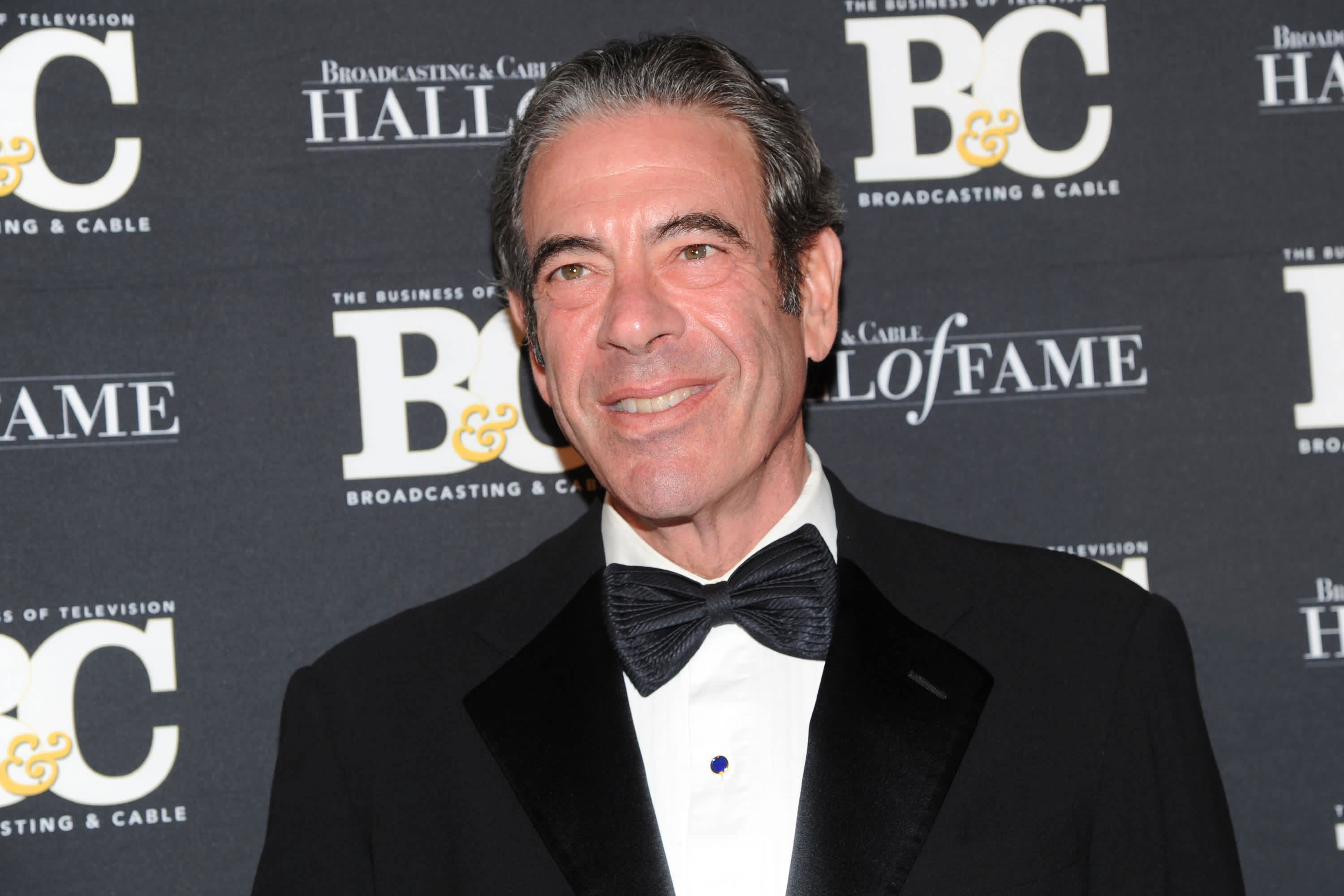

You may not have heard of Steve Bornstein, but you’ve almost certainly seen the sports content he’s helped create over the last three decades.

Bornstein, who in 2021 returned to media to change the sports landscape yet again, recently spoke to CNBC’s Jabari Young about what we can expect from live sports in 2022 and about what he learned during his time at ESPN and the NFL.

First, some background on his successes. Bornstein joined ESPN in 1980 as a programming executive and eventually served as its president. During his tenure, the network launched SportsCenter, NFL Primetime, and channels such as ESPN2. He joined the National Football League in 2002 and was vital in launching the NFL’s in-house network, which he publicly fought to place within the cable ecosystem, and the RedZone channel.

