Morgan Stanley is set to report third-quarter earnings before the opening bell on Wednesday.

Here’s what Wall Street expects:

- Earnings: $1.28 a share, according to LSEG, formerly known as Refinitiv

- Revenue: $13.23 billion

- Wealth management: $6.63 billion, according to StreetAccount

- Trading: Equities $2.41 billion, Fixed Income $1.73 billion Investment Banking: $1.11 billion

Morgan Stanley has managed to avoid the turbulence afflicting some of its rivals.

While Goldman Sachs was forced to pivot after a poorly executed foray into retail banking and as Citigroup struggles to lift its stock price, the main question at Morgan Stanley is about an orderly CEO succession.

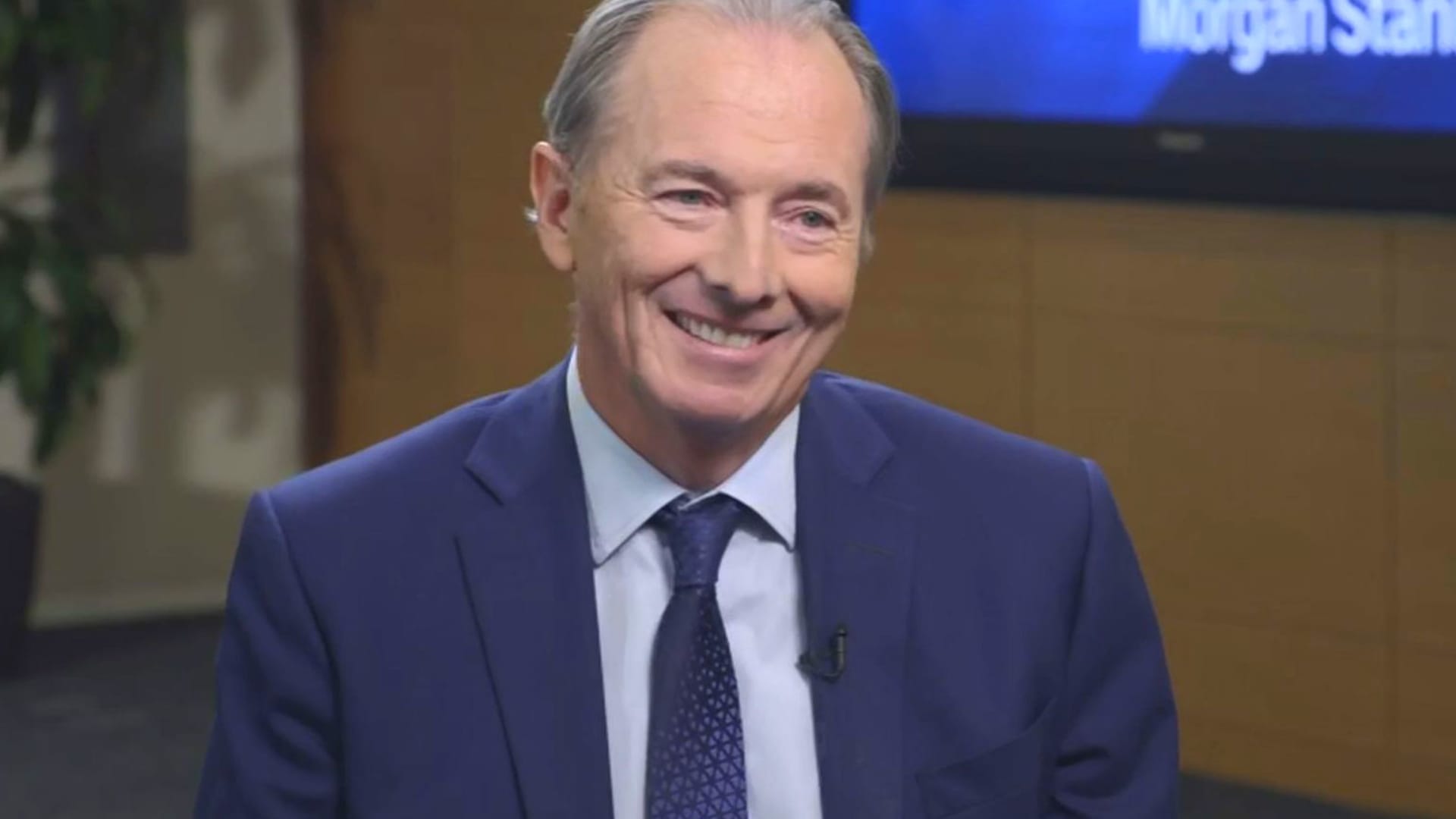

In May, CEO James Gorman announced plans to resign within a year, capping a successful tenure marked by massive acquisitions in wealth and asset management. Morgan Stanley’s board has narrowed the search for his replacement to three internal executives, he said at the time.

Analysts will be keen to hear any updates Gorman has on the search process.

Last week, JPMorgan Chase, Wells Fargo and Citigroup each topped expectations for third-quarter profit, helped by low credit costs. Goldman Sachs and Bank of America also beat estimates on stronger-than-expected bond trading results.

This story is developing. Please check back for updates.