The Charging Bull near Wall Street is pictured in New York.

Carlo Allegri | Reuters

The stock market has been hitting record high levels day after day, but that doesn’t mean corporate CEOs are bullish about next year, according to J.P. Morgan Chase regional investment banking head John Richert.

Instead, CEOs are worried about delivering earnings growth amid increasingly uncertain times, thanks to slowing growth around the world, the U.S.-China trade dispute and upcoming U.S. presidential election. As a result, most of the CEOs Richert speaks with are reining in capital spending for 2020 and modeling how a possible recession will impact their business, he said.

“Everybody looks at the stock market and sees share prices going through the roof right now, but few of the CEOs I talk to feel good about that,” Richert said. “There is an increased worry about their ability to deliver results amid prolonged periods of uncertainty next year.”

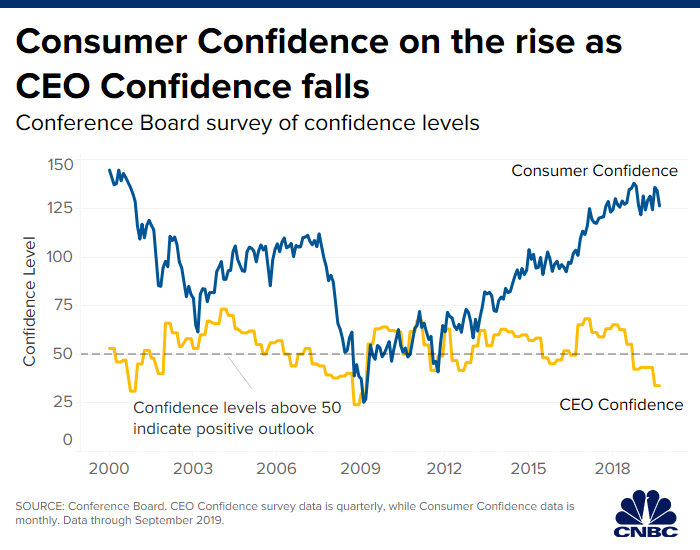

The uncertainty for corporate leaders about 2020 and beyond has created an unusual situation: While CEO confidence is at the lowest in a decade, consumers are relatively optimistic, buoyed by wage gains and unemployment levels near 50-year lows, according to the non-profit Conference Board. Consumer spending has helped keep the U.S. economy out of recession, despite the impact of tariffs, but its unclear how long that will last.

Regardless of how that tension resolves, CEO anxiety over the future has translated into a record level of engagements with corporate clients, said Richert, who focuses on companies that generate $500 million to $5 billion in annual revenue.

The pipeline for potential deals in his group is the highest it’s ever been, Richert said, and his bankers are increasingly being called to examine companies’ capital plans and offer strategic possibilities like divesting non-core businesses.

“There’s a lot of discussions among industry players to figure out the best way to put companies together,” he said. For the mid-cap companies under his purview, Richert said that CEOs are increasingly examining so called “mergers of equals” to scale up and help firms weather a future downturn.

Warren catalyst?

In particular, the upcoming election offers a wide range of outcomes: Another four years of what is generally seen as a pro-business environment under Trump, or the possibility of sweeping, structural changes to regulation and taxes if a Democrat such as Sen. Elizabeth Warren were to win.

If Warren gains momentum, that could jolt CEOs into acting on deal-making plans on the possibility that valuations would decline, Richert said. The record stock market has some business owners on the deal sidelines as they hold out for ever-higher prices, he added.

The corporate anxiety hasn’t been evenly distributed, Richert said: Manufacturers, transportation and consumer retail companies are facing harder times than technology and service firms.

“You talk to any industrial, old-line economy company here in the U.S., they’ll tell you we’re in a recession right now,” he said. “The service economy and tech is keeping the cycle going for now.”

Richert’s group, a once-sleepy area of investment banking targeting smaller companies, has gained in prominence as competitors including Goldman Sachs and Bank of America have ramped up hiring. His unit garnered record revenue in the third quarter, up roughly 25% from a year earlier, and J.P. Morgan plans to hire another 10 senior bankers early next year, Richert said.