I spend a lot of time telling people to save for college, and to save as soon as possible. But there are situations where saving for college doesn’t make sense.

Recently I received a call from a parent whose son was entering college. They were frantic, “When should I take money out of my 529 account? I only have enough saved for one year of tuition, so should I take it out now or wait?” It’s a question that cannot be answered without more information, so we set up some time to discuss.

What I found thereafter was that the family had racked up considerable personal and credit card debts and had suspended their retirement contributions. They had poor cash management habits in general but had automated contributions into their 529 plan. As important as a higher education may be, this was one time the family shouldn’t have been saving for college.

Here are five instances where college savings should take a back seat to other financial priorities.

There are financial priorities that come before college savings.

getty

1. You’re In Debt: The Bad Kind

Whether to save for college depends a lot on the rest of your personal financial picture, the first of which is your debt. If you have “good” debt, like a mortgage, you may find investing in a tax-deferred higher education account offers better returns than paying down your debt. Conversely, if you have extensive credit card debt, it may be a better idea to pay that down first.

Consider the mortgage: In 2008, a 30-year mortgage was as high as 6.5%, and that was pretty good, by historical standards. Today, a 30-year mortgage can be had for under 3.0%. That kind of debt isn’t just inexpensive, it’s downright cheap, particularly if you consider that real estate, on average, has appreciated at a rate of about 9.4%, according to the National Council of Real Estate Investment Fiduciaries (NCREIF).

Student loans are where things get murky, because there can be quite a few “fringe benefits” to student loans. It can also get confusing, because federal loans and private loans are treated quite differently. For example, borrowers can deduct up to $2,500 on the interest paid on qualified student loans from their taxable income. Due to COVID, federal student loan payments were paused by the CARES Act through September, and then extended by Executive Order through December (Forbes). You’ve also got loan forgiveness in some cases and other factors to take into account. With rates anywhere between 4.0% and 6.0% on average it really depends on the borrower’s personal situation and the type(s) of loan(s) as to whether their student loans might be considered “good” or “bad.”

Conversely, the average credit card has an annual rate of 17.89%, according to the WalletHub 2020 Credit Card Landscape Report. This is highway robbery by any measure. Personal loans vary, but generally range between 6.0% and 10%, according to Bankrate. Due to their high cost and lack of tax benefits credit cards are “bad debt,” and you definitely do not want to be putting money away for a child’s education when you are accumulating this kind of financial burden.

2. You Have No Emergency Fund

The bedrock of a sound financial plan is an emergency fund, which takes priority over college savings. CFP Board Ambassador Lynn Ballou, CFP® stated, “Set up an emergency fund with an amount that allows you to withstand unexpected economic loss without destroying your finances.” This is typically between three- and six-months salary.

That may seem like a lot, as a recent Bankrate survey found the average American had only $8,863 in their savings account, relative to a median income of $61,937, according to the U.S. Census. But an emergency fund is your first line of defense when the unexpected happens, be it an illness, unexpected death, a tree falls on your home, you lose your job, or a national pandemic of unprecedented scope strikes. It is also an opportunity fund, meaning it can be used as startup funding for a business or to acquire a property long desired.

TALENT, OR – SEPTEMBER 15: Having an emergency fund in place is critical to pay for immediate needs … [+]

Getty Images

3. You’re Not Saving For Retirement

“You can borrow for college, but you can’t borrow for retirement,” goes the adage. There is wisdom in that maxim, as modern Americans can no longer rely on generous pensions or government funds for their retirement. Today, Americans are expected to save for their own future, for good or ill, and for most people that means regular contributions to their employer-provided retirement plan, along with outside savings where possible.

