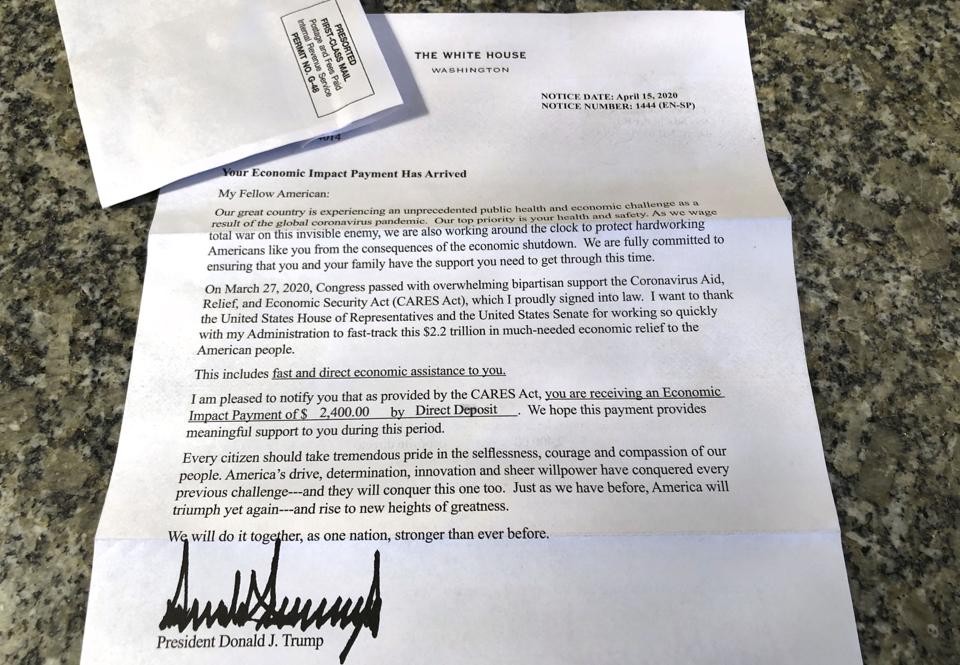

A letter from the Internal Revenue Service, signed by President Trump, notifies a family via U.S. … [+]

ASSOCIATED PRESS

It seems that the biggest tax story currently is whether there will be a second stimulus payment (Economic Impact Payment – EIP). Shahar Ziv on this platform is watching that closely. Here is some news on how the first and maybe only stimulus payment went.

Good Job!

You always hope for things to get better, but the Treasury Inspector General for Tax Administration (TIGTA) gave the IRS high marks for their efforts. Payments started going out on April 10, just two weeks after the passage of the CARES Act. By May 21, 157 million payments had been issued totaling $264 billion.

By TIGTA’s reckoning about 98% of the payments were correct. That strikes me as really good. Of course the problem when you are dealing with numbers of this magnitude is that even 2% is, as we say, “a number”.

People Who Got Paid Who Should Not Have

There were 1,236,214 payments issued to prisoners and dead people totaling $1.7 billion.

There were 309,601 payments totaling $423 million that may have gone to nonresident aliens, but it appears that TIGTA and IRS are still sorting that out.

People Who Got Paid More Than Once

And then there are 40,656 individuals who already have their second stimulus payment, even though they were only supposed to get one. It appears that that was a sort of divorce bonus. People appeared as the secondary name on 2018 joint returns and then they filed their own return in 2019.

“IRS management noted that programming requirements were put in place to ensure that multiple EIPs were not issued to the same individual. However, because the IRS processed payments based on both Tax Years 2018 and 2019 return filings, the programming was unable to mark the account for the Tax Year 2018 return to show a payment was issued before the Tax Year 2019 payment was issued. Presently, the IRS is asking individuals to voluntarily return payments.”

People Who Still Have Not Gotten Paid

There were problems with some payments going to accounts associated with Refund Anticipation Loans.

And then there is what you might think of as the divorce debit. Payments went out based on 2018 returns that were joint, but a subsequent split meant the whole payment went to one of the spouses. IRS is washing its hands on that issue.

“ IRS management stated that obtaining the EIP from the former spouse is a civil matter between the two individuals who filed the joint Tax Year 2018 return.”

That’s going to go really well.

A big concern was getting EIP to people collecting social security and veterans benefits who did not have an income tax filing requirement. Apparently there are 1.3 million widows, widowers, orphans, senior citizens and veterans who had not gotten paid by May 21.

Those Who Have It Really Hard

And also close to my heart along with the widows and the veterans there are the homeless. IRS has this great tool for non-filers to enter payment info, but homeless people generally don’t have great internet access and of course the places where they might get access are mostly closed.

TIGTA notes:

“The IRS recommends individuals use the online Non-Filers: Enter Payment Info Here tool on IRS.gov. However, many homeless do not have access to a computer to file a return. This is further complicated by the fact that many locations with public access to a computer have been closed due to the pandemic. Finally, these individuals often do not have access to a bank account and are unable to negotiate a paper check once received because they do not have the necessary government issued identification to verify their identity.”

There is outreach going on and coordination with other agencies. I hadn’t thought about this and just put in a call to my minister to find out what might be going on in my community. Might make an interesting story and maybe another way accountants can help the community.

The Debit Card Debacle

Kelly Erb let people know that they might be getting debit cards. And I wrote something letting people know that they were for real, but not everybody got the word. TIGTA noted:

“However, a number of news outlets have reported that the debit cards were mailed in unmarked envelopes and little notice was provided to the public about the issuance of these cards. As such, individuals have reported that they destroyed the cards, thinking that they were a scam or an unsolicited credit card offer.”

IRS has let people know how to get cards reissued and TIGTA is keep an eye on it.

“In our discussion with representatives from the BFS and MetaBank on June 11, 2020, MetaBank representatives estimated that they have received 30,000 to 35,000 requests for a replacement card to date. We plan to continue to assess the IRS’s issuance of EIPs on prepaid debit cards and assistance to those individuals issued these cards.”

Other Issues

There is a discussion of the Credit for Sick and Family Leave and the Employee Retention Credit, which have not received as much attention as the Economic Impact Payment and the Paycheck Protection Program. There are procedures now for advance payments on those credits.

There is also a discussion of the massive backlog of paper that has been created by Service Center closures. It is a pretty long discussion. My practical takeaway from it is that if you mailed something to the IRS don’t expect an answer anytime soon.

There is also a backlog of error resolution cases. If your refund is held up for some reason, don’t expect rapid resolution.

Bottom Line

If there is a second stimulus payment, let’s hope they can get the score past 99%.