Cutting spending prematurely could make the recession deeper and longer.

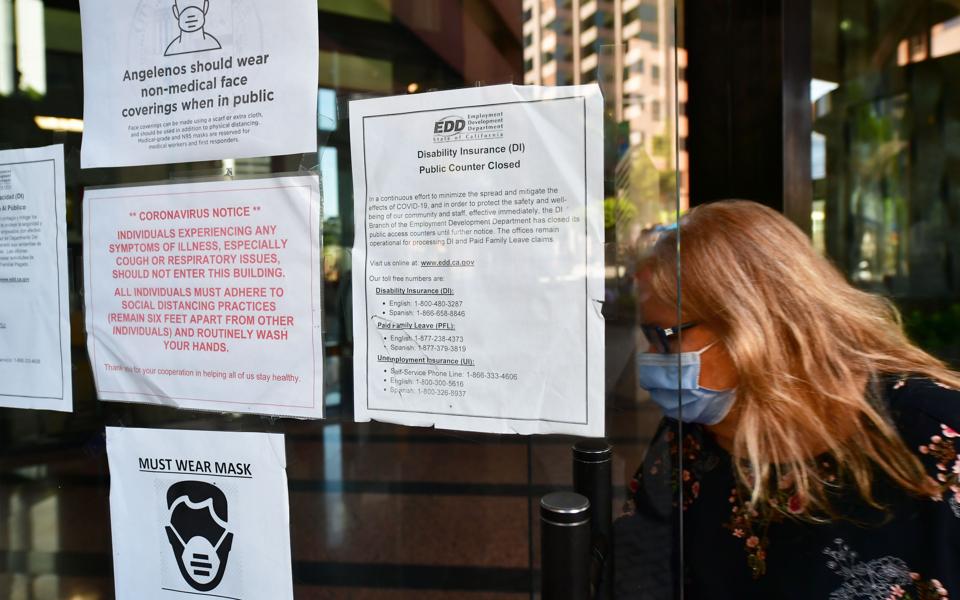

A woman wearing a facemask enters a building where the Employment Development Department has its … [+]

AFP via Getty Images

Is the economy turning around? Thursday’s labor market data said “no,” but today’s monthly unemployment report has positive news. But although any good economic news is welcome, don’t overreact: the depth of our labor market problems means any full economic recovery is a long way off. And if we stop government spending, we could easily make things worse.

Today’s report surprised many economists; we were expecting further bad news in unemployment and job creation. But the surveys for May found instead that the unemployment rate declined from 14.7% to 13.3% and new payroll jobs rose by 2.5 million. President Trump said the numbers were “better than a V” (meaning a “V-shaped” recovery, one with a fast rebound), “this is a rocket ship.”

Unlike President Trump, economist William Rogers (my colleague at the New School’s Schwartz Center), doesn’t see a “V-shaped” recovery, but rather a “Nike Swoosh”—the sharp drop followed by a slow upward movement, and one that will be worse for blacks. Bill reminds us in this video that unemployment for black and Hispanic workers remains much higher than for whites. And he connects the protests over George Floyd’s murder to the continuing rise of economic inequality, especially for blacks but now affecting many whites as well.

The positive news was especially surprising given Thursday’s latest report on weekly new claims for unemployment insurance (UI). Although the number declined from the previous week, it once again was at an unprecedented scale—around 2.5 million new claims, 1.88 million in traditional unemployment and another 623,073 for the new Pandemic Unemployment Assistance which goes to gig workers, the self-employed, and people with limited work histories who wouldn’t qualify for regular UI.

Those new weekly numbers were the 11th week in a row where we’ve seen claims in the millions. Remember, the previous weekly record for new claims in the 53 years we’ve gathered these data was 680,000 in 1982. We’ve shattered that record for 11 weeks in a row, and we may not be done yet.

But the Administration and those who have called for aggressive economic reopening are claiming victory based on Friday’s numbers, and denying the need for further government stimulus. Stephen Moore, an economic advisor to the White House, said “There’s no reason to have a major spending bill. The sense of urgent crisis is very greatly dissipated by the report.”

But many economists, while surprised by the positive report, say this is no time to stop stimulus. Rather, they view the positive news as evidence that stimulus is working, and should continue. Labor economist Ernie Tedeschi said Moore’s conclusion is “exactly backwards, like stopping an antibiotic prematurely because you start to feel better.”

Elise Gould at the Economic Policy Institute agrees, pointing out that “jobs losses since February still total 19.6 million, and are currently 13% below its February level.” And Gould pays special attention to public sector job losses, noting that “Over the last three months, state and local government jobs have declined by 1.6 million, nearly half of them (759,000) in local government education (public K-12).”

Declining state and local government jobs are a ticking time bomb for any recovery. States and localities have to balance their budgets, and the pandemic recession’s depth pushing them deeper into a sea of red ink. In response, they can only cut spending, and that means jobs.

Since education gets the biggest share of locally raised revenues, declining revenues means big education spending cuts. And that means loss of spending and demand (both for employees and for contractors from school busses to construction to food service), and strains on K-12 as a place where kids can go so their parents (mostly mothers) can return to work.

Prior to today’s report, some Republican Senators were beginning to loosen their objections to continuing generous unemployment benefits, and Congress also was starting to negotiate over necessary aid to state and local governments. Today’s report means opposition to further spending will increase.

Especially at risk is the $600 addition to unemployment insurance which expires at the end of July. Ironically, those significant financial benefits may be one reason for the better jobs numbers. So far, the US has done a reasonable job in providing trillions of dollars to fight off the downturn, from individual household checks to small business “loans” that actually are grants, to broader and more generous unemployment benefits. But if these funds are not renewed, and funding to state and local governments doesn’t happen, we easily could see a deeper and longer recession.

After viewing pessimistic economic forecasts both for this and next year, Federal Reserve chair Jerome Powell warned in mid-May that “deeper and longer recessions can leave behind lasting damage to the productive capacity of the economy” arguing that “additional fiscal support could be costly but worth it if it helps avoid long-term economic damage.”

While today’s unemployment report is welcome, Elise Gould points out that “the unemployment rate of all groups is still higher than the highest level the overall unemployment rate hit at the height of the Great Recession.” We are not out of the woods by any measure. And taking today’s report as a reason to stop government spending—to not provide state and local government aid, or renew well-funded unemployment insurance, or continuing helping small businesses—will risk any progress that we’ve made so far.