In August, Bornstein, 69, joined London-based data and technology company Genius Sports as president of North America operations. Genius provides data to set betting lines to sports gambling services, such as DraftKings, FanDuel and Caesars. The firm offers data to create next-generation stats for on-screen graphics during sporting events. In 2021, it landed an exclusive data rights deal with the NFL valued at roughly $1 billion and acquired Second Spectrum, which uses cameras to collect data on players in real-time, for $200 million.

Companies are spending billions on sports league data rights and using the information to increase fan engagement. So Genius, which joined the New York Stock Exchange this year after a $1.5 billion merger, hired Bornstein to help it expand.

“I look at Genius Sports, and I see ESPN in 1981 or 1982,” said Bornstein. “Your destiny wasn’t clear at the point, but you were able to influence it.”

“What we’re doing at Genius and Second Spectrum is taking big data and artificial intelligence in sports and applying it to practical applications that make the consumption of games more compelling,” said Bornstein. “I think this is the next wave of how people consume content.”

New tech to keep viewers engaged

Earlier in December, before I requested this interview, I heard Bornstein speak at a Sports Business Journal conference in New York City. He was animated and insightful while discussing how sports leagues are more innovative than the TV networks that show the games.

It used to be the opposite, noted former CBS Sports President Neal Pilson, who recalled his unsuccessful attempt to convince former National Basketball Association Commissioner David Stern to use digital technology in the early 1990s.

But in 1998, when Bornstein was in charge at ESPN, the network added the digital overlay that shows the first-down line to viewers. It’s the yellow line you see on the screen during NFL and college football games. Bornstein’s new firm has another idea that can keep viewers tuned in to the action.

Genius sent CNBC a video demonstrating CBS Sports’ “Romo Vision,” which uses technology provided by Genius to show an NFL play animated on the screen moments after the play occurs. It’s named after former Dallas Cowboys quarterback Tony Romo, now a CBS NFL analyst.

Romo Vision is designed, as the yellow first-down line was, to keep TV viewers engaged longer. To pull it off, and obtain the data feed, Genius installed cameras around Heinz Field, where the Pittsburgh Steelers play, for CBS’ broadcast on Dec. 5.

Bornstein and I talked about Romo Vision and, more broadly, about the sports media landscape today and how it’s changing.

Jabari Young, CNBC: Watching Romo Vision reminds me of a John Madden video game. I felt like I was watching a diagram of an actual play I would use when I played. I remember you said at the sports conference that this is the future and a way to keep viewers engaged. So, I’d like to start there. What is the networks’ problem when it comes to presenting games today?

Steve Bornstein: When you say networks, do you mean the traditional broadcasters?

Yes.

I look at it this way. This [Romo Vision] is essentially the next iteration of consumption of content, right? And we’re going from one to many broadcasting models, which is basically what cable and ESPN is — what broadcast is — we’re going to customize feeds. I don’t know if it’s going to be a one-to-one feed or one-to-many, but I think that’s essentially how it’s going to begin. We’re going to customize your video experience to stuff that you’re most interested in. For example, if you’re watching a game and you don’t know all the players, to put up graphics that identify all the people that are on the field is a very compelling experience, and people resonate well with that.

So, you think it’s the video customization — the ability to alter your feeds. That’s the future?

It’s also trying to take — we have all this data coming out of sports because sports, in particular, lends itself well to data, whether it’s baseball, basketball or football. There’s just a lot of information, and the funnel is almost so big that what we’re trying to do is figure out what data you’re interested in seeing. We did a little bit of that at ESPN with the [the yellow line]. Fox did a lot more of that when they did the “Fox Box” — basically a constant score and clock up on the screen. Those are innovations that made [NFL games] more engaging. We have the opportunity now to have all this data that’s being collected — how do we use it for an application that’s fun and engaging to the consumer? That’s what we’re doing and what you saw with CBS. We’re just scratching the surface.

What needs to happen over the next decade around sports consumption?

