CRYPTIC: Restricted stock, restricted stock units, and restricted securities sound alike but are not … [+]

getty

Grants of restricted stock or restricted stock units (RSU) have become the equity compensation of choice for many public companies and some larger private companies. They may be granted instead of or in combination with stock options.

RSUs in particular are now the most frequently granted equity awards in public companies. However, companies, employees, and financial advisors often call RSUs “restricted stock” or “restricted securities.”

That lax use of terminology can be problematic and confusing, as those three things are not the same. As a lawsuit by current and form Uber employees shows, it’s important to know what type of stock grant you have and its tax treatment. In this article I explain the important differences between restricted stock, RSUs, and restricted securities.

Unidentical Twins

Restricted stock, along with its nearly identical twin restricted stock units (RSUs), is a direct grant of company stock, as opposed to an option to purchase stock (as in stock options). The stock is “restricted” because it is subject to a vesting schedule, which can be based on time worked at the company after grant and/or on specified performance goals.

Restricted stock and RSUs used to be granted only to key employees and executives or as a replacement stock grant when you were leaving behind valuable stock options at another company. For a long time, stock options were the grant of choice for rank-and-file employees and managers.

However, stock options have become somewhat tarnished by changes in their accounting, concerns about shareholder dilution, option-backdating scandals, and the vast number of underwater options employees were stuck with from past economic downturns. As a result, many companies now grant restricted stock and RSUs more broadly to employees and managers, either in place of stock options or in combination with them.

Both restricted stock and RSUs are considered “full value” grants. This means that you receive the entire value and ownership of each share when it vests.

Example: You received a grant of restricted stock for 1,000 shares. At vesting the stock price is $15. You now have company stock valued at $15,000.

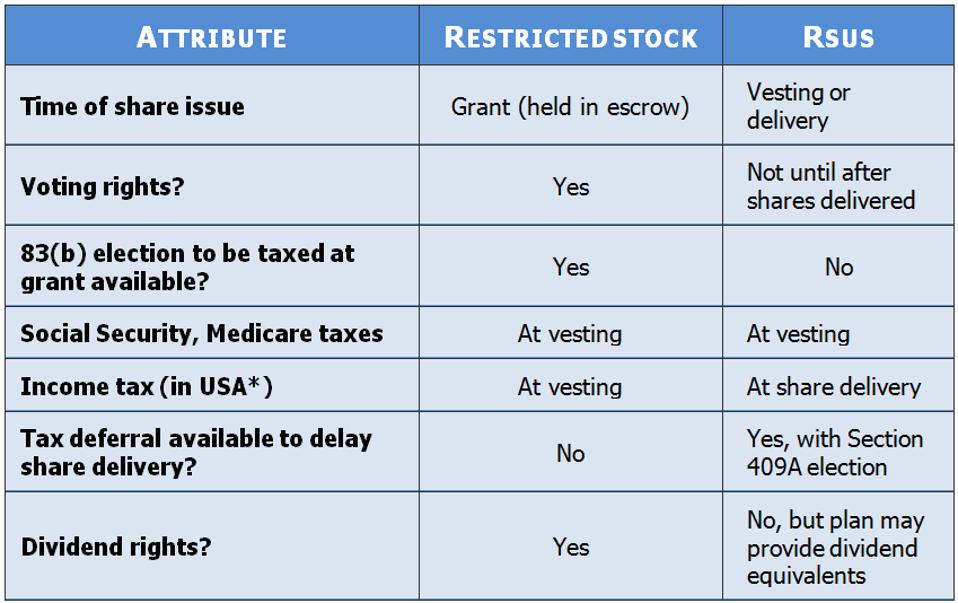

The table below shows key differences between restricted stock and restricted stock units, including their taxation. It is from the website myStockOptions.com, which has educational content and tools on all types of equity grants.

myStockOptions.com

* For the tax treatment of restricted stock and RSUs in other countries, see the Global Tax Guide at myStockOptions.com.

Explaining The Differences

The principal traits of restricted stock include the following:

- At grant, restrictions on sale and the substantial risk of forfeiture exist until you meet vesting goals of employment length or performance targets.

- Normally, the grant vests in increments over several years (graded vesting); but it can instead vest all at once (cliff vesting).

- During the restricted period (i.e. the vesting period), dividends are usually paid, and grant-holders have voting rights, like shareholders.

- Under Section 83(b) of the tax code, you can elect to be taxed on the value at grant rather than on the value at vesting—a tax flexibility that is not available with RSUs. This election allows you to pay tax on the lower value at grant, and not at vesting when you’re confident the stock price will be higher, and also start the capital gains holding period earlier. To make the election, you need to file it with the IRS within 30 days of the grant.

- Some private companies grant early-exercise stock options that are immediately exercisable into restricted stock with its own vesting schedule.

Restricted stock units have many similarities, including that both represent compensation equal to the value of a share of stock. But important differences exist:

- With RSUs, the stock itself is not issued or outstanding until the actual release of the shares at vesting. Before then, RSUs are essentially a bookkeeping entry—technically an unfunded promise to issue a specific number of shares (or a cash payment) at a future time once vesting conditions have been satisfied. For various reasons, RSUs are now more commonly used than restricted stock, including that they are easier for your company to administer. Stock-settled RSUs are much more common than cash-settled RSUs.

- Under most RSU plans, such as RSU grants made by Amazon, Microsoft, Apple

AAPL

, and Intel, the delivery of shares occurs at vesting. These plans are similar in concept to standard time-vested restricted stock. - A small number of companies have RSU plans with a tax-deferral feature that lets you select a later date for share delivery, which also delays the income tax. Alternatively, the company can specify a date for deferred delivery (e.g. retirement).

- Larger private companies tend to grant RSUs that require an additional vesting condition of a liquidity event, such as its acquisition or IPO.

- Holders of unvested RSUs have no shareholder voting rights and, depending on the plan details, may or may not receive dividend equivalents. Ask your company if you’re not certain about whether and when it pays dividend equivalents on its RSUs.

Restricted Securities

Restricted securities are shares that are not registered with the SEC, such as shares in a private company. They have a formal definition under the US securities laws. When you work for a startup or fast-growing private company that hopes to get acquired or go public, the shares you receive from your restricted stock or RSU grants are also restricted securities. The stock investors buy in a private company are also restricted securities.

The “restrictions” in restricted securities, such as the special resale holding periods under the SEC rules, come from the securities laws, whereas the vesting restrictions in restricted stock come from your company. Restricted securities are resold under SEC Rule 144 or another SEC registration exemption, until registered with the SEC in an IPO.

When the shares are owned by a senior executive or director (i.e. an affiliate), they are also called control stock, even when acquired from an open-market purchase or from stock compensation. Technically, the phrase “restricted shares” also refers to restricted securities, though some companies confusingly use “restricted shares” to mean restricted stock grants.

When you acquire restricted securities, the stock certificate will have a legend stamp indicating that the shares are restricted and therefore cannot be resold unless they are registered with the SEC or unless an exemption applies. This legend will need to be removed before you can resell the stock.

Ready For A Quiz?

Test your knowledge of restricted stock units and restricted stock with two free interactive quizzes on myStockOptions.com: