-payroll costs were $44,000.

- June 11, 2020 arrives, and the 8 week period is over. On June 25th, X Co. rehires A.

- At the beginning of July, X Co. is now ready to apply for forgiveness. Let’s work through the steps:

X Co turns first to the application, and fills out the relevant information on the top half of the form.

Loan Amount: $129,375

Loan Disbursement Date: April 16, 2020

Employees at Time of Loan Application: 5

Employees at Time of Forgiveness Application: 6

EIDL Information: X Co. did not take out an EIDL, so these two sections are inapplicable.

Payroll Schedule: Twice a month.

Covered Period: April 16 – June 11, 2020.

Now, we have to jump to the Worksheet for Schedule A, and start computing compensation costs and possible reductions in the amounts eligible for forgiveness.

Worksheet A

We start by completing Table 1:

Worksheet, Table 1

Nitti

A few things to note:

- B and F are not included in Table 1 because they earned more than $100,000 in 2019.

- Because C and D work only 20 hours a week, they are only .5 FTE each.

Most importantly, C had his salary cut from $90,000 to $55,000 on April 1, 2020. As a result, we have to work through the steps to see if forgiveness must be reduced.

Step 1: Determine the average annual salary or hourly wage for each employee during the covered period (or alternative payroll period, if elected). C’s average salary during the period was $55,000.

Step 2: Determine the average annual salary or hourly wage for each employee during the period from January 1, 2020, through March 31, 2020. C was paid an annual salary of $90,000 from January 1 – March 31, 2020.

Step 3: Divide Step 1 by Step 2. The result is 61%.

Step 4: If Step 3 is greater than 75%, no reduction is required. Do not fill out the column in Table 1 for this employee.

Step 5: If Step 3 is LESS than 75%, a reduction may be required. The reduction is tentatively determined by multiplying the amount determined in Step 2 by 75%, and then subtracting from that result the amount from Step 1. This is $67,500 ($90,000 * 75%) – $55,000, or $12,500. We then divide $12,500 by 52 and multiply it by 8, or $1,923. This is the amount of the required reduction.

The reduction is not required, however, if a safe harbor is met. Whether the safe harbor is met is determined via the following steps:

Step 1: Determine the annual salary or hourly wage as of February 15, 2020. This was $90,000.

Step 2: Determine the average annual salary or hourly wage for the period from February 15, 2020 through April 26, 2020. This was $90,000 from February 15 – April 1 and $55,000 from April 1 – April 26, 2020. This comes to an average annual salary of approximately $68,000.

Step 3: If Step 2 is greater than Step 1, the safe-harbor does not apply. Because Step 2 is less than Step 1, however, we must proceed to Step 4.

Step 4: Determine the average annual salary or hourly wage for the employee as of June 30, 2020.This remains $55,000. Because this amount is not equal to or greater than Step 1 ($90,000), the safe harbor does not apply. X Co.’s forgiveness must be reduced by $1,923 attributable to Employee C.

Next, we populate Table 2:

Worksheet, Table 2

Nitti

B belongs in Table 2, because she had annualized salary for 2019 in excess of $100,000. Her salary for 2020 also exceeded an annualized rate of $100,000, meaning she is capped at compensation costs of $15,384. You’ll also note that F, the shareholder-employee, is NOT included on Table 2 because F is a shareholder, and will be dealt with separately on Schedule A.

Next, we must determine if any reduction is required due to headcount.

Reduction in Forgiveness Due to FTEs

As determined in Tables 1 and 2, X Co. had 3.5 FTEs during the covered period. X Co. must compare these FTEs to the amounts in either of the two periods:

- February 15 – June 30, 2019: X Co. had 4.5 FTEs (1.0 for each of A, B, C, and E and .5 for D). Presumably, F, the owner, doesn’t count towards FTEs in any scenario.

- January 1 – February 15, 2019: X Co. had 4.5 FTEs.

Thus, regardless of the base period chosen, X Co. had a reduction in FTEs during the covered period relative to the base period. As a result, we tentatively have a reduction quotient of 3.5/4.5

This quotient, however, will be eliminated if either of two scenarios are met:

- X Co.’s FTEs are the same on January 1, 2020, (4.5) and the end of the covered period (3.5) This test is not met.

- X Co. satisfies the safe harbor. To satisfy the safe harbor, X Co. must first determine its FTEs for :

- The period from February 15, 2020, through April 26, 2020, and

- For the pay period that includes February 15, 2020.

