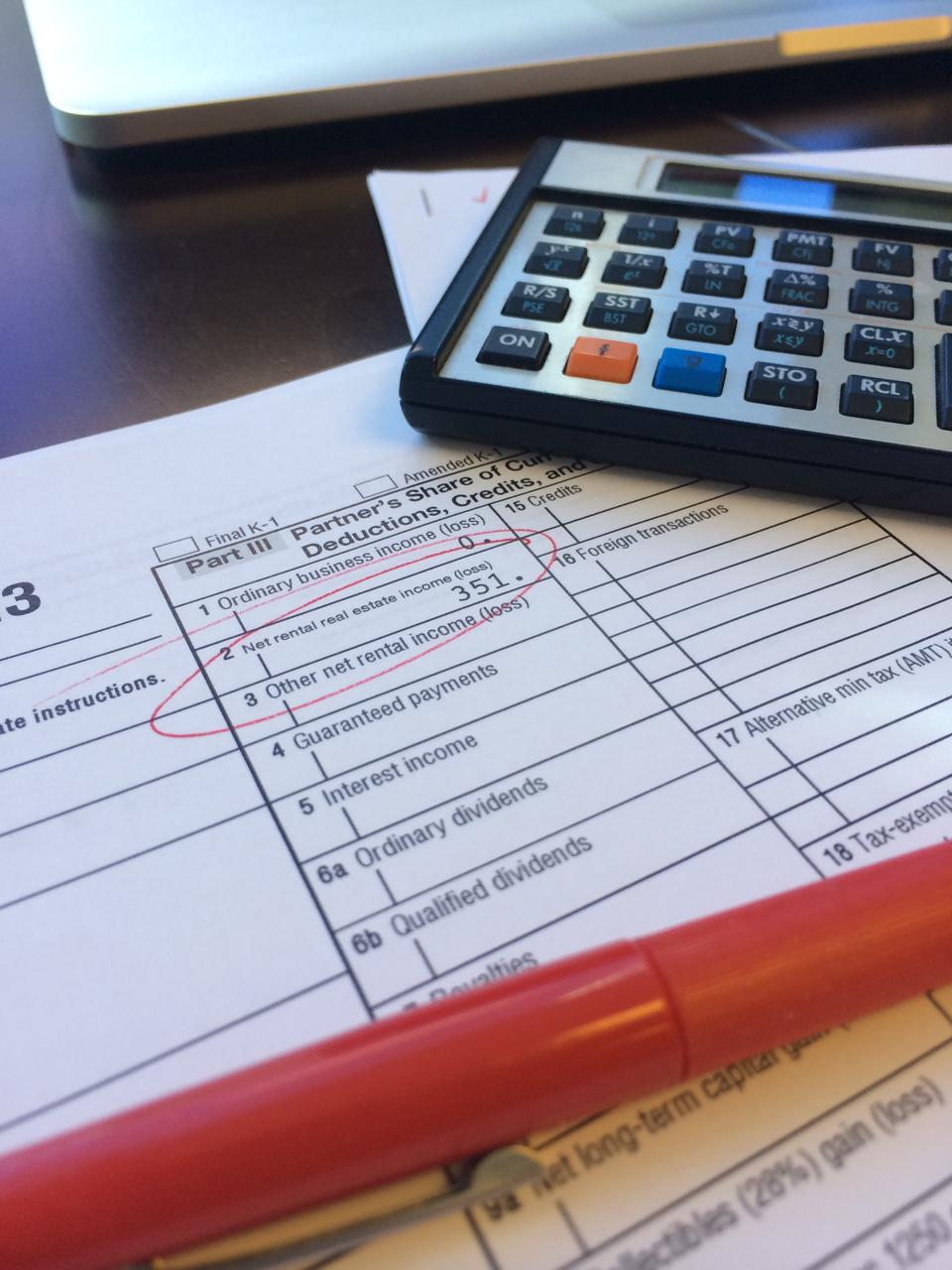

Income on a K-1

flickr Editorial/Getty Images

If you ever receive a K-1 from a partnership, send it to your accountant without looking at it and expect that your accountant is tracking things thoroughly, pay attention. If you do your own return, pay even closer attention.

IRS efforts to tighten up partnership reporting may be making for some nasty surprises in the coming years, especially if IRS starts getting more enforcement resources. That’s what makes the recently released otherwise incomprehensible Notice 2020-43 of practical interest to regular people.

The Problem

When you have a loss flow from a partnership or money is distributed to you from a partnership it reduces your basis. Basis can never go below zero. So a distribution that would lower your basis below zero requires you to recognize gain. A loss that would lower your basis below zero should be suspended.

What happens if you don’t recognize the gain or suspend the loss? Quite likely nothing, because the IRS does not have the tools to know that it has happened. You might not even know it has happened.

Running basis below zero should set off some sort of an alarm, that shows up somewhere. It actually does not. The IRS has been trying to create one, but has met resistance. Notice 2020-43 is the next step. It is actually a request for comments on a proposed next step, but I take it as an indication of the direction in which the wind is blowing.

