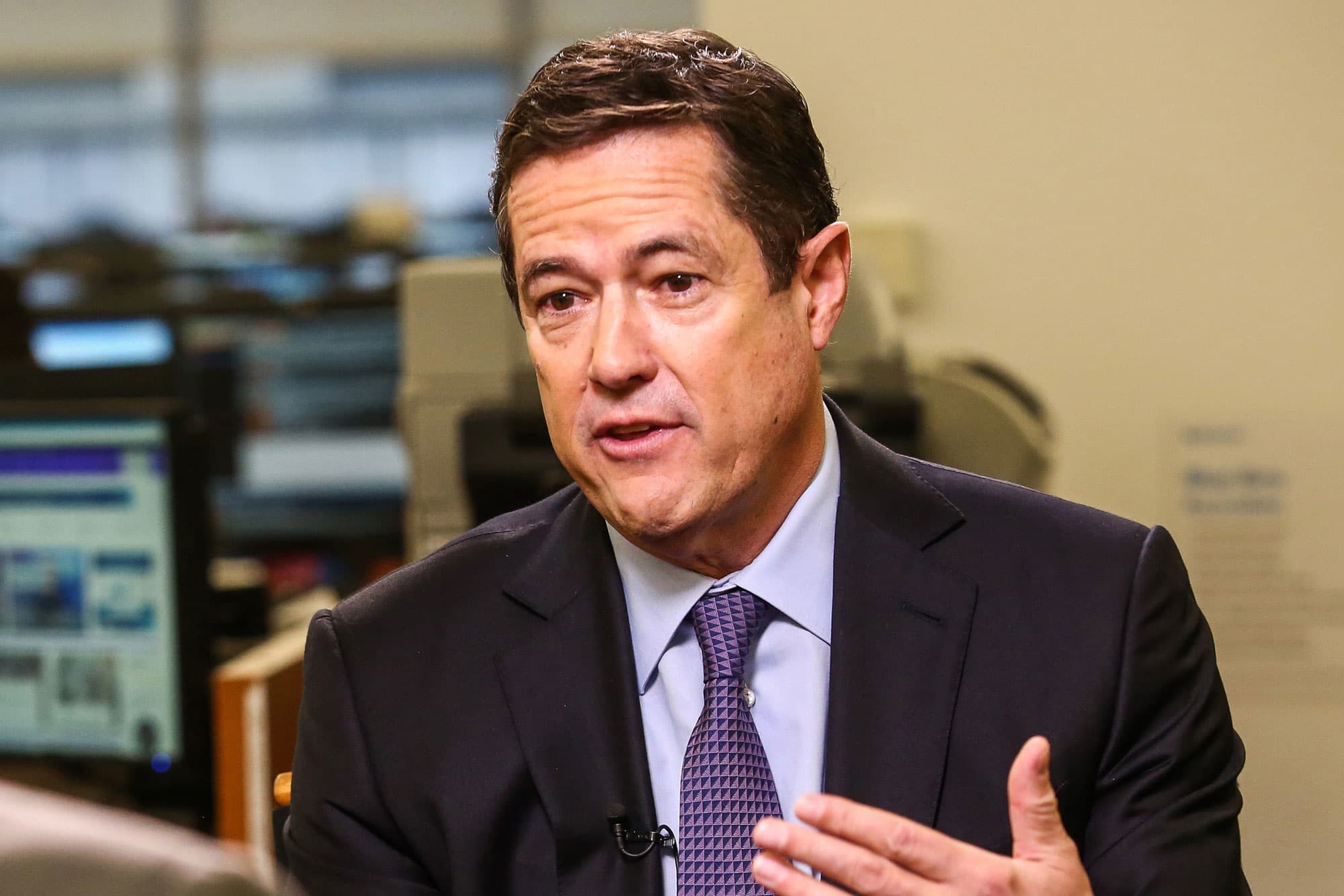

LONDON — Barclays CEO Jes Staley will stand down following an investigation into his relationship with Jeffrey Epstein, the bank said in a statement Monday.

“Barclays and Mr Jes Staley, Group Chief Executive, were made aware on Friday evening of the preliminary conclusions from the FCA and the PRA of their investigation into Mr Staley’s characterisation to Barclays of his relationship with the late Mr Jeffrey Epstein and the subsequent description of that relationship in Barclays’ response to the FCA,” the statement said.

“In view of those conclusions, and Mr Staley’s intention to contest them, the Board and Mr Staley have agreed that he will step down from his role as Group Chief Executive and as a director of Barclays.”

The bank said the investigation had not found that Staley “saw, or was aware of, any of Mr Epstein’s alleged crimes.”

Billionaire financier Epstein was arrested in July 2019 on child sex-trafficking charges but hanged himself a month later in a Manhattan federal jail.

Barclays said C.S. Venkatakrishnan (known as Venkat) will take over as Group Chief Executive with immediate effect, subject to regulatory approval.

It said its board “has had succession planning in hand for some time, including reviewing potential external appointees, and identified Venkat as its preferred candidate for this role over a year ago, as a result of which he moved from the position of Group Chief Risk Officer to Head of Global Markets.”

Barclays said it was confident that under his leadership, the bank “will continue its strategic direction and improve performance in line with the progress of recent years.”

Prior to joining Barclays in 2016, Staley worked at JP Morgan Chase from 1994, holding senior roles in asset management and investment banking.

This is a developing story and will be updated shortly.