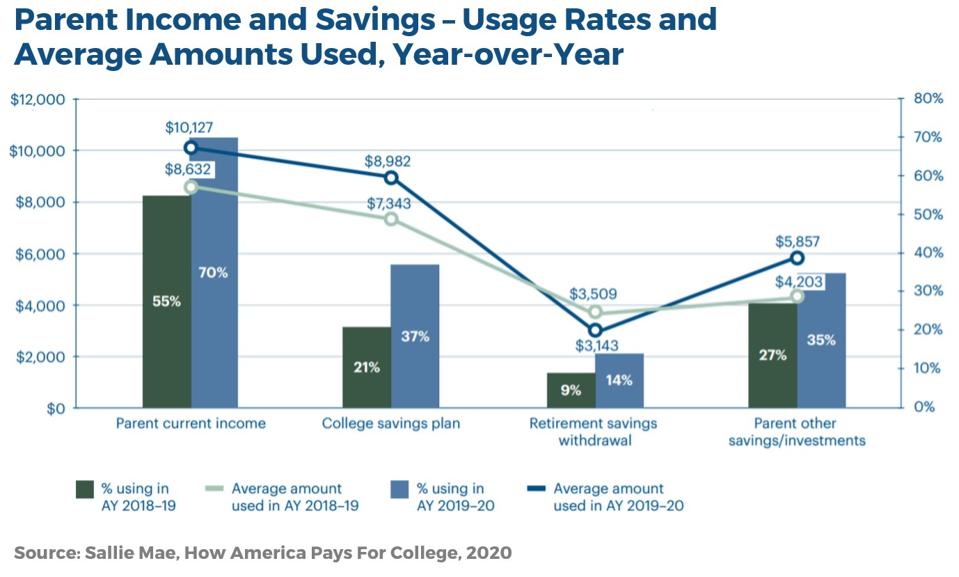

Unfortunately, some families – with the best of intentions – save for college ahead of retirement. Worse yet, many end up withdrawing assets from or borrowing against their retirement savings for their family’s college expenses, particularly with the Cares Act allowing easier access to those funds. But there are major drawbacks to foregoing retirement contributions in favor of college savings or borrowing against retirement accounts:

- If you forego employer retirement plan contributions you may be leaving money on the table. Many if not most employers provide a “match” for contributions you make to the retirement plan. If you’re not sure, contact your human resources representative.

- Distributions from a retirement account for college expenses may negatively impact eligibility for financial aid. For example, taking a distribution of principal from a Roth IRA, a popular option, to pay college expenses counts as income to the student in the tax year of the distribution. This could reduce their federal aid eligibility in future years.

- There may be tax consequences associated with taking an early withdrawal from a retirement account. Similarly, there may be tax consequences if taking a non-qualified withdrawal from a college savings account.

- When taking money from a retirement account you will miss out on earnings potential, including compound earnings. This is not only due to the reduced assets but – potentially – the more conservative allocations of college savings plans due to their shorter time horizon. Age-based portfolios in a 529 plan generally have a reduced window to grow investments for college relative to a retirement plan, which can be more aggressive due to the longer time until draw-down on the account.

- You may create a greater burden on the student if you end up having insufficient funds at retirement. Consider if you cannot afford your own living expenses, encounter health issues, other unforeseen events, or simply don’t have enough funds by the time you stop working and require them to support you. It is not just a financial hardship, but can derail career paths and have ripple effects for the rest of their lives.

Parents drawing on retirement savings for college expenses were up over 55% from the prior school … [+]

Sallie Mae, How America Pays For College, 2020

4. You Have A Short Time Horizon

Some might say it’s never too late to save for college, but that’s not always true. Depending on the age of the beneficiary, your state of residence, and personal financial situation it may not make sense to use a dedicated college savings account or to save at all.

The primary benefit of 529 plans and Coverdell Education Savings Accounts is their tax-deferred status. If you only have a year left until college and there is no in-state tax benefit, putting that money to work outside a college savings vehicle may provide more flexibility in how you can use the money and in what that money is invested.

Conversely, if you live in a state with a generous tax benefit for 529 plan contributions – such as Indiana, New York, Washington, D.C., and others – it can make sense to open a 529 account to take advantage knowing the money is going to be used for higher education regardless. Review your in-state plan to determine the value of any state tax benefits that might be available to you, and if there is a minimum holding period for contributions.

5. You Have Better Options

Lastly, it may not make sense to save for college if you have a straight-up better option. You might be putting your money to work in a successful business, investing in unique real estate, or have other opportunities available to you that might not be available to the average American. In these cases foregoing college savings to focus on growth in alternative strategies may make more sense, but it is up to you to assess the risks of those ventures relative to a traditional college savings strategy.

This information does not constitute tax or financial advice and is provided for informational purposes only. Please consult your tax advisor, financial advisor, local taxing authority, and/or plan provider or sponsor for more information.