It Is Not Easy Fooling With Partnership Taxation

So imagine it was 2016 or so and the Commissioner of the IRS told you to find the shenanigans that were going with partners and partnerships. All those partnerships are filing Form 1065 with a K-1 for each partner. Check those out, that should tell you.

What you would find is described in a quote attributed to Peter Bernstein.

“The information you have is not the information you want. The information you want is not the information you need. The information you need is not the information you can obtain. The information you can obtain costs more than you want to pay.”

Of course when the IRS wants information it is the taxpayers that have to pay and as it has asked for more information for 2018 and 2019 returns it got push back. Now we have Notice 2020-43 which tells us what it wants on the 2020 returns.

The notice will concern the people who have to prepare partnership tax returns, other than those of the simplest sort. The notice should also concern a larger group of people.

That larger group would be those who have been wittingly or unwittingly getting away with understating their income from certain sorts of transactions involving partnerships. This push for coughing up information is a sign that they might be coming for you.

I’m going to try to explain it so that people who just get K-1s in the mail and send them to their accountants without looking at them or pop number into Turbotax without understanding them can have a clue about what is going on. I will probably fail, but I feel obligated to try.

How Partnerships Affect Taxable Income – Flow Through

Partnerships are pretty close to pure flow-through entities. The tax effects of the partnerships transactions are spread among the partners. Form 1065 K-1 communicates to each of the partners their share of the various items. They can be pretty simple essentially saying something like your share of the profits is $10,000, include that on Schedule E and carry on.

On the other hand, the flow-through information can be horrendously complicated with all sorts of different flavors of income and deduction. Look at the right hand side of the 2019 Schedule K-1 i.e. Part III. There are twenty boxes some of them with “Other” as part of their label. If you scroll to the next page you will see that many of the boxes have letter codes some with over twenty possibilities.

K-1s from hedge funds, which seem to do just about everything just about everywhere drive 1040 preparers crazy.

But it is more than the flow through. Partnership interests are assets (usually capital assets) so there can be gains or losses from dispositions and sometimes from distributions.

How Partnerships Affect Taxable Income – Gain Loss And Basis

At a very fundamental level, we have an income tax not a tax on gross receipts. That means if you are receiving money or other property and just recovering your basis you don’t have taxable income. If you recover less than your basis you might have a loss you can deduct.

But what is basis? I have a brief piece here What is Basis and Why is it Important?, but we’ll just talk about partnerships here. Your basis in a partnership interest is something that keeps changing.

When you contribute money or property to the partnership, your basis in the partnership interest goes up. When the partnership distributes money or property to you your basis goes down. When the partnership flows income items to you, basis goes up. When the partnership flows deductions items to you basis goes down.

One reason this is important is that at some point you will want to stop the madness and sell or abandon the damn thing and your gain or loss is in part determined by your basis.

The other thing is something that is very important about basis. It can never go below zero. Never. That means that if the partnerships distributes money that goes beyond your basis you recognize gain. If the partnership flows through losses or expenses that would lower your basis below zero, those losses are suspended.

Partnerships Are Special

When it comes to basis, partnerships have a very special feature. Your basis in your partnership interest, besides purchase price plus contribution and income less distributions and losses, includes your share of the partnership’s liabilities.

This is why partnerships were the favored vehicle for old fashioned tax shelters and also the ideal vehicle for leverage real estate. A partnership can borrow money and distribute it to its partners and there is no net effect on their basis. You can’t do that with corporations, not even S Corporations.

How Do You Know What Your Basis Is?

Well gee. You are supposed to keep track. You haven’t been keeping track? Well your accountant or other tax pro is keeping track for you, you think. Could be. Maybe you hired Amie K Consulting

My unscientific survey is not totally in yet, but so far it is running at about 57% of preparers tracking the basis at least pretty well. There may be a little of what our President calls truthful hyperbole in there and some of the respondents might be managing partner types who think that their staff are tracking basis, because they are so good and will be shocked, shocked to learn the workpapers are not all they are cracked up to be.

Note that Amie K in her answer is referring to cleaning up behind former preparers.

Back To The K-1

What is interesting is the 30% or so that that indicate that they look at the K-1. Let’s go to the K-1 again and find what they are talking about. Where is the basis box? That was a trick question. There is not one.

If you look at boxes K and L, there is some possibly relevant information. Add up the three numbers in the ending column in Box K (I know they are blank. Play along here.) Those are the three flavors of the partner’s share of liabilities. What flavor the liability is can be important for other reasons but they all count toward basis.

Then in Box L at the bottom you see Ending Capital. That might be a negative number.

Anyway if you combine those two numbers, there is decent chance that that is your basis. And you can figure something that might be your opening basis by using beginning capital and the sum of the first column from Box K.

If your basis went negative or more negative, you have a problem. Maybe you need to recognize gain or maybe you need to suspend losses. Doing this computation to come up with something that might be your basis seems a little odd. The reason for the “might be” has to with those capital numbers.

