Noel Hendrickson | Getty Images

The milk industry is under pressure.

The latest sign of upheaval: Dean Foods, the nation’s largest milk maker, filed for Chapter 11 bankruptcy Tuesday. The Dallas-based company is engaged in discussions with the Dairy Farmers of America, the biggest dairy co-operative, to sell all or part of its business.

That deal will need to be reviewed by regulators and the bankruptcy court. The Dairy Farmers are hoping to make sure that the group’s 14,500 members have a market for the milk they supply.

But if they clear antitrust hurdles, and successfully buy Dean Foods out of bankruptcy, they will still need to contend with the big shifts that are occuring in demand.

Here are 5 charts that show why the milk processor filed for bankruptcy:

Changing consumer tastes

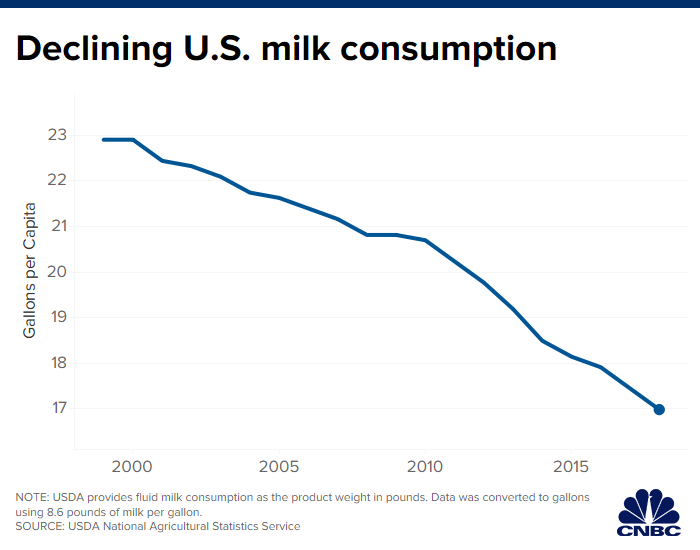

U.S. milk consumption has been falling for decades. In 1984, milk consumption represented a 15% share of all eating occasions, according to the NPD Group. By 2019, milk represents only a 9% share.

Sales of cereal, a common mealtime companion for milk, have also fallen in recent years as consumers shun sugar and embrace higher protein breakfast options.

Bottled water, which has exploded in popularity since the turn of the century, has been stealing customers from milk. Bottled water appeals to consumers who are on the go and health conscious, although increased concern about plastic waste and pollution has led its own growth to slow in recent years. However, some people are still drinking water instead of milk. They just bring it along in a reusable bottle.

Rise of nondairy alternatives

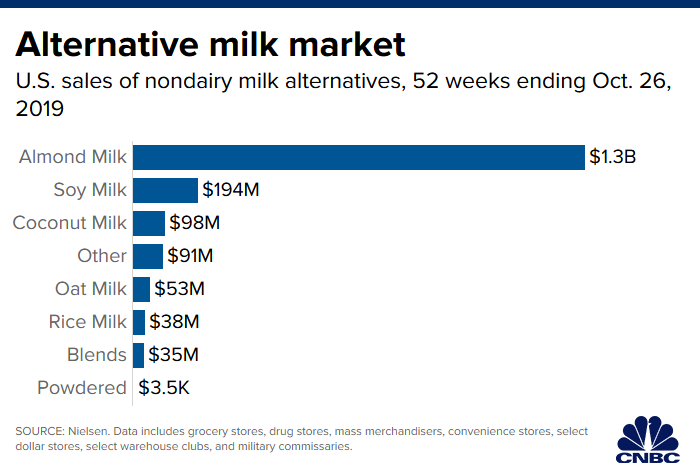

The decline of milk consumption has accelerated in the last decade as alternatives have soared in popularity.

In the last four years, sales of nondairy milks have risen 23%, according to Nielsen data. Alternatives like soy and almond milk have become popular as health-conscious consumers have grown wary of dairy.

