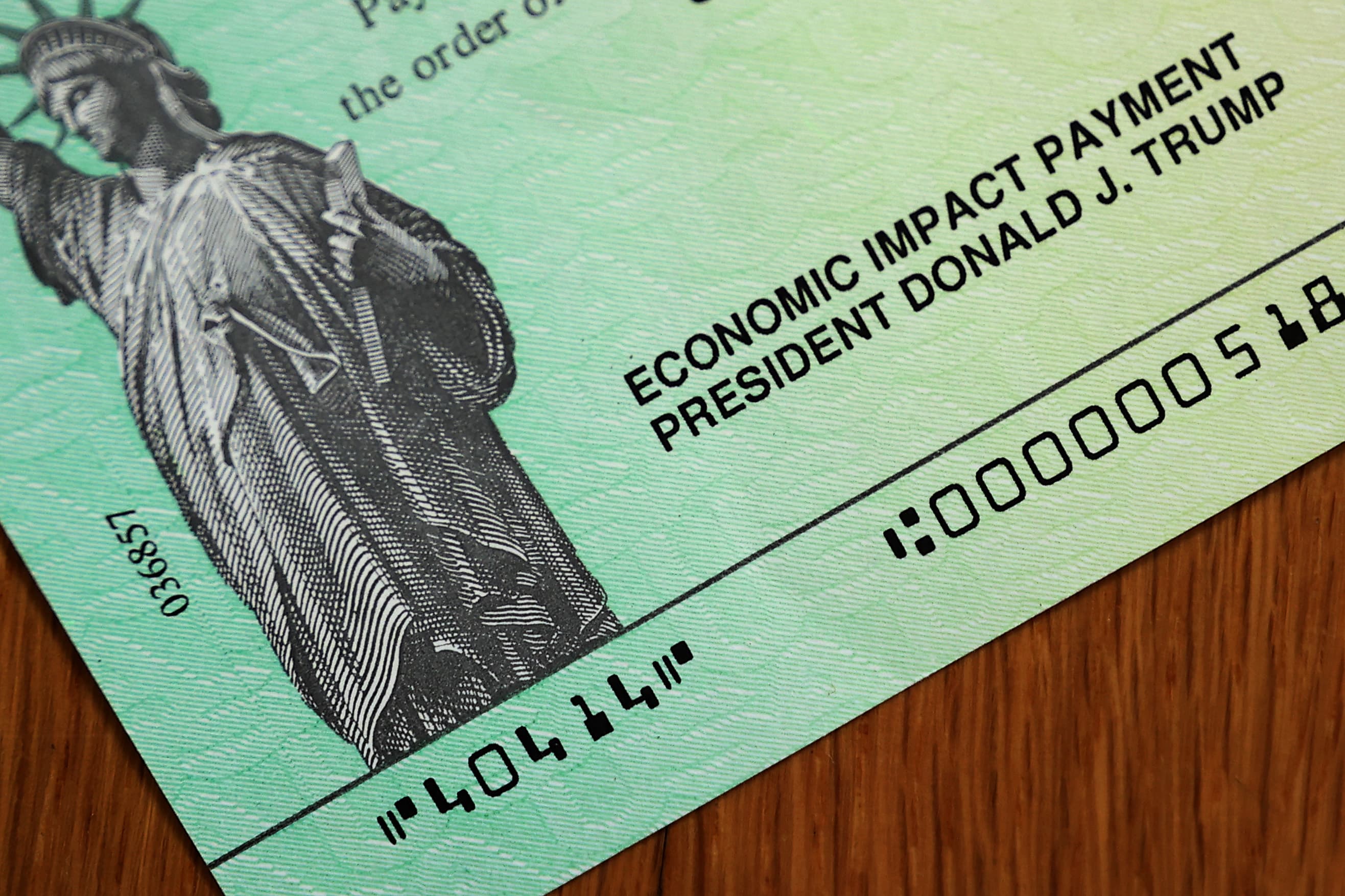

U.S. President Donald Trump’s name appears on the coronavirus economic assistance checks that were sent to citizens across the country April 29, 2020 in Washington, DC.

Chip Somodevilla | Getty Images

If you’re eligible for a $1,200 stimulus check and haven’t received yours yet, there’s good news: Money is still available.

The U.S. government just announced that it has sent 159 million stimulus payments for a total of more than $267 billion.

The payments — up to $1,200 per individual, $2,400 per married couple plus $500 for children 17 and under — were authorized by Congress through the CARES Act.

Because that legislation authorized up to $300 billion, that means there is still roughly $33 billion to be deployed.

The Treasury Department said its latest tally does not include the more than $2.5 billion that has been delivered to people who live in U.S. territories.

“Payments have been sent to all eligible Americans for whom the IRS has the necessary information to make a payment,” the Treasury Department said in a statement.

The checks that have gone out include 120 million payments by direct deposit, 35 million by check and 4 million by prepaid debit card.

If you have not received your payment yet, you can check on the status of that money on the Get My Payment tool.

If you do not typically file tax returns and have not received your stimulus money, the government is urging you to use the non-filer tool. That website will let you enter your basic information to get your stimulus check.

The deadline is Oct. 15 for entering that information in order to receive your money this calendar year.

Payments have been sent to qualifying individuals who do not file tax returns but receive government funds such as Social Security, Veterans or Railroad Retirement benefits, according to the IRS.

More from Personal Finance:

The stimulus proposals that could put more money in your wallet

More than half of students probably can’t afford college due to Covid-19

Here’s what happens to your 401(k) loan if you are laid off

If you have filed tax returns for either the 2018 or 2019 tax years and have not received your money yet, you can call a phone line the IRS has set up at 800-919-9835 to try to expedite the payment.

Otherwise, you will be able to claim your money when you file your 2020 tax return next spring.

Individuals who did not receive as much money as they are entitled to will also be able to get those additional funds when they file their 2020 tax returns. That includes eligible families who did not receive the $500 payments for children under 17.