The result for period a) would be less than 4.5 because A was terminated on April 1. The result for period b) would be 4.5. Because the average FTEs for the first period is less than the FTEs for the second period, X Co. must then compare the average FTEs for the second period (4.5) to the total FTEs as of June 30, 2020. Because X Co. rehired A in June, X Co.’s FTEs are again 4.5 on June 30. As a result, the safe harbor is met, and no reduction is required. The reduction quotient is 1.0.

Next, we flip over to Schedule A:

Schedule A:

Schedule A

Nitti

You’ll note that the amounts for Line 6, 7, and 8, come from the table above where all payroll costs for the 8-week period were detailed. We did not include amounts paid to F, the owner-employer, because it appears non-compensation payroll costs for owners are not forgivable. Whether this is correct is still a matter of dispute.

- On Line 9, we cap F’s compensation at $15,384.

- Line 11 reflects the 4.5 FTEs X Co. had during the two base periods (1 each for A, B, C, and E and .5 for D).

- Line 12 reflects the sum of Lines 2 and 5.

- Line 13, however, reflects that X Co. determined that the safe harbor was met, and thus the reduction quotient is 1.0.

Now that Schedule A has been filled out, we can head over to the application and finish this thing off:

Application

Nitti

For the sake of simplicity, I combined the rent/utility payment on Line 3.

On Line 5, we move over he reduction attributable to Employee C.

On Line 6, we determine our maximum forgivable costs of $116,806. We should pause for a moment and notice that this is significantly less than the $129,374 that was borrowed. What makes up the difference?

- For starters, basic math. X Co. terminated Employee A and slashed the salary of Employee B. Thus, payroll costs were reduced.

- Next, at least currently, we are treating the non-compensation payroll costs paid to F, the owner, as being ineligible for forgiveness. This is another $14,000. Thus, we would expect the total forgivable costs to be less than $100,000, but it’s actually at $116,806.

- X Co. incurred $129,000 in non-payroll costs. We would expect that to come to about $20,000 for the 8-week period. But by paying rent and utilities in arrears, X Co. had total rent costs of $44,000, bringing the total forgivable costs back above $100,000 to $116,806.

Next, Line 7 would reduce the maximum forgivable amount resulting from a loss in FTEs if the safe harbor hadn’t applied. Because X Co. satisfies the safe harbor, the quotient is 1.0, and Line 8 is the same as Line 6.

Finally, our forgiveness is again limited to the lesser of:

- Line 8: the total determined above, or $116,806,

- Line 9: the PPP loan amount of $129,375, or

- Line 10: the total payroll costs ($74,729) divided by 75%, or $99,638.

Thus, X Co. is stuck with forgiveness of $99,638. This haircut is required to ensure that no more than 25% of the total forgiveness is attributable to non-payroll costs. In this case, payroll costs of $74,729 are exactly 75% of the total forgiveness of $99,648.

It’s a harsh result, but it could be worse. The SBA could have applied the reduction for lost employees/reduced salary to the LESSER of the three numbers. Or, in the worst case scenario, the SBA could have mandated that if 75% of the loan proceeds were not used on payroll costs – as was the case here – NONE of the loan would be forgiven.

To seek forgiveness of a PPP loan, a borrower must submit this application to the lender that is servicing the loan, and must include the following items:

-Documentation, including payroll tax filings reported to the Internal Revenue Service and state income, payroll and unemployment insurance filings, verifying the number of full-time equivalent employees on payroll and pay rates for the following periods:

- The 8-week covered period of the loan,

- February 15, 2019 through June 30, 2019 or January 11, 2020 or February 29, 2020, depending on the dates used to measure any drop in employees or salary as required by Section 1106(d)

- In the case of a seasonal employer, February 15, 2019, through June 30, 2019,

- The last full quarter prior to the covered period,

- February 15, 2020 through April 27, 2020.

-Documentation, including cancelled checks, payment receipts, transcripts of accounts, or other documents verifying payments on covered mortgage obligations, payments on covered lease obligations, and covered utility payments, and

-A certification from a representative of the eligible recipient authorized to make such certifications that the documentation presented is true and correct and the amount for which forgiveness is requested was use to retain employees, making interest payments on a covered mortgage obligation, make payments on a covered return obligation, or make covered utility payments, and

-Any other documentation the SBA determines necessary.

No eligible recipient will receive forgiveness without submitting to the lender the required documentation. No later than 60 days after the date on which a lender receives an application for loan forgiveness from an eligible recipient, the lender must issue a decision on the application.

Look, this isn’t the end of the story. There has to be more guidance coming out, and when it does, we’ll get this cleaned up. Or maybe I’m wrong, and the SBA will simply leave two million borrowers twisting in the wind, in which case this article is the best shot you’ve got at figuring this all out. If that’s the case, I really hope this helps.