Trendy coffee shops like Stumptown Coffee or Blue Bottle Coffee have also introduced their customers to nondairy milks by making lattes with alternatives, such as oat milk.

Dean Foods owns Good Karma, which makes flaxseed-based milk and yogurt alternatives, but the majority of its portfolio is dairy products. In 2013, the company spun off WhiteWave, the parent company of Silk and a leading maker of soy and almond milks.

Out of all nondairy milks, almond is the most popular. Soy, rice and coconut milks have seen sales decline in the 52 weeks ended Oct. 16, according to Nielsen.

High milk prices

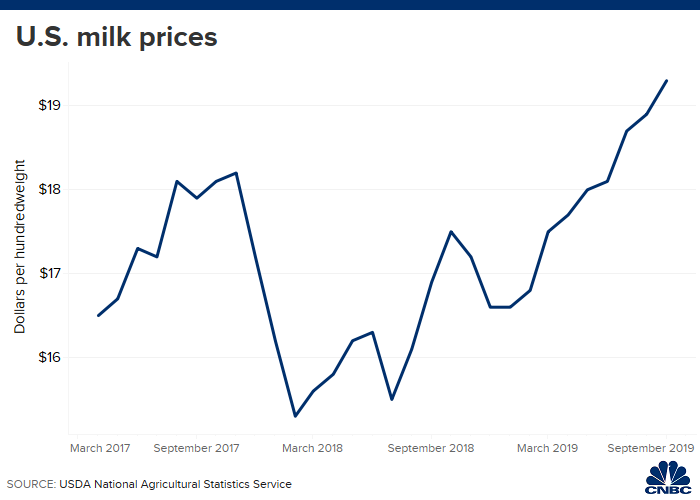

In 2019, milk prices have risen 16%, according to data from the U.S. Department of Agriculture. In September, prices spiked to $19.30 per hundredweight, its highest level since December 2014.

Historically, milk prices have soared even higher. In September 2014, they hit $25.70 per hundredweight. But this year’s surging milk costs come as Dean Foods is struggling with higher freight and fuel costs. At the same time, grocery stores are willing to lose money to sell their private label milk to lure shoppers through their doors.

Mounting losses

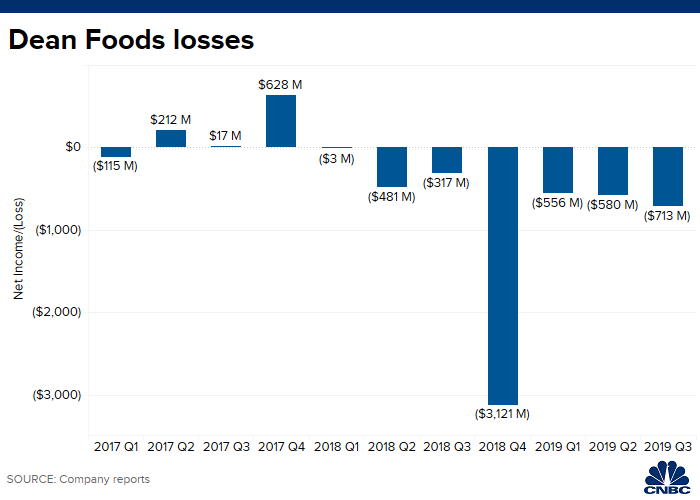

Dean Foods has reported net losses in seven out of its last eight quarters as increased competition has led to declining volumes and plant closures.

In 2017, Walmart, Dean Foods’ largest customer, started processing some of its milk, drawing a sizable chunk of sales away from Dean Foods. The retail giant accounted for 17.5% of the milk processor’s revenue that year, according to the company’s annual report. In 2018, Walmart only accounted for 15.3% of its net sales.

In 2018, Dean Foods held 12.5% of the market share for milk, according to Euromonitor data. Euromonitor is projecting that the company’s market share will fall to 12.1% during 2019 but will still hold onto its top spot.