Capital Accounts Of All Sorts

The fundamental accounting equation is that Assets = Liability plus Equity. In partnerships the equity is represented by the capital accounts. Here’s the thing. There are a variety of ways in which capital accounts might be maintained for reporting purposes. And prior to the 2018 returns, the IRS seemed indifferent about which one you used.

I once went to a seminar where the speaker came up with six possible ways the capital accounts might be done. I don’t remember how they got to six. I will just give you three.

GAAP

One is Generally Accepted Accounting Principles. GAAP is worse than useless for providing relevant information about your tax basis. There are all sorts of reasons why GAAP asset values will be different from tax basis – inventory rules, fixed asset cost recovery, marking investments to market.

704(b)

Then there is 704(b). Like much else in the realm of partnership taxation 704(b) capital accounts come out of the war against tax shelters. The fundamental goal behind 704(b) is to make tax effects correlate with economic effects. One way to satisfy the regulations is to maintain capital accounts in accordance with the regulations under 704(b). Many if not most partnership agreements call for the maintenance of 704(b) capital accounts.

In the brief time I spent at a national firm in the twilight of my career, one of the most interesting guys I met was a young manager who led a team that would “deploy” to straighten out 704(b) capital accounts. They charged a lot.

One of the things that shocked me about the national firm was that the standard engagement letter for a partnership return indicated that it did not included work around capital accounts. It struck me that in effect they were giving the client a price for doing the return, but indicating that actually doing it right would cost extra.

A 704(b) capital account plus your share of liabilities might be your basis in a lot of cases, but in many cases it will not be. You may have contributed property rather than cash. Or somebody might have been admitted to the partnership requiring the assets to be written up. Those are just examples.

Income Tax Basis

Then there are income tax basis capital accounts. There is a very good chance that an income tax basis capital account plus your share of the liabilities will be your basis. Unless, for example, you bought the partnership interest from somebody else. And there is not much in the way of guidance as to how tax basis capital accounts should be maintained.

So you or your accountant might be able to put what is on the K-1 together with some other pieces of information that the person doing the partnership return might or might know to come up with your basis.

But it is not going to alert the IRS that you should have recognized gain or should be suspending losses. One of the most demoralizing things I learned from a recent TIGTA report is that all the care and worry I had put into doing allocations correctly and tracking capital and the like and studying 704(b) and 704(c) for over thirty years may have been a waste of time. The IRS was hardly paying any attention at all.

Where IRS Is Going

The introduction to the notice makes it clear (to me anyway) what IRS is really interested in.

“The final versions of these 2019 forms and their instructions provide that partnerships and other persons must report partner capital accounts consistent with the reporting requirements in the 2018 forms and instructions, including the requirement to report negative tax basis capital accounts on a partner-by-partner basis.”

Get that. They are looking for “negative tax basis capital accounts”. They can then compare them to the partner’s share of liabilities and if it nets less than zero – Gotcha!

How IRS Is Getting There

The way they are going to do this is by only allowing two ways to fulfill the Tax Capital Reporting Requirement

“ For such purpose, a partnership may report, for each partner, either (i) the partner’s basis in its partnership interest, reduced by the partner’s allocable share of partnership liabilities, as determined under § 752 of the Code (Modified Outside Basis Method) or (ii) the partner’s share of previously taxed capital, as calculated under a modified version of § 1.743-1(d) of the Income Tax Regulations (Modified Previously Taxed Capital Method). “

I am sure you are dying for me to explain the “Modified Outside Basis Method” and the “Modified Previously Taxed Capital Method”. Well when we are done with social distancing, you can come visit me in North Oxford and we’ll sit down for a couple of hours in front of a computer with some spreadsheets. When I was a managing director at a not quite Big 4 firm (more nimble) it would have been $500 per hour. Way, way, way less now.

It Is Not That Hard But Not That Easy

I don’t know how useful this piece will be. One thought I had was that my friends on #TaxTwitter might be able to send it to some of their clients to help explain why you can’t do a partnership return of any appreciable complexity for a couple of hundred bucks if you want to do it reasonably right.

When it comes to that I thought the results of another survey I did might be of interest.

1040 is the individual return. 1065 is the partnership return. 1120 is corporate. 1041 is the fiduciary income tax return. I had complaints that I left out 990 the return for not-for-profits.

Other Coverage

KPMG put out a release on the notice.

Ed Zollars has a very through discussion of the notice on Current Federal Tax Developments.

Lydia O’Neal has something behind the Bloomberg Tax paywall.

The earliest coverage of the overall issue that I found is this piece by Don Susswein, Nick Passini and Lauren Van Crey of RSM,.

Their piece makes me realize that this all starts with the instructions to the 2019 Form 1065, which I did not have to read, because I retired from active practice in November of 2019. Better to be lucky than good.

I want to thank Joe Kristan for alerting me to this notice, which I might otherwise have not, you know, noticed.

Since I mentioned my retirement I will share that my covivant and I were mostly touring the country in our RV. We saw many great sights, but this one is kind of my favorite.

The westernmost point of US Route 20 in Newport Oregon. Opposite end reportedly in Kenmore Square … [+]

Anonymous