We learned a fascinating thing when we launched the RedZone channel. Some of the conventional wisdom is that it was somehow going to negatively impact the games that you were playing on Sunday afternoons because consumers were going to end up watching the RedZone channel and not the games being televised on CBS and Fox. What we found was that it ended up rising all boats. Not only did the RedZone channel perform extraordinarily well and exceed expectations, but the Sunday carriers saw a boost in their ratings. We discovered the multiscreen experience. The next generation of sports consumers are going to be multiscreen individuals. That, to me, is where it’s all going. What we have to do at Genius is make those experiences enhanced.

I asked what needs to happen but, what will actually happen over the next decade?

Now that’s a fair question and a difficult one to answer (laughs). I think the gamification of content will continue. What that gamification is and how it looks is still being written. But that answers your other question about why I came to Genius Sports. I think they are at the cutting edge of figuring out what the fan wants in the gamification of sports content.

Does Meta, formerly Facebook, have a role in the way this will look?

I’m sure it does, but my thinking is that it’s probably much further down the line. The reality of that is a lot more difficult to achieve than the concept of it. I look at the metaverse as an opportunity, and clearly, the people that are developing that are more in the esports space than traditional sports.

Take me back to when you first started at ESPN. Is there a media fundamental you still utilize as you take a lead role with Genius Sports?

Yeah, and it’s pretty simple. The model at ESPN — and it took us a while to get there — was we wanted to serve fans everywhere. I think that’s still the most important element of ESPN’s success, that they put the fan first. We’re trying to do that here at Genius. What do they want? How do they want to manipulate this data to make it a more engaging, fulfilling, fun experience?

And the NFL Network? What did you discover at the NFL that you’re bringing to Genius?

The NFL Network — you had this incredibly important content to the consumer. There is no sport people care about more in this country than American football. You had this incredible library at NFL Films and all this content they were producing every week. How could you stretch it out and make it a 12-month experience? So we invented content that didn’t exist before — whether it was the schedule release show or moving the draft into primetime — and it was all taking the stories that were already being told by the NFL and making it more accessible to people. So, the lesson I learned out of my experience at the NFL was: When you have all these compelling stories, what you need to do is to tell them. And then we created outlets [where] you can tell them, whether it’s the RedZone channel on Sunday afternoons or featuring NFL films in prime time on Tuesday and Wednesday evenings [with “Hard Knocks” on HBO and “Inside the NFL” on Paramount+]. All those things were basically compelling storytelling of content that people cared about. We brought that more to the people.

How big of a role will sports betting play in this gamification?

It’s going to be a pillar, but look, gambling and sports betting has been going on for as long as there have been sports. So, I don’t see that increasing or decreasing in any foreseeable fashion. It’s nothing new, we’re just shining a light on it. We’re able to tax it now, and society can get a piece of it. But the profit motive hasn’t changed, and the desire for people to wager on it hasn’t changed. What has changed is we have recognized it, and hopefully, we can come up with smart ideas that make it more enjoyable.

Final thoughts on the sports leagues

Genius made two key moves in 2021 by landing deals with the National Basketball Association’s Africa operation and the Canadian Football League. The agreements allow Genius to further innovate and test gamification concepts and multiscreen experiences such as Romo Vision.

When it comes to future fan experience, the way people consume sports games on TV and how they’ll engage with leagues, tell me what comes to mind when I mention the sports properties. Let’s start with the NBA.

The stuff they are doing courtside is really interesting. They can put people in a [first-person] perspective that’s pretty unique. People typically don’t have an opportunity to experience that. I think that could be real.

And the WNBA?

The same. But what they’ve proven about the WNBA is that people care about it. That was very important — just because people play the game, it doesn’t mean [viewers] care about it. But they’ve developed the personalities, always had the talent, and now telling stories that people are engaged with. That’s what touches people, and it makes sports popular.

Major League Baseball? (MLB is still engaged in a lockout at publication time.)

(Laughs) I have a lot of different thoughts that come to mind. Baseball is still an important element of American entertainment consumption, but they need to address a lot of issues of the game. And then make it a better experience.

The NFL?

It’s still the greatest entertainment in North America. It’s the platinum standard to what all other content is judged by. They do such a great job of putting the event on the field, and they’ll continue to improve that. What we can do is enhance that experience. I don’t think we fundamentally change it. We take a great product and allow people to enjoy it everywhere, not just the stadium or at home on your big TV.

What about Major League Soccer?

MLS is becoming more and more important to the fabric of American sports consumption, and the World Cup coming here in 2026 is going to rise all boats.

Disclosure: CNBC parent Comcast and NBC Sports are investors